Engagement is one of the most elusive success metrics for app developers.

There are many ways to measure how much users interact with your app, ranging from the number of users per day or month, and the number and length of the sessions, to retention and churn.

And while financial apps enjoy high engagement overall, fintech as a subcategory suffers from one of the lowest retention rates.

According to a Business2Community study, the average annual retention rate of fintech apps is just 16%, compared to 32% for insurance and 57% for banking apps.

Indeed, engaging fintech users is challenging, but it’s not impossible, thanks to a few simple strategies.

Boost app engagement with gamification

Gamification, or the implementation of game elements and experiences in an app that isn’t a game in itself, is currently one of the most well-loved strategies for driving engagement.

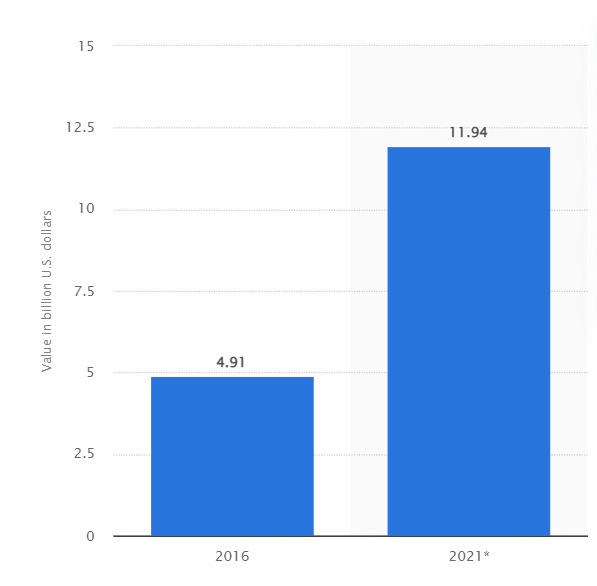

In fact, the global gamification market is worth $11.94 billion in 2021—an almost 250% jump from just five years prior.

Source: Statista

Fintech is full of examples of gamification strategies used to various degrees. Some apps keep it simple and only add little touches like progress bars and badges. A select few, however, take things to the next level.

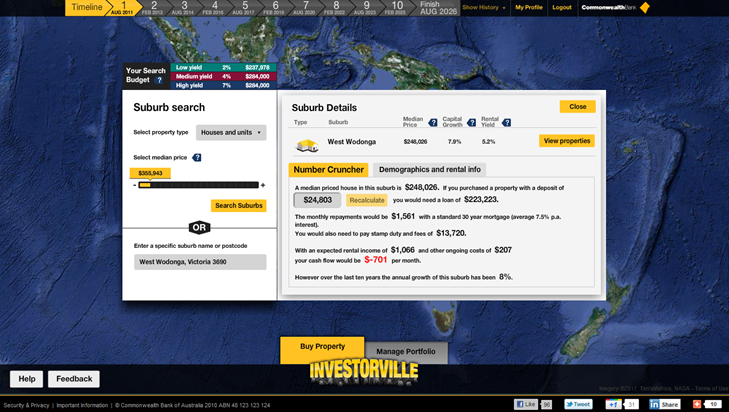

An early example is Investorville, a 2011 property investment simulator program developed by the Australian Commonwealth Bank.

It allows potential real estate investors to try their hand at buying properties without actually risking their money.

However, since the game uses real-world concepts, it’s a great way to educate people and, hopefully, encourage them to try their hand at real investing.

Source: Tech AU

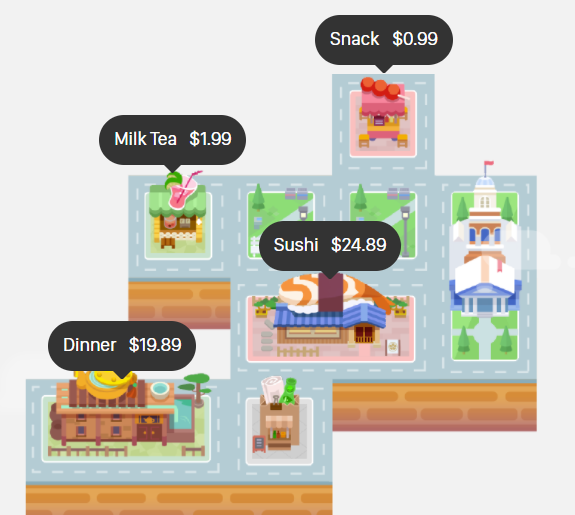

Then there’s Fortune City, perhaps the best example of a gamified finance app. In reality, it’s a personal finance app under the guise of a city simulation.

