Fintech is a lucrative field right now, and it’s expected to grow to $31.5 trillion by 2026. That’s a fact.

No wonder startups want to get in on the action.

Another fact: it’s also one of the most challenging app niches to get into.

Endless regulations, competitive markets, risky new technologies, and an unfamiliar market are just some of the things that can derail even the best fintech ideas.

Luckily, there’s no such thing as an immovable mountain in fintech. So while they will demand your skills, patience, and effort, it’s possible to conquer these challenges.

Here are some common challenges you’ll face when developing fintech applications.

Identifying a gap in the market

The first step in developing any fintech app is probably the most challenging: finding a great and unique idea to hedge on.

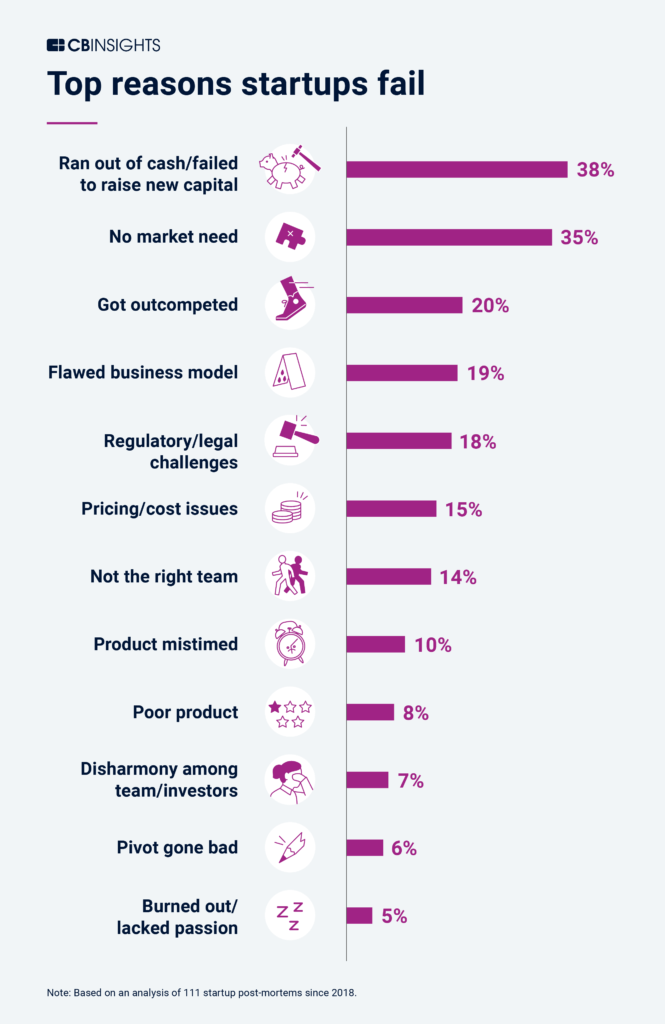

A shaky idea can single-handedly bring your business down. Just take a look at this study by CBInsights, where they found that lack of a market need is the 2nd most common reason for startup failure.

Source: CBInsights

The upside is that finding a fintech idea with strong market demand is the surest way to succeed.

This starts with spotting gaps in the market that you can fill. Easier said than done, though, since there’s no single way to identify market gaps.

One good approach is to start with the already profitable or in-demand niches and find underserved sectors there.

