How do you create a digital banking app that stands out on the market? Here are the steps to take to build a top-notch digital banking app.

Ideas for gamifying fintech apps

Regardless of age or gender, people love playing games.

That’s why adding gaming elements to your fintech app is a great way to make it more engaging.

You’re bound to reap great results, too: companies that use gamification see a 700% profit increase compared to their competitors that don’t.

No wonder gamification is one of the hottest and most effective app strategies today.

Still, simply adding a progress bar or some badges isn’t going to cut it. Much like any part of your fintech app, you have to take the correct approach to make the most of gamification.

Here are some ideas to get you started.

Table of Contents

Gamify the onboarding process

Onboarding is perhaps the most important aspect of your app, since it’s the first thing your users interact with. It educates the user, personalizes the app, and paves the way for a fantastic experience.

Indeed, according to a Salesforce study, 70% of people cite that understanding how to use a product is a crucial factor in their purchase decisions.

And more than half of customers abandon a product because they don’t know how to use it.

Therefore, it’s crucial that users complete your onboarding process to get the most out of your app. And the best way to ensure they do is through gamification.

There are many ways to do onboarding gamification, but using a progress bar is by far the most common. It’s a way for users to monitor how far along they are, sets expectations and gives them the psychological push to finish it.

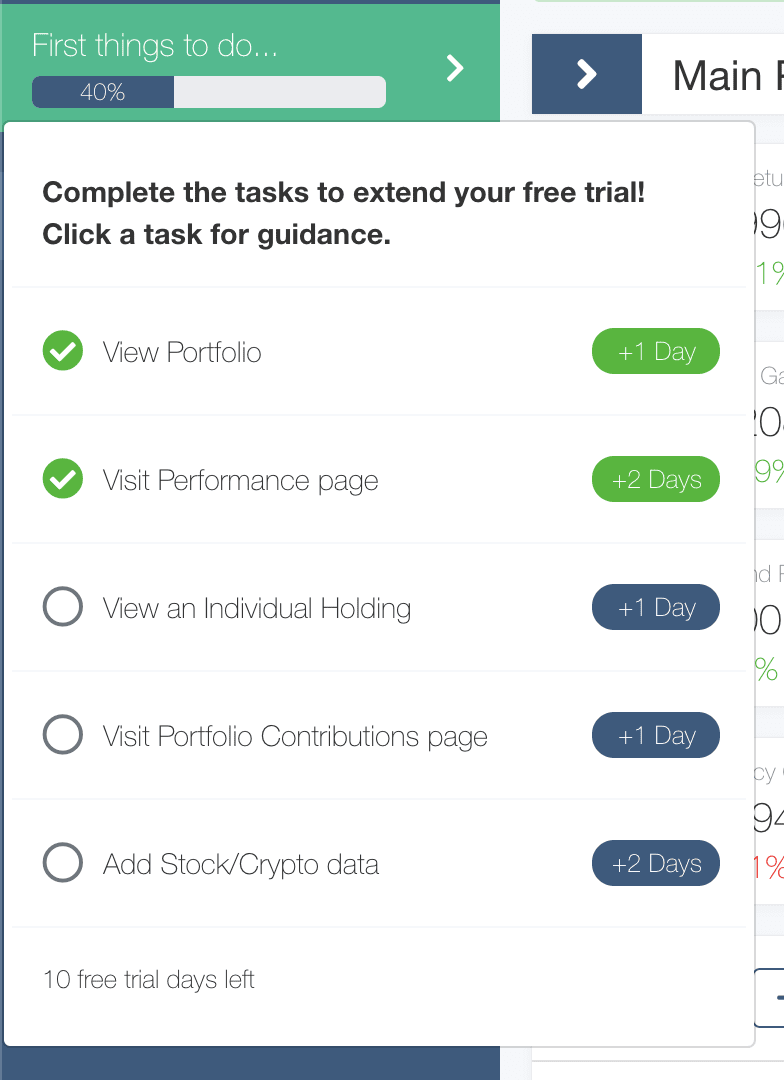

Nevertheless, as mentioned earlier, progress bars are just the beginning. Take a look at this example from the portfolio tracker app Navexa.