Users can build out their virtual town by performing tasks like recording expenses or making payments. But, even if it looks fun, it still has robust features you’ll want in a finance app.

Source: Fortune City

The popularity of gamification shouldn’t come as a surprise. People love playing games—it’s in our nature. In 2021, there were 3.24 billion gamers worldwide, and the number of players is expected to exceed 3 billion in the next two years.

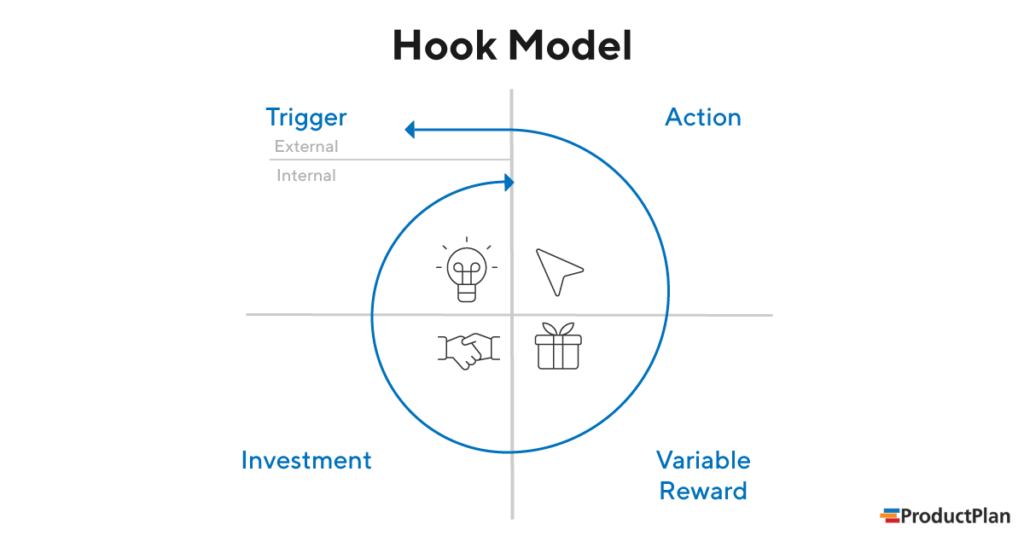

But what is it that makes gamification so effective and engrossing? The so-called Hook Model can help us explain it.

Source: Product Plan

The concept was introduced by Nir Eyal in his book Hooked —How to Build Habit-Forming Products. It explains how successful products, like Facebook, use experiences called “hooks” to create habits.

A key component of hooks is a variable reward the user gets for doing something. The reward reinforces the user to repeat the action to continue getting it.

This endless action/reward cycle is what eventually builds a habit.

And as any player knows, games are the embodiment of this cycle.

People continue to play because winning makes them feel good about themselves.

Sometimes, there are even additional prizes and bonuses at stake.

Indeed, even if you don’t decide to gamify your app, rewards are such an integral component of app engagement that they deserve an entire section.

Incentivize users with rewards

Rewards are the oldest and most effective motivator there is. I’m sure we’ve all been bribed with a new toy or extra lunch money when we finished our chores as kids.

Indeed, external rewards are required to elicit any human behavior, according to the Incentive Theory of Motivation.

Source: Very Well Mind

It’s the reason why loyalty programs are so effective at driving engagement and repeat purchases. According to a recent study, consumers were 78% more likely to pay more for a brand if it had a great rewards program.

Not surprisingly, fintech apps are exploiting the engagement power of a good rewards program.

This strategy is especially effective at changing the behavior of consumers that aren’t usually financially savvy.

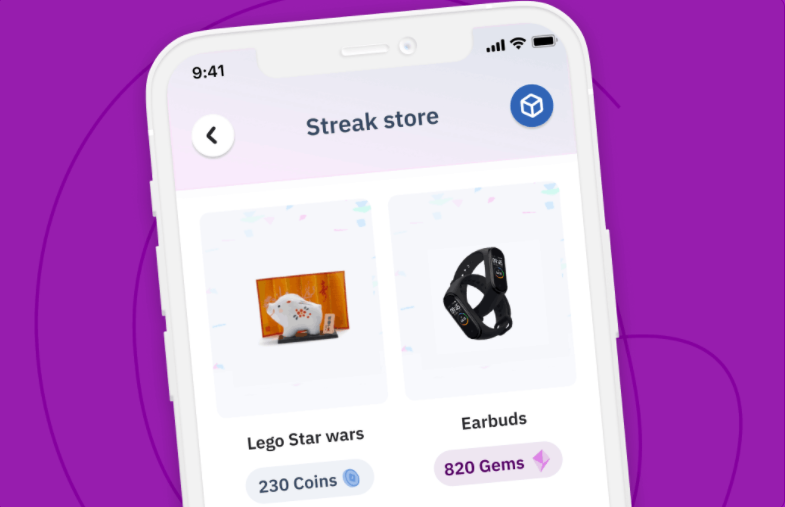

Take the Streak app, for example. It’s a banking app aimed primarily at teens—not exactly the best money savers on the planet.