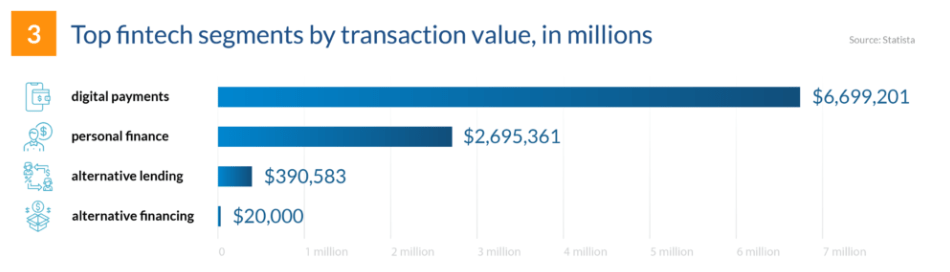

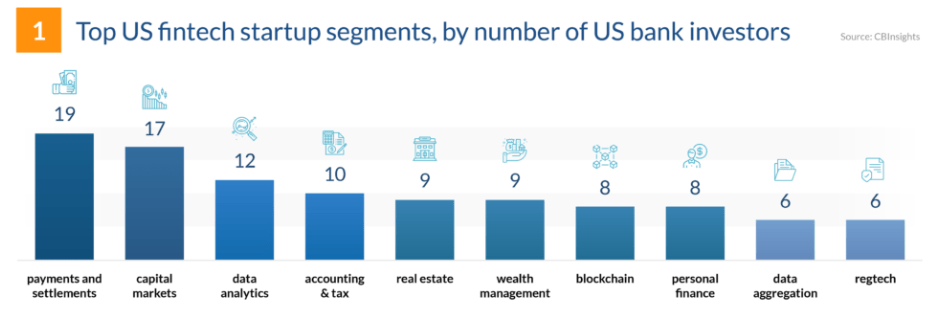

For example, digital payments and settlements are by far the top fintech sector. It has the most transaction value and also attracts the most U.S. banking investors, according to research by Statista and CBInsights.

Source: Finances Online

Naturally, that makes it one of the most crowded fintech niches. But even within that niche, there are still underserved blindspots to consider.

For instance, Direct Carrier Billing allows you to send payments and charge them to your monthly phone bill. It’s mostly used in emerging markets as an alternative to credit cards, but that doesn’t mean the idea wouldn’t be feasible in more developed countries.

Once you’ve identified a few niches you wish to explore, the next step is market research. You can do this through surveys, questionnaires, focus groups, and plain old’ Googling. You can also get insights from third-party research firms.

Remember, the ultimate goal of your research is to answer this fundamental question:

“Is the problem that people in this niche face worth solving, and is it profitable to do so?”

Is the answer an emphatic yes? Then maybe you have a winner on your hands!

If you need further fintech app ideas and emerging trends to capitalize on, check out our article here. Or you can study what the fastest-growing fintech apps are doing for inspiration.

Picking the right tech stack

Once you’ve picked your app idea, the next step is to figure out how to flesh it out. A core concern here is the tech stack you’ll use.

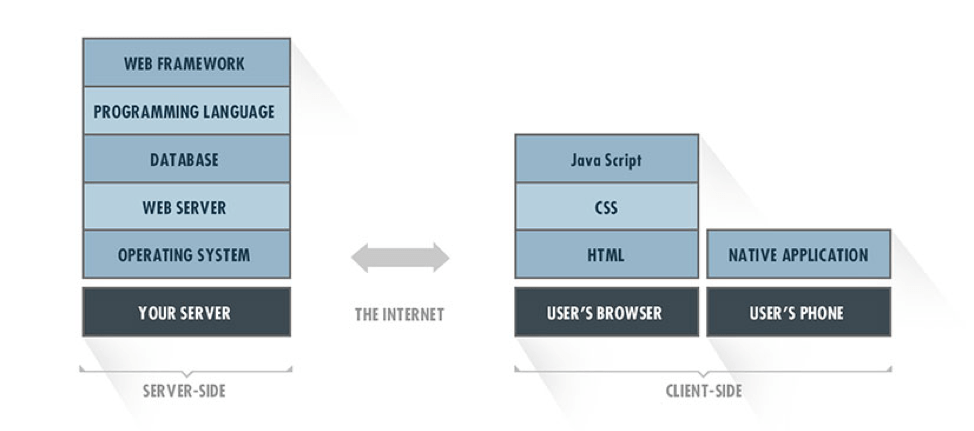

Your tech stack refers to the platforms and tools your app is built upon, both on the client and server sides. This includes the programming language, third-party APIs, servers, and even the underlying operating system.

This is what it looks like:

Source: Clutch

The wrong tech stack is a death sentence for a fintech app. It can increase your costs, lower app performance, or (worse) introduce security vulnerabilities. But, of course, you don’t want that in an app that deals with sensitive financial information!

Now, it’s easy to simply pick the best technologies in each category, but that’s neither practical nor cost-effective. So instead, you should base your tech stack on your app’s requirements, scope, and schedule.

The worst thing is to go with the most popular technology or tool that ends up extending your development time unnecessarily.

In most cases, bringing your app to market faster is a top priority. Dave Girouard, the former president of Google Enterprise Apps, said it best in his quote:

“All else being equal, the fastest company in any market will win. Speed is a defining characteristic—if not the defining characteristic—of the leader in virtually every industry you look at.”

For example, you might pick Python as your programming language because it’s fast to work with.