Source: Pointzi

First off, Navexa doesn’t force users to go through a pre-set onboarding sequence. Instead, it presents a list of tasks they must complete, similar to “achievements” or “missions” in a video game.

But the true game-changer is the rewards system built into Navexa’s onboarding. When users complete a task, they get an extension of the free trial period.

This automatically reflects at the bottom of the screen, giving the user instant recognition. Completing the onboarding effectively extends the free trial from 7 to 14 days in total.

Overall, this makes Navexa’s onboarding much more engaging and rewarding, while continuing at a pace that’s comfortable to the user. Plus, the added time encourages the user to stick around more. It’s a win-win situation!

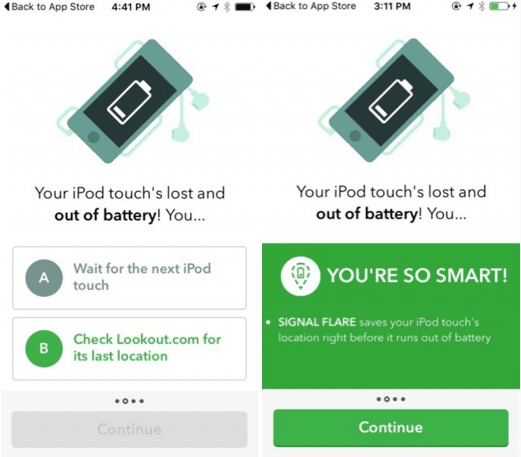

Interactive quizzes are also very popular onboarding approaches.

While this example from Lookout is in the mobile security industry, you could easily incorporate it into any fintech app:

Source: The Manifest

Lookout’s onboarding asks users questions related to the product’s usage. If they get it wrong, the app explains the correct answer by incorporating features. It’s a nifty and refreshing way of showcasing what an app can do.

Overall, gamifying your onboarding sequence is a great approach, especially so for apps that require a lengthy process, such as investment and banking apps.

Combined with other onboarding strategies, it can help engage users from day one.

Challenge your app users to meet goals

One of the biggest reasons people are addicted to games is that the tasks in the game pose a challenge to them.

Think about it—if the game you’re playing is too easy, you tend to get bored and quit.

You can take that same concept and apply it to your app’s gamification by giving users a goal they need to work towards.

Often, including a clear goal into a gaming challenge makes it more likely that a person will do it.

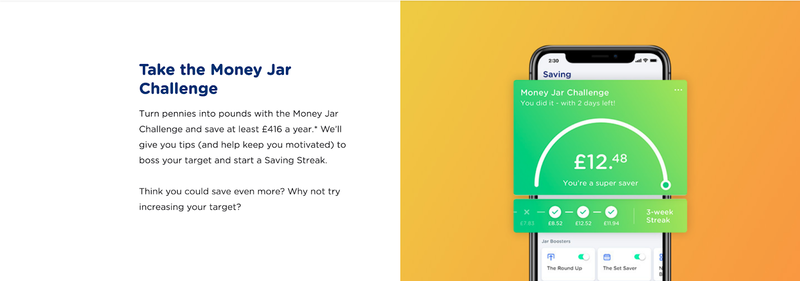

Take saving money, for example. For most people, it’s a tedious task. But when apps like Yolt present it as a game, suddenly, people are much more motivated.

The way Yolt does it is through its Money Jar challenge, which is the app’s virtual piggy bank.

Source: Adam Fard

Users can set Yolt to automatically set aside a portion of every purchase they make and place it into the money jar. The jar tracks how much money is saved weekly, which can instill a sense of achievement in the user.

Sadly, Yolt closed down at the end of 2021. But their gamification idea can still be applied to your app project.