But thanks to the app’s Streak Coin system, teens can earn points whenever they perform tasks like saving money or doing chores. These can then be exchanged for toys, gadgets, and other products.

Source: Streak

Making the most of incentives to drive engagement requires rewarding users the right way.

According to gamification expert Yu-kai Chou, you can use two kinds of rewards: intrinsic and extrinsic. Extrinsic rewards are often tangible perks or prizes, like gift cards and money. Intrinsic rewards are internal motivators such as status and recognition.

As Chou points out,

“It is better to attract people into an experience using extrinsic rewards then transition their interest through intrinsic rewards.”

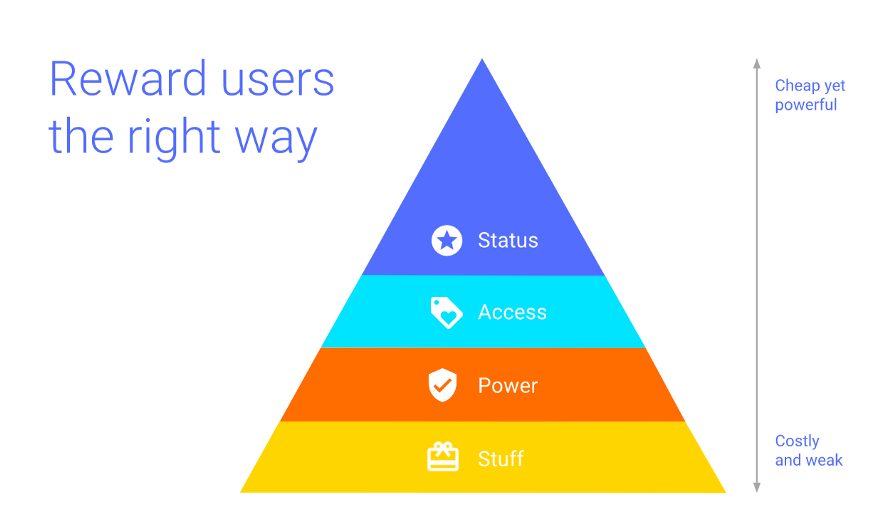

Another way of looking at this is through expert Gabe Zichermann’s SAPS framework:

Source: Medium

As you can see in the diagram, tangible rewards like money and gifts are the weakest motivator—surprisingly so. Instead, it’s often much better to give incentives that play to a person’s status or exclusivity.

It’s why leaderboards and badges are so powerful: they are “bragging rights” that show a user’s status or accomplishments.

Both Chou and Zichermann point to a crucial thing to remember: intrinsic rewards are far better at driving long-term habits.

Custom push notifications

Push notifications are one of the basic ways that apps create engagement.

That’s because it’s a subtle call to a person that says, “Hey! I have something important for you. Check it out!”

Its popularity, however, is also its biggest drawback. Apps abuse push notifications too frequently, so users are getting annoyed with them.

In fact, a survey revealed that overdoing notifications is the number one reason people will uninstall an app.

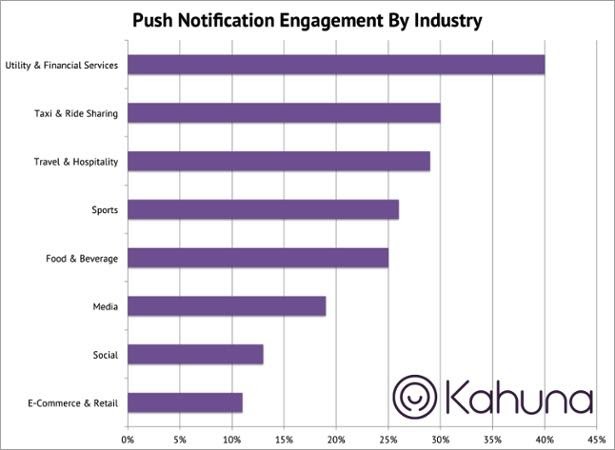

Fortunately for fintech developers, fintech apps users seem to be more receptive to notifications.