But if your development team is already versed in Java, the extra learning time you need to switch to Python might make those speed gains negligible. Of course, Java must also be a good technical fit.

The bottom line is to evaluate each tech stack on how its pros and cons will impact your app requirements and development speed.

Properly planning for different app complexities

Identifying the potential problems your app can solve is one thing. But the real challenge is in narrowing it down to the select problems it will solve.

Focusing on a few key problems is much more effective than tackling 50 issues at once. It allows you to spend more time and effort polishing your app’s core features.

In addition, too many features can make the app more complex, negatively impacting user experience.

However, it can be tricky to niche down if you have a long list of potential problems to solve. But it can be done with the right criteria:

Source: DECODE

First, evaluate each problem depending on its urgency. Is it the foremost concern of your market that needs to be solved right now? Or can it be delayed for a future app release?

You should also assess each problem based on your ability to solve it. Do you have the best solution for it compared to the competition? Is it elegant and effective?

Lastly, look at the costs. How much money will it take to solve the problem? Is it still profitable to do so?

Once you’ve finally narrowed the problems down, it’s time to put it to paper with a Software Requirement Specification (SRS) document. Think of it as a guide for your app development. It can also help you plan out costs, schedules, and resources.

You can take this one step further and build a minimum viable product (MVP). This prototype validates your app’s core features in the real world. In addition, it can give you the insight to further define the scope of your app.

Source: DECODE

Remember, no app can solve every market problem efficiently. But sharpening your focus can allow it to have a much greater impact with less development time and costs.

Designing a good user experience

An excellent user experience (UX) is perhaps one of the most crucial factors for app success. According to research by Forrester, a well-executed UX can bring as much as 9,900% back in ROI. That’s huge.

However, there’s a reason not many fintech apps can boast good UX—it’s incredibly tricky to pull off. On average, only 20%-30% of apps retain users for more than 90 days.

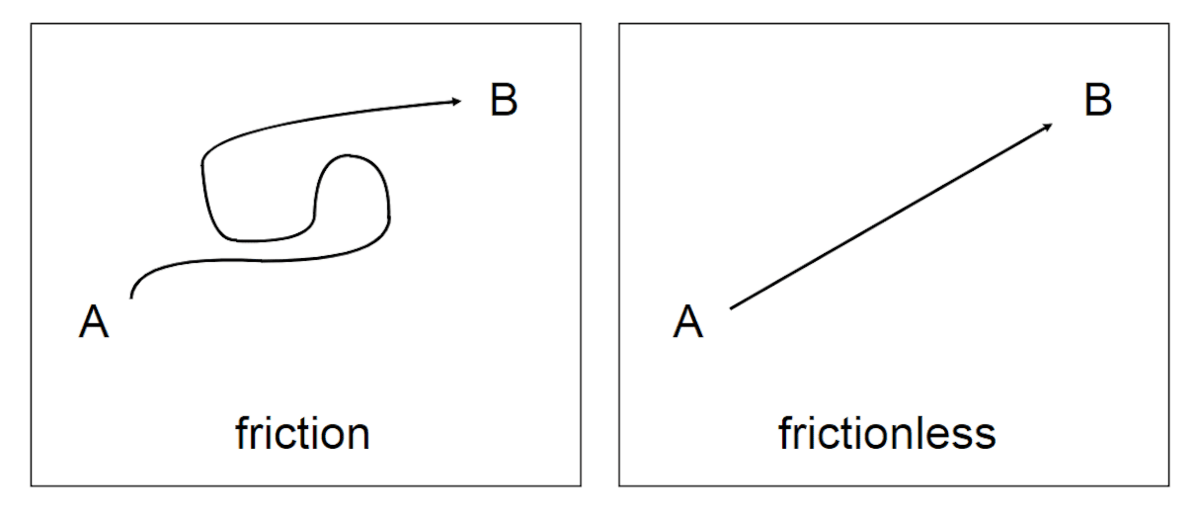

The big challenge with fintech apps is that they need to simplify complex financial processes and terms. The key to having a user flow that reduces friction as much as possible.

Friction is anything that gets in the way of the user from getting from point A to B. Unnecessary steps, a clunky user interface, or unclear instructions are all common forms of friction.

Source: Shopify

One caveat, though, is that some friction is necessary. That’s because extra steps (like a confirmation prompt or warning) serve as ways to prevent users from making easy mistakes that can cost them money.