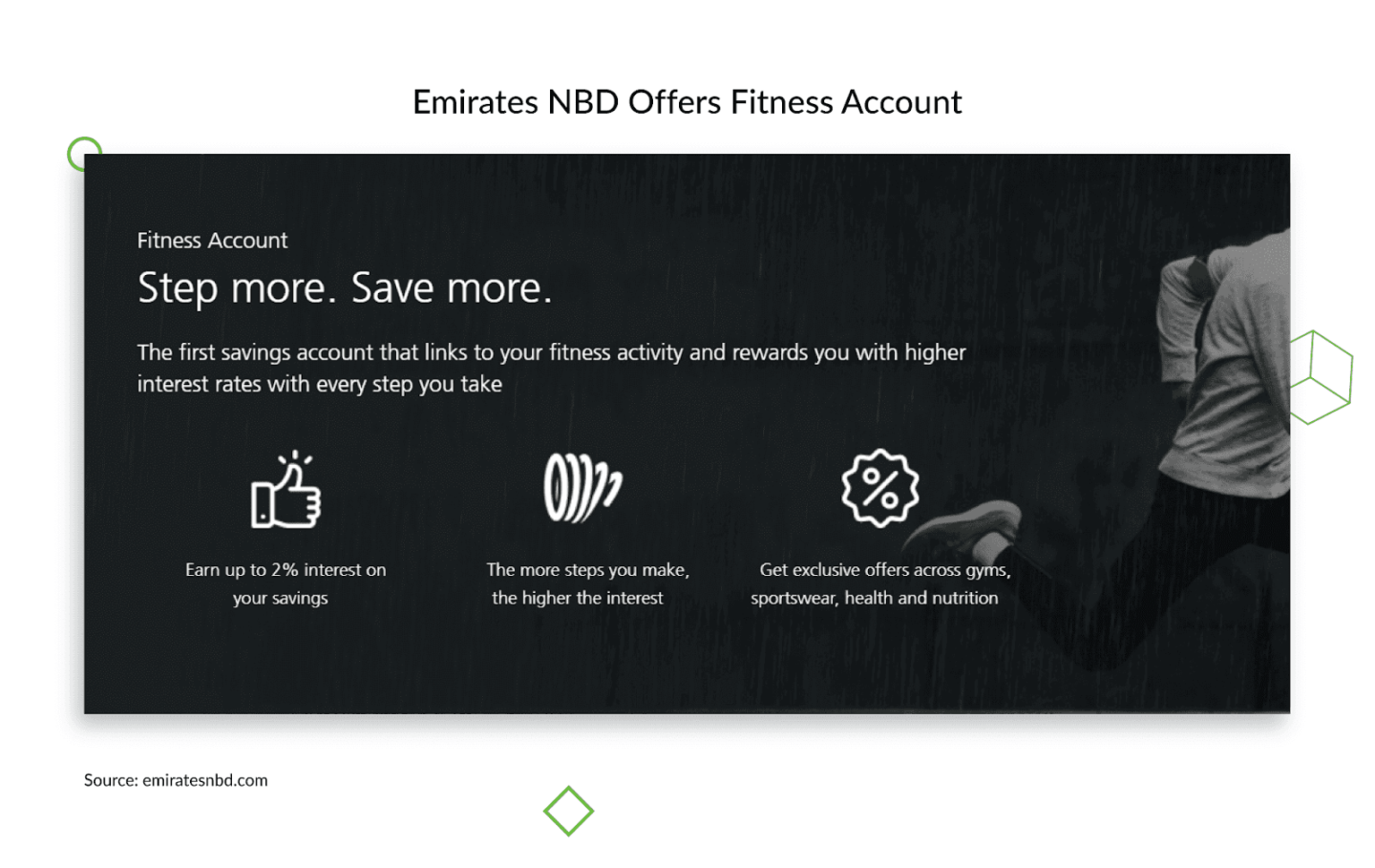

Another great example of app challenges is the Emirates NBD. This banking app is unique because it challenges users both financially and physically.

The app can connect to a fitness account and allows users to partake in fitness challenges. They then get financial rewards once certain goals are met, like walking a set number of steps a day.

Source: Emirates NBD

Gamification with challenges and goals is especially vital if your target users aren’t financially savvy to begin with.