Indeed, a Kahuna study suggests that fintech apps report the highest engagement rates from push notifications.

Source: Kahuna

In a way, it makes sense. People will be more attentive to push notifications that have something to do with their money.

Plus, fintech notifications are vital for reminding users of important payments or alerting them of suspicious transactions.

Of course, that’s no excuse to overdo your push notifications. There’s a proper way of doing it.

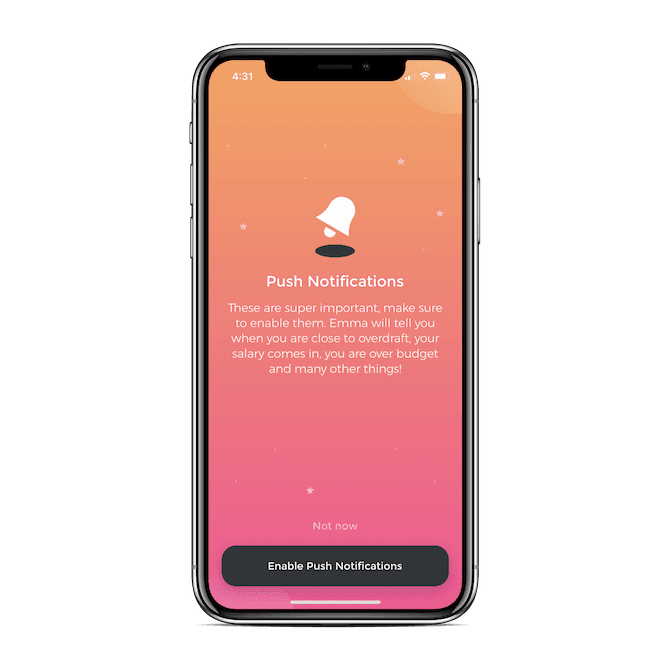

First, it all begins with asking the user’s permission during onboarding. When doing so, it’s important that you explain how enabling push notifications will benefit them.

Just look at how the Emma app does it.

Source: Telerik

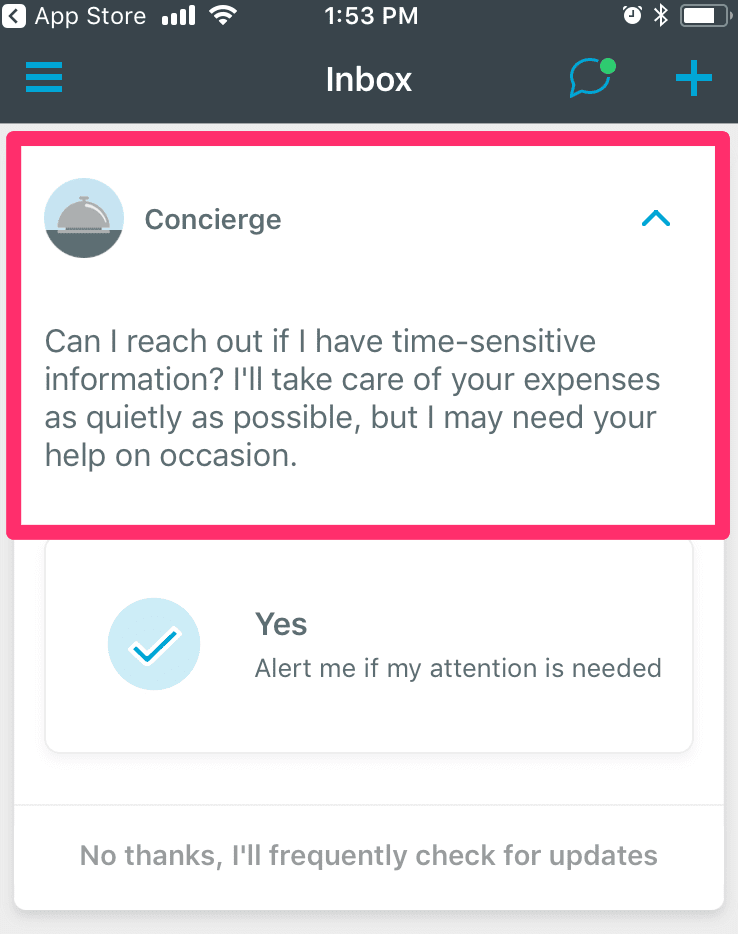

The language you use matters, whether it’s asking for permission or on the notification itself. The Expensify app does this very well with its Concierge feature, which mimics a courteous butler at a hotel.