This balancing act between ease of use and safety is key in UX.

Then there are hundreds of little things that can derail or enhance UX. The color scheme, typography, visuals, and layout all play a role.

Additionally, gamification, when done right, is great for improving UX; but it can also easily do harm when it goes wrong.

With such complexity and scope, your best tool to achieve excellent UX is knowing your users inside and out thanks to market research. Pair that with attention to detail and the services of a UX designer, and impressive results are within reach.

Are you looking for more tips on increasing your UX? Check out our helpful article here.

Protecting sensitive user data

With cybersecurity threats getting more prevalent and varied, protecting your users’ sensitive data is becoming harder to do.

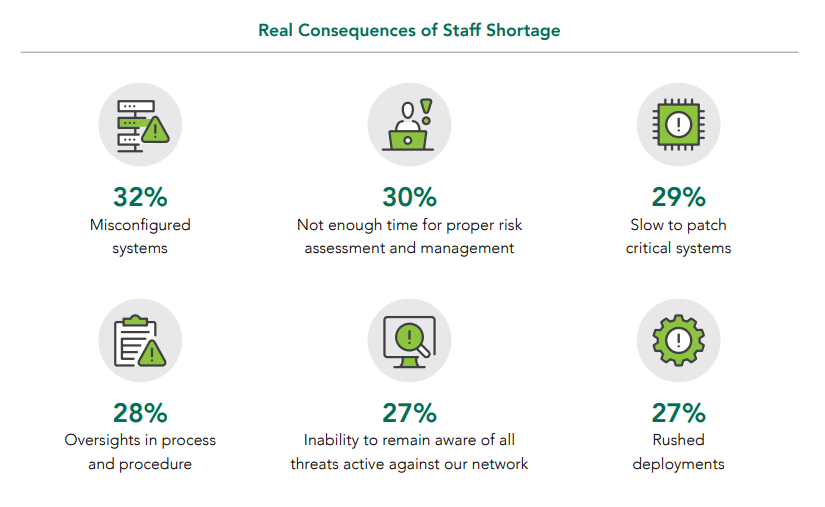

To further fan the flame, there’s a shortage of cybersecurity professionals as well. As much as 48% of companies reported a lack of qualified security staff, according to a 2021 Cybersecurity Workforce Study.

This is bringing a host of vulnerabilities to apps and systems worldwide:

Source: ISC2

This shortage of professionals is a real danger, so you should do everything in your power to overcome it. The leaking of sensitive data can significantly erode the trust of your users, and it’s often enough to bring any app down single-handedly.

At the minimum, you must encrypt your data so that hackers can’t capitalize on any data they manage to steal.

Ensure you’re using both at-storage (like AES) and in-transit (like PGP) encryption protocols.

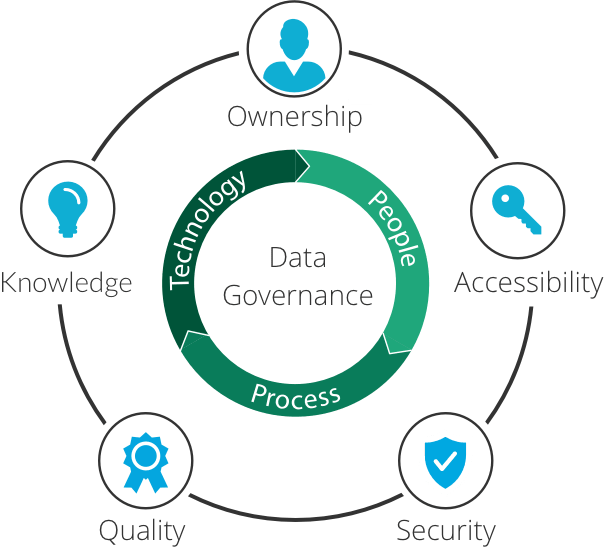

It’s also worthwhile to develop a data governance framework—a holistic set of policies that outline how data should be stored, used, and secured. It’s crucial for streamlining your data security and privacy.

Source: Imperva

Finally, you should comply with major data protection regulations and standards, such as the General Data Protection Regulation (GDPR) in the EU. Doing so ensures that your systems and processes effectively protect user data and privacy.

This brings us to our next challenge: governmental regulations.