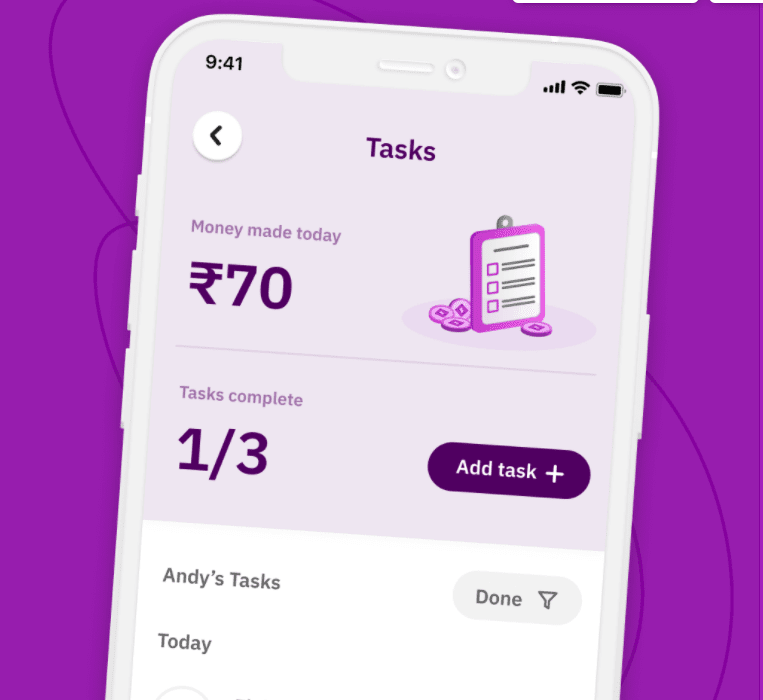

For example, take the case of Streak, a digital banking app aimed primarily at teens.

Streak presents an easy-to-use and attractive interface for teens. It allows them to set savings milestones in the context of what matters to them—making purchases for gadgets or toys.

In addition, Streak also allows parents to add tasks that teens can then complete in exchange for money into their accounts. It’s a great gamification tool to make them more financially and socially responsible.

Source: Streak

In fact, Streak does gamification so well that it also features another strategy we’d like to highlight.

Reward users for engaging with the app

Rewards are a powerful motivator because it’s something that’s tied into human nature.

According to the incentive theory of motivation, people need to get something in return for altering their behavior.

It’s why strategies like loyalty programs work exceptionally well at keeping customers interacting with a business.

In fintech apps, there are plenty of ways to implement rewards, both physically and virtually.

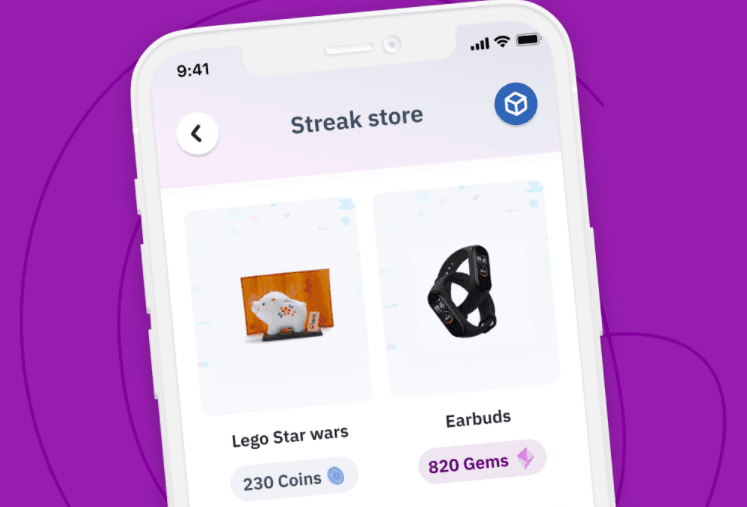

Let’s go back to the Streak and check out their rewards system.

Every time a user spends using their Streak card, they can earn Streak coins. These coins can then be exchanged for physical rewards. And because this is a teen-oriented banking app, the items are in line with their interests.