Source: Taplytics

The content of the notification matters a great deal as well. You should prioritize only the information that’s crucial to the user.

According to research by Think with Google, these are security concerns, account updates, and transaction updates.

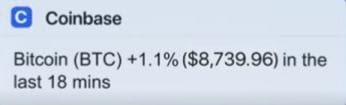

Allowing users to customize the push notification content they receive is also important. This is especially important in trading apps, where users need up-to-date information only on select stocks or assets.

Source: Taplytics

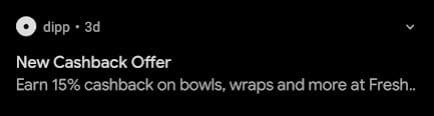

Promotions and other marketing messages are often the lowest on the list of priorities, and thus, they have a higher chance of being disregarded by the user.

Nevertheless, the trick is to personalize your offers so that they’re very relevant to your user, like what the Dipp app does.

Source: Taplytics

As you can see, push notifications can be a double-edged sword as an engagement strategy. Still, as long as you implement them with restraint and keep the user’s needs in mind, they will serve you well.

Create a better onboarding process

Onboarding is perhaps the most powerful and fundamental engagement tool you have in your arsenal.

Indeed, Localytics realized that a strong onboarding sequence improved their retention rates by up to 50%.

To make the best onboarding sequence, it’s crucial to understand its role in your fintech app.

First, onboarding is important for establishing trust with your user right away. You can do this by being transparent about what your app can do for them.

Gaining their trust this way is vital because data gathering is another critical onboarding role.

For example, virtually every fintech app needs a user’s financial information to work—whether it’s their bank account or social security number.

But if users don’t trust you first, they won’t be willing to part with such sensitive information.

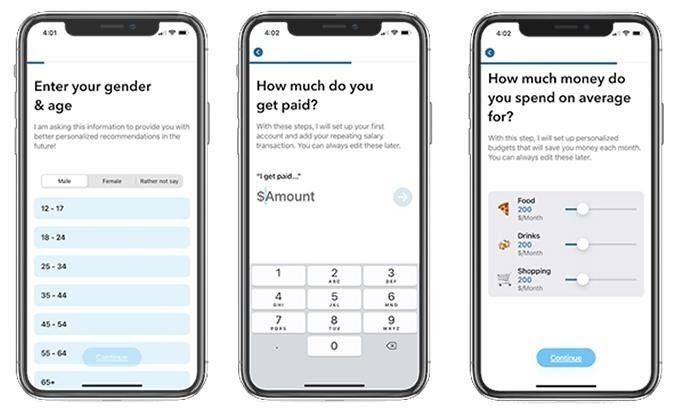

The MoneyCoach app does a great job of establishing trust while getting a user’s data simultaneously. They do this simply by explaining why they need each piece of information. And it’s always framed to the user’s benefit.

Source: Telerik

Nevertheless, the most important point of onboarding is educating your users on how to use your app. This ensures that users can master usage and reap the benefits much quicker. It can be as simple as displaying your app’s core features, like so:

Source: Judo

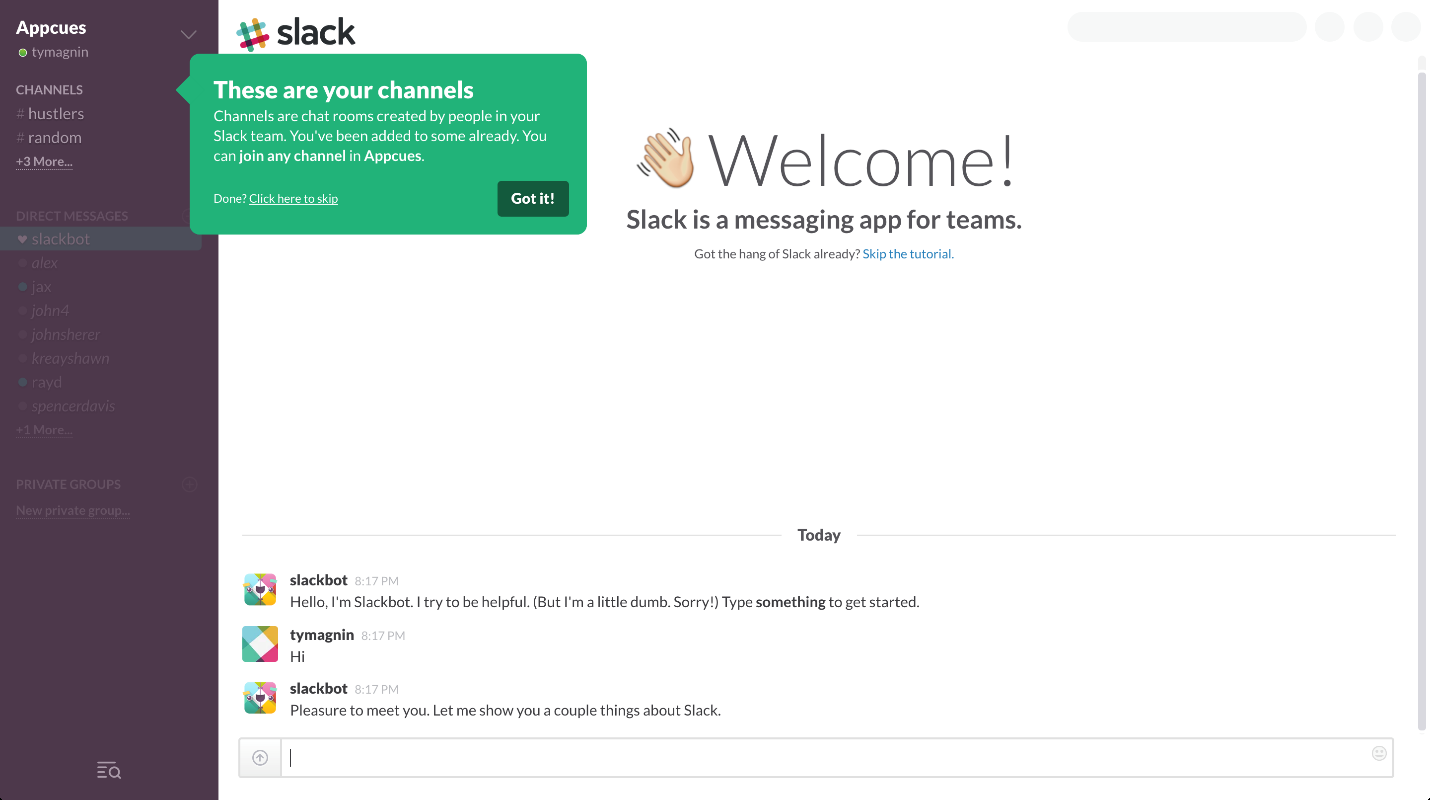

Or it can be an interactive tutorial that guides users through the app. Slack has arguably mastered this art to a high degree with their amazing onboarding.

Source: Really Good UX

One crucial thing to remember with onboarding is that it shouldn’t be done just at the beginning. In fact, it’s beneficial to space out your sequence so as not to overwhelm users.

For instance, you can have a mini-onboarding whenever users unlock a new feature or subscribe to a paid version of your app.

And a final piece of advice: don’t make your onboarding sequences too long. Remember, the point of onboarding is for your users to use the app as fast as possible.

If you’re interested in more onboarding best practices, check out our excellent guide here.