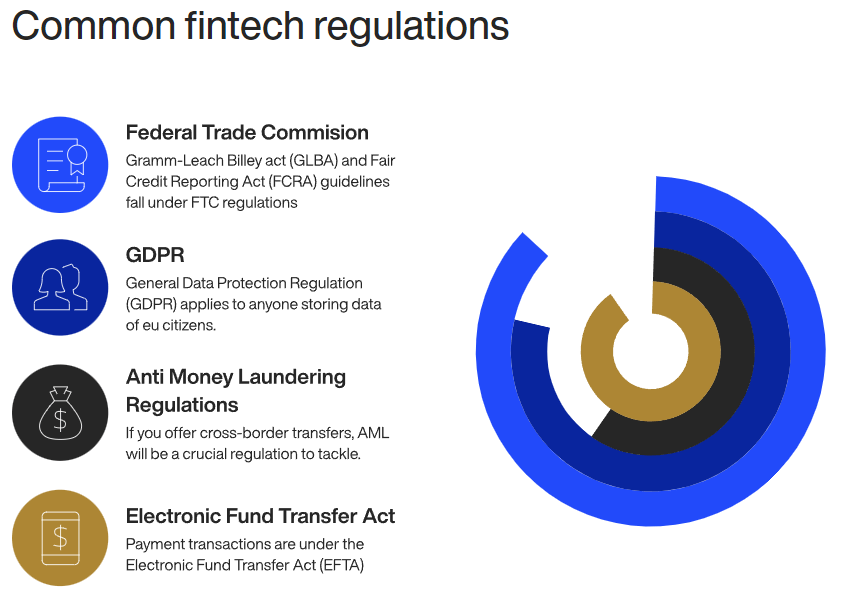

Complying with governmental regulations

Compliance is often one of the trickiest challenges of any fintech app. The biggest reason is that laws vary in complexity from country to country.

Source: DECODE

The U.S. is notorious for this, as there is no single regulation that covers fintech specifically. So instead, you’ll have to deal with dozens of agencies and regulatory bodies, which can make compliance a nightmare.

The most common regulations you need to comply with are the Federal Trade Commission (FTC) Safeguards Rule and the Consumer Financial Protection Bureau (CFPB) Fair Credit Reporting Act.

These mostly deal with data protection and privacy laws, which is similar to the GDPR, which we mentioned earlier.

For some other types of regulation, the need for compliance will depend on the type of fintech app you’re developing.

For instance, the Office of the Comptroller of the Currency (OCC) is in charge of lending or digital banking apps that process checks (although that’s still a gray area).

On the other hand, for investing or trading apps, you’ll need a green light from the Financial Industry Regulatory Authority (FINRA).

The challenges increase if you choose to deploy your app in multiple regions. That means you’ll have to deal with the vague—and sometimes conflicting—regulations that are in force within each region.

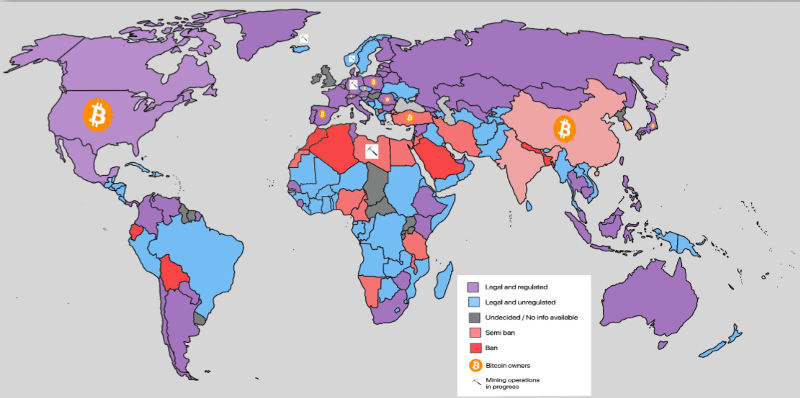

This is particularly clear when it comes to cryptocurrencies. Different countries have various laws that govern cryptos, with some countries even banning them outright.

So if you have an app that supports Bitcoin and you want to deploy it in China (where it’s illegal), you’ll need to heavily modify your app to fit the regulations.

Source: Finextra

Compliance is tricky and is one area where help is necessary. Your best bet is to hire a lawyer or legal consultant well versed in fintech and the financial industry.

Alternatively, you can also invest in RegTech solutions. These use AI and other automation tools that can streamline the process for you.

And as you can see, AI is a big driver of innovation in fintech, as long as you harness it properly.