Source: Streak

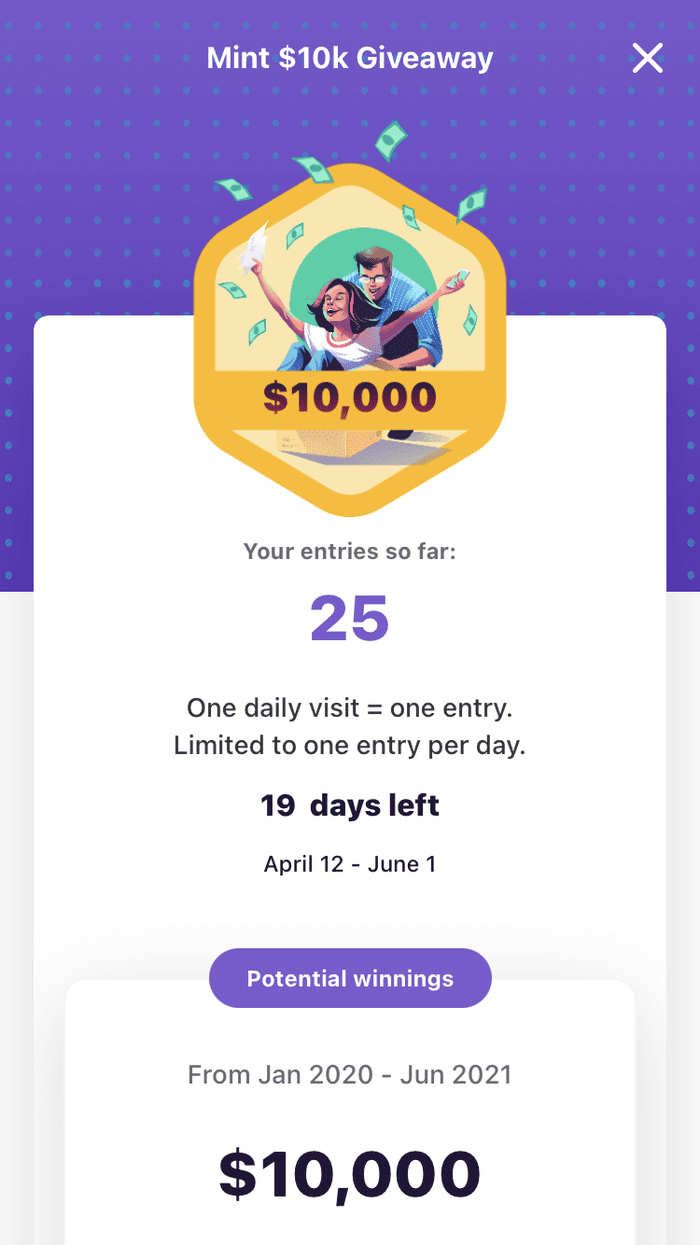

Another great example of an app rewarding user engagement is Mint’s $10k giveaway promo.

Here’s how it works.

Every day that users log into the Mint app, they get one entry ticket. The more entries a user has, the greater their chances of winning.

The prize? Mint will pay up to $10,000 worth of bills. This also incentivizes users to link more accounts to the Mint app to cover more expenses.

Source: Buzzfeed

The Mint app also shows the entries a user has earned so far and the potential winnings they can receive. This further motivates them to engage with the app to win.

This lottery-style gamification is also used in other savings apps like Save to Win and Yotta.

While monetary rewards work well, virtual rewards like badges and achievements can be just as effective.

Sometimes, a sense of pride and accomplishment is all it takes to maintain the users’ interest.

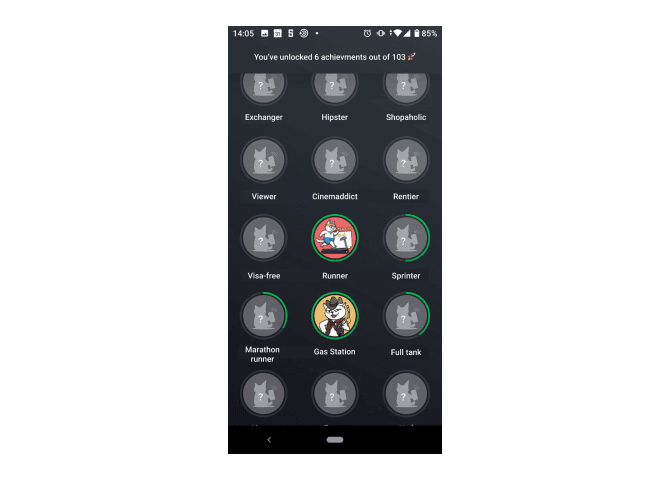

The Ukrainian digital banking app monobank does this well, with more than 100 challenging yet feasible achievements. Cute illustrations further motivate the users to collect them.