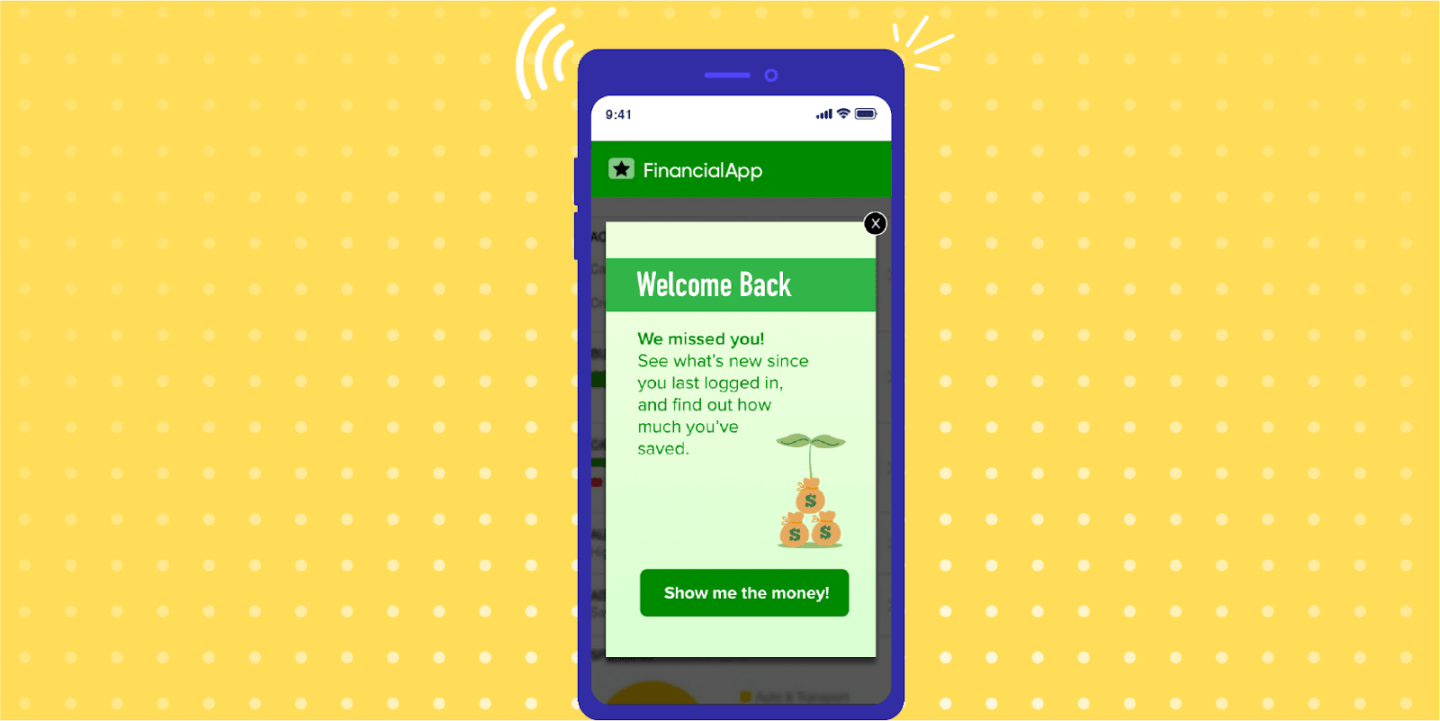

Use in-app messaging

In-app messages are notifications that pop up while the user is using the app. They usually alert them to something important, such as a promo or important new app feature.

Source: CleverTap

They’re very similar to push notifications, so many of the rules for those notifications also apply here. The bottom line is: the content must be useful and relevant to the user.

When done right, in-app messaging can be exceptionally effective at enhancing the user’s experience.

Take the case of the trading app Robinhood. Their Messages feature periodically sends timely news and announcements on their chosen stocks.

Since every bit of information can affect their investment, the users openly welcome these updates.

Source: Robinhood

Over time, users learn to rely on Robinhood to get the latest financial news instead of other sources. Guess how that affects the app’s engagement rate?

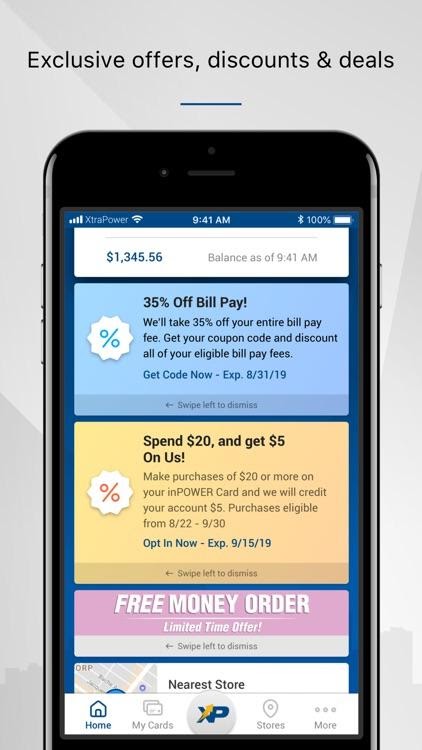

Another great example of effective in-app messaging is the Payomatic app. Using the Braze platform and a wealth of customer data, the app was able to push in-app messages with personalized offers for the user.

This was further enhanced with emails, push notifications, and onboarding campaigns.

Source: App Advice

The result? Payomatic saw a 32% increased adoption rate in mobile deposits and 11% higher app engagement.

There are plenty of other use cases for in-app messaging with fintech. For example, they can be used as pop-ups to ask users to sign in to a banking app or ask users to join your referral program.

If you recognize that in-app messages are more than just for promotions and marketing, you’ll find better success with them.

Allow user feedback

In any business, customers are king. The same is true with fintech. So your app’s features are largely driven by what your users need.

Eric Ries, the author of The Lean Startup, said it best:

“Success is not delivering a feature, it is learning how to solve the customer’s problem.”

So, how do you know if your app effectively does this? You get their feedback.

Actively getting and acting on feedback is by far the most effective and fastest way to improve your app. It helps you prioritize which features to add and what bugs to fix.

It even has marketing use since you can get more data on your user’s wants and needs.