Leveraging AI and big data

Artificial intelligence is already making a big impact on the future of fintech.

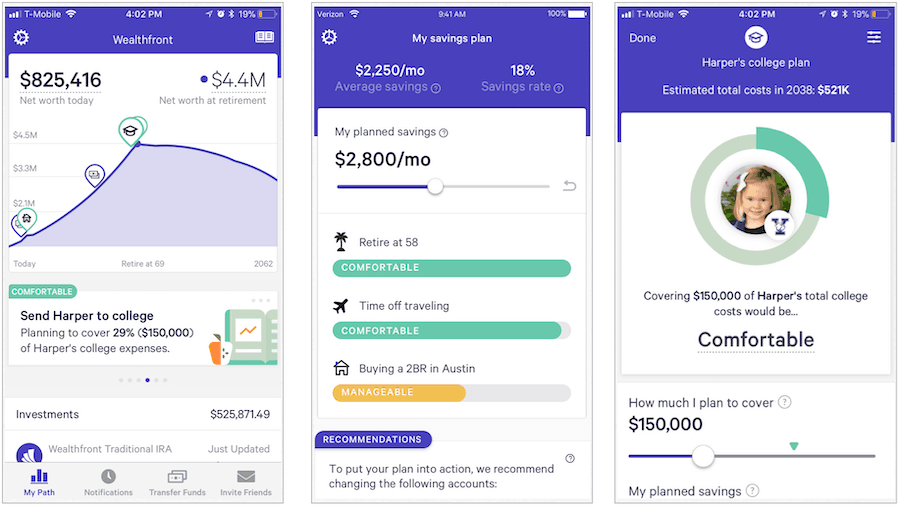

For instance, it’s opening up new niches like autonomous finance. This innovation enables apps to perform complex and tedious tasks, like picking a stock portfolio or finding the best lenders, automatically.

A good example is the Wealthfront app, which can choose the best investments based on a user’s goal, income level, and risk tolerance.

Source: Groovy Post

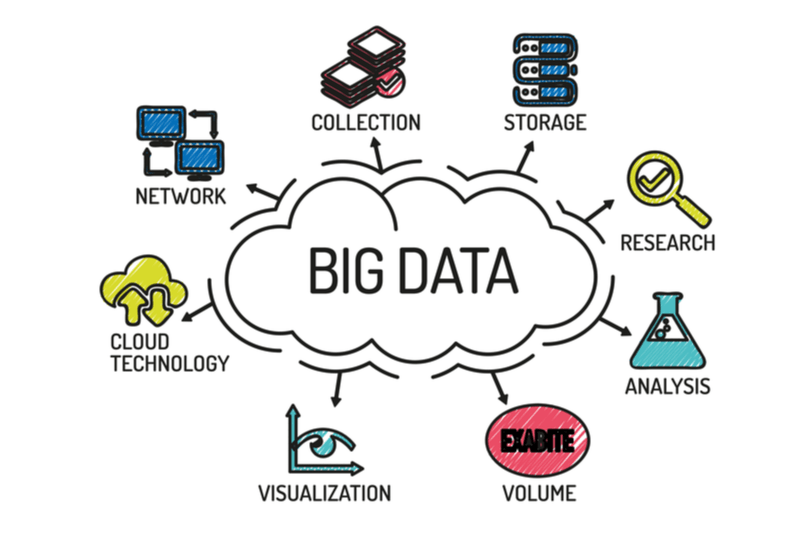

But AI is useless if there’s no data it can work with. That’s why Big Data is also a crucial piece of the innovation puzzle.

Source: Mobindustry

However, AI and Big Data are highly specialized fields, and they require equally great talent to fill, yet because of their complexity, there is a talent gap.

For example, according to a Tencent study, millions of AI roles are in demand worldwide, but only 300,000 professionals can fill them.

Unfortunately, there’s no way around this dilemma. Big Data and AI are far too advanced to solve through APIs or third-party tools in most cases. Therefore, you need someone with expertise in both AI and Big Data and how to integrate them.

But it’s worth going through the trouble of hiring them, as AI and Big Data can provide your app with tremendous benefits and a competitive edge.

How to overcome the challenges in fintech development?

Developing fintech apps is challenging, which is why the vast majority of startups fail. But we believe everything is possible—even manageable—with the right partner.

As an award-winning mobile app agency, we think our successful track record in fintech is your best weapon to smash through the many obstacles of app development. So contact us today, and let’s make your success a reality!