Source: monobank

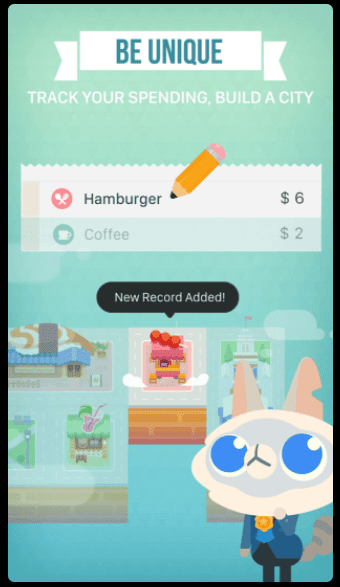

You can even get creative with your virtual rewards, like Fortune City. This unique saving app centers around a city simulation game, which you can build by completing tasks like saving money or recording your expenses.

Source: Fortune City

The bottom line is that there are infinite ways to reward your users. The only requirement is that the prize is something they’re genuinely interested in.

Enable customization

Gamification enables you to customize the user experience.

You see this all the time in video games; players spend hours building their online persona and even going as far as buying virtual costumes to deck out their virtual characters.

A 2019 study by Nadine Bol and others explains this behavior. They concluded that users tend to be more engaged if they have a sense of autonomy and control.

You can achieve the same with your fintech app by enabling users to customize aspects of their experience.

The ability to choose the colors and background elements of the app constitutes the most basic of customizations. In addition, most apps today have a Night Mode, which makes viewing the app easier in the dark.

Avatars can also add a sense of excitement and ownership to a fintech app.

For example, Liquid Avatar is a blockchain-based system that allows users to create and manage their online identities.

They also recently partnered with a fintech app to extend their technology to the payment and banking sphere.

Source: NCFA Canada

Some fintech apps deal with large amounts of data, and it’s a challenge to present all of these on a small screen.

In those cases, a good approach is to allow users to customize the UI by repositioning and removing elements.

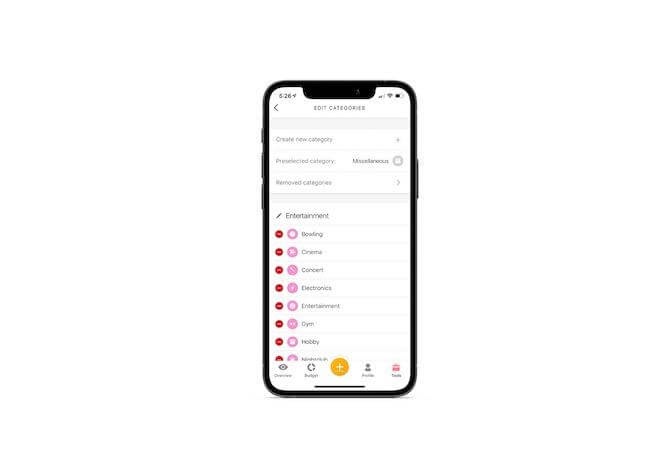

The Buddy app is a good example of this. During the onboarding process, the app asks users which categories are the most relevant to them and includes only those on the screen.

You can also tweak themes, colors, language, and other such elements.

Source: Telerik

Customization is relatively easy to implement compared to other strategies on this list, but its impact on user experience is just as substantial.

Create redeemable in-app points

In-app points are just another form of a rewards system in fintech apps.

The app rewards users with points for completing certain tasks, such as saving a set amount or sending money online. These points can then be redeemed for various prizes.