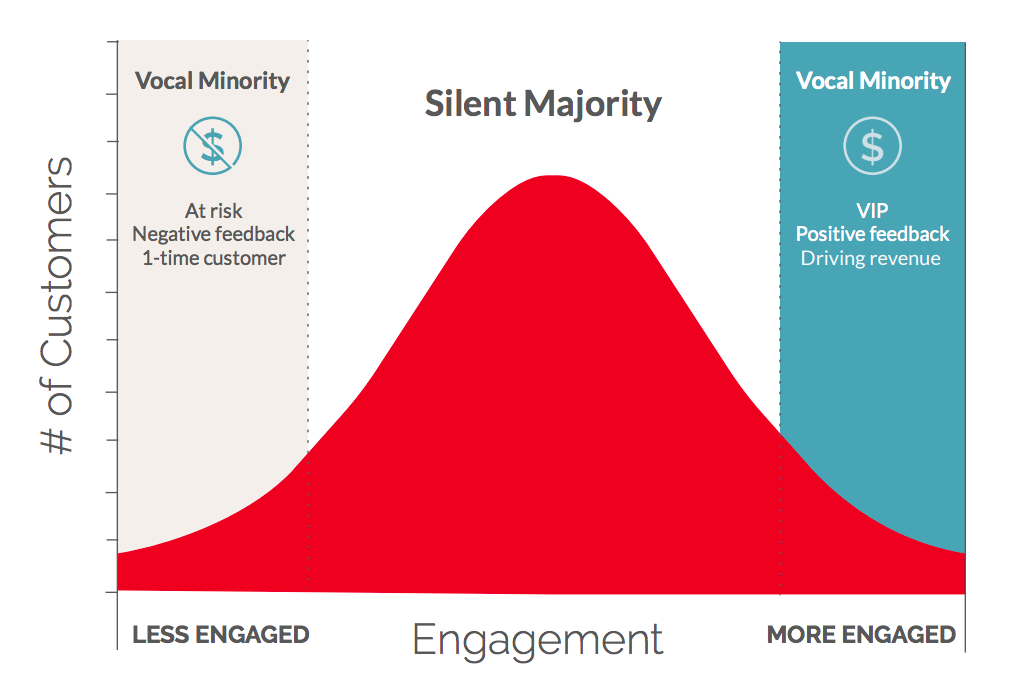

Plus, you have to be aware that users will only voluntarily give you feedback when they’re either really happy or have a major complaint. Otherwise, most of your users will be silent— and you lose out on their insights unless you make an effort to extract them.

Source: Business2Community

Of course, every app knows the value of user feedback. The real trick is in getting it in a way that’s not disruptive to the user experience.

Generally, the less time the user spends giving feedback, the better. But at the same time, the quality of their feedback matters, too. So there needs to be a balance.

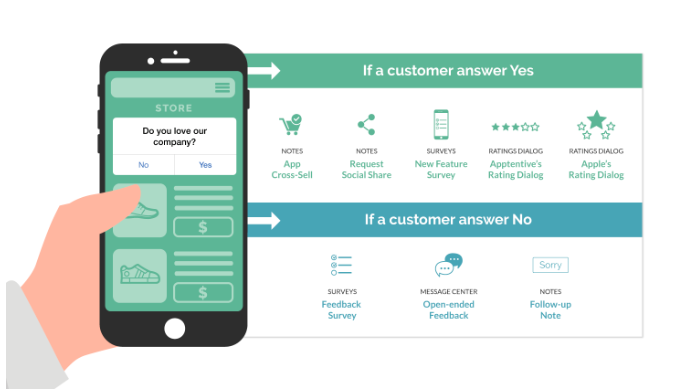

That’s why “rate us” or “yes/no” pop-up boxes are popular. They’re easy on both the developer and the user. You can then further ask for more feedback based on their initial response:

Source: Business2Community

Relying on the above strategy will prevent your users from getting overwhelmed.

After all, there’s no point asking for a review or rating if the user isn’t happy with your app to begin with. In this case, it’s better to uncover why they’re unhappy.

You can also consider putting a feedback form at the end of a sales funnel or major feature.

Then, if they experienced something wrong or inconvenient with the process, there’s a higher chance they’ll let you know.

Engagement is all about putting the user first

As you can see, there are many ways to increase your app’s engagement. But if you look at all of them, you’ll realize that they all have one thing in common: they put the user first.

So long as you have this mindset, you’re well on your way to creating an engaging app.

Need help with your app retention rates? Contact us today, and let’s figure out how to make your app indispensable to your users.