Using points is sometimes preferable because it gives users flexibility in what they want to be rewarded.

However, the items on offer should be appealing to the user for the points system to be successful.

Of course, if you serve a wide audience, it’s best to offer a variety of prizes, too. That’s what Spanish bank BBVA did with their award-winning BBVA Game app.

Every task in the app, from doing online transactions to completing your profile, will net you points.

You then exchange these points for rewards, which can be anything from a smartphone to football tickets.

Source: Django Stars

Another great example is the OctoChallenge feature provided by the Malaysian-based CIMB banking app. Built using The MoneyThor platform, the app’s gamification system awards users with points for every action they perform in-app.

These points can then be redeemed for vouchers that can be used on popular e-commerce platforms in the country.

In many ways, this gives far better flexibility than offering specific items on the platform. Plus, vouchers are easier to maintain and cost next to nothing.

Add a social element

Probably one of the most effective ways to engage a user is to bring out their competitive side. And there’s no better approach to do this than to show them how others are doing.

In games, this is where the idea of leaderboards came from.

Seeing another player’s high score provides a psychological need to beat it because it makes you believe you can, too.

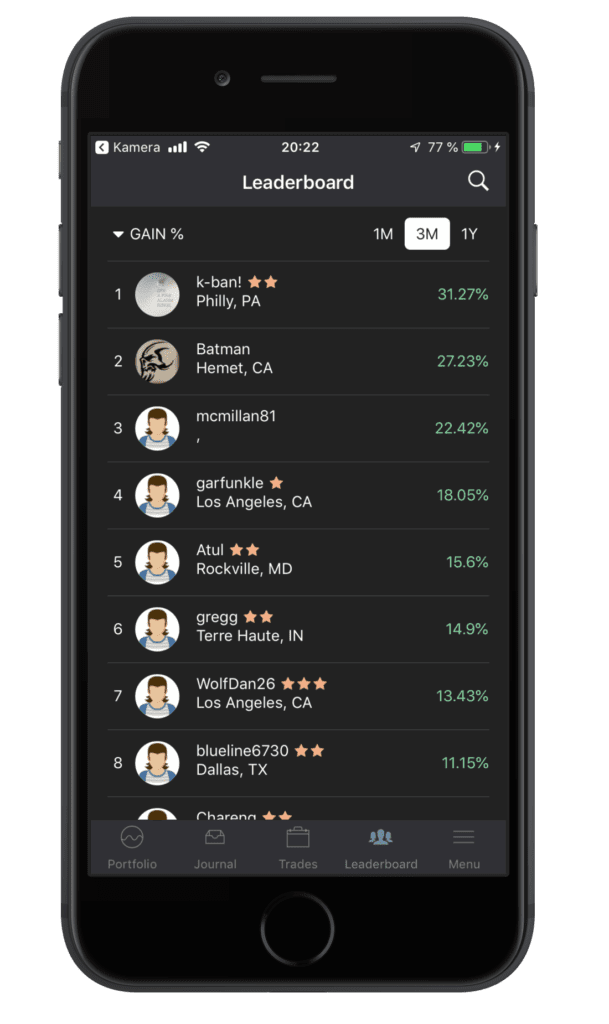

One of the best fintech apps that best show this element in play is Kinfo. It’s a social trading app that allows you to look at other users’ trading performance and styles.

It also includes a ranking of the top traders on the platform, which you can use as a “target” to improve your trades.

This makes Kinfo great for educating and motivating users.

Source: Kinfo

However, social elements aren’t just limited to competition. Creating connections, cooperation, and a feeling of belonging is also as effective.

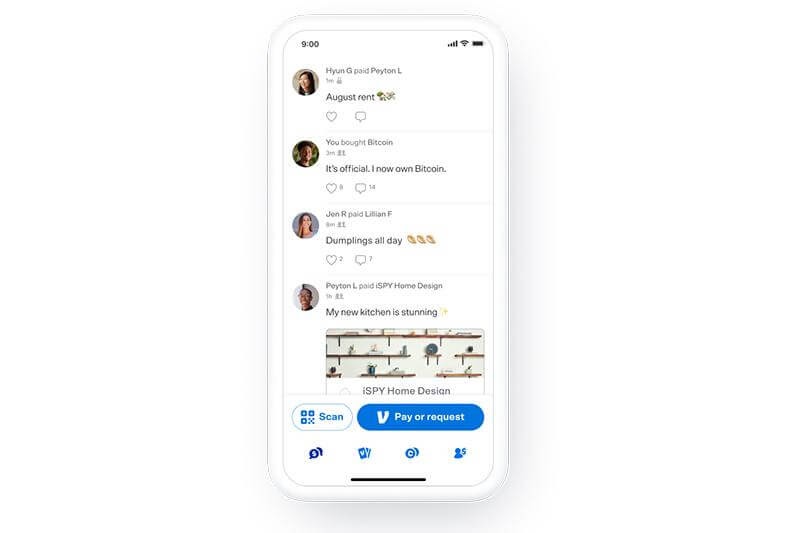

Venmo has been known as not just a payment portal but also a social platform. It allows users to send cash, split payments, and flaunt purchases to friends. In addition, it uses the same gamification elements that make social media so addictive.

Source: Venmo

Referral and affiliate programs are also great for leveraging a person’s social network.

In a way, this is also a kind of gamification, in that it rewards users for inviting other people to become users as well.

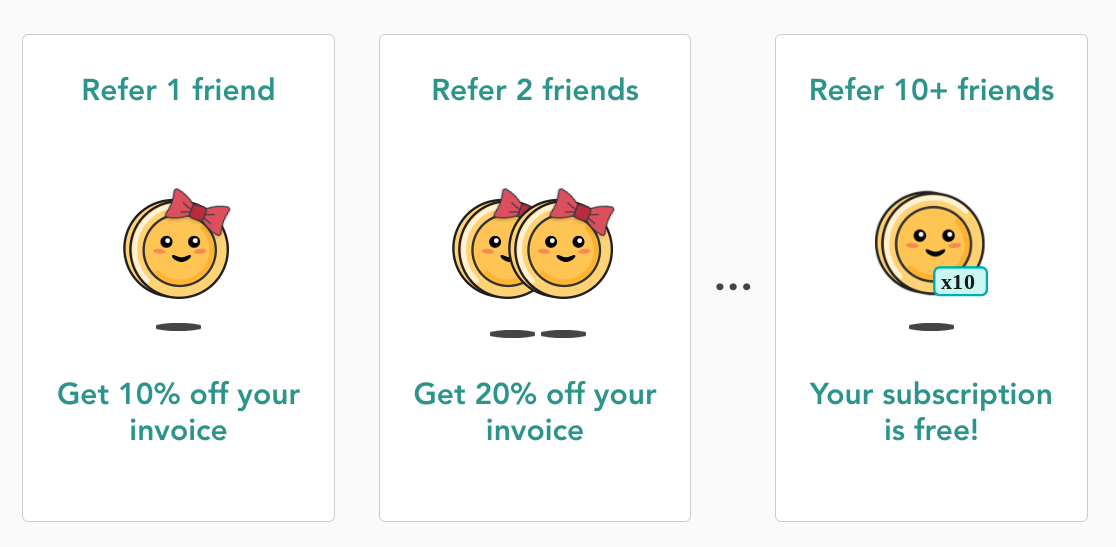

Most fintech apps offer some bonus when you encourage someone else to sign up for the service, so there’s lots of inspiration here. Let’s look at one app that does this right—the budgeting app Lunch Money.

Source: Lunch Money

Their referral scheme is a mini-game in itself, with a multi-tier reward system. The prize you get depends on how many people you get to join, which can ultimately net you a free subscription if you manage to refer more than ten people.

Gamification is the future of fintech

As fintech integrates itself into everyday life, expect to see more gamification strategies in action.

After all, it’s the best way to take something foreign and complex, like finance, and make it fun and exciting.

Are you ready to implement some of these gamification strategies in your next app project?

We’re here to help! Contact us today, and let’s talk about ways to make your fintech app more exciting.