According to a Boku Report, 60% of the world will use mobile wallets by 2025.

Looking at today’s statistics, the prediction seems quite plausible. Right now, an estimated 2.8 million people are already e-wallet users. 2020 alone saw over $1 billion in transactions.

There’s no denying—digital wallets are the future of finance. Not surprisingly, this niche is attracting everyone, from independent developers to Silicon Valley tech giants.

Standing out in this increasingly competitive market will be tough for a new e-wallet app. But it’s entirely possible, and it starts with getting these key features right.

Frictionless self-registration

Like any fintech app, registering for an e-wallet app should be quick and efficient. This is important if you want to maintain a great user experience (UX).

One of the key ways to achieve this is to make the registration process easy for the user to conduct independently, with minimal outside help.

This might seem counterintuitive because you’re effectively leaving your customers to fend for themselves. However, some studies have shown that your users actually prefer it that way. For instance, a ZenDesk survey showed that 67% of respondents prefer self-service over human contact.

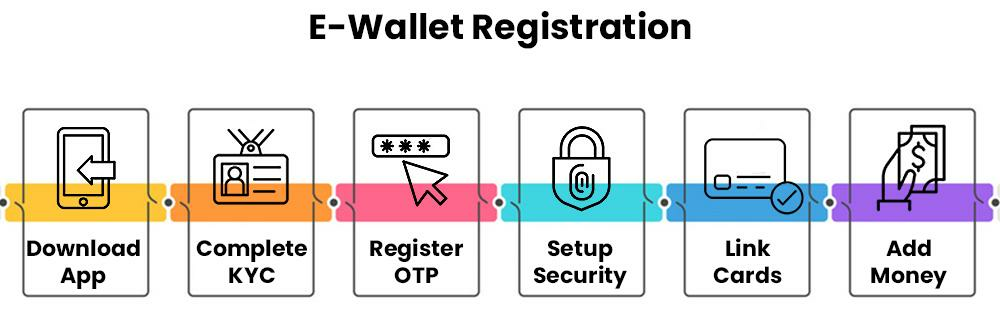

Here’s what a typical self-registration process looks like:

Source: DECODE

The KYC (Know Your Customer) process is arguably the most critical step here. Not only is it required by regulation, but it can also contribute to a safer user experience. It achieves this by identifying legitimate users from fraudsters and bots.

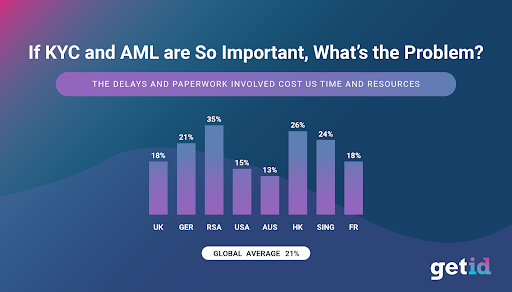

KYC is tricky, however, as it can add extra time and friction to the registration process.

Source: Get ID

You need to be mindful while implementing KYC and make it palatable to users. A key way is to minimize the steps or requirements involved.

Venmo, for instance, only verifies your bank account without needing any further documentation.

Apple Pay is even easier, as it only asks you to link your credit card (although the card issuer might have additional verification processes).

Another tactic you can use is only requiring document verification for “serious” users who want to unlock higher transaction limits or other perks. One good example of an app doing this is the Skrill wallet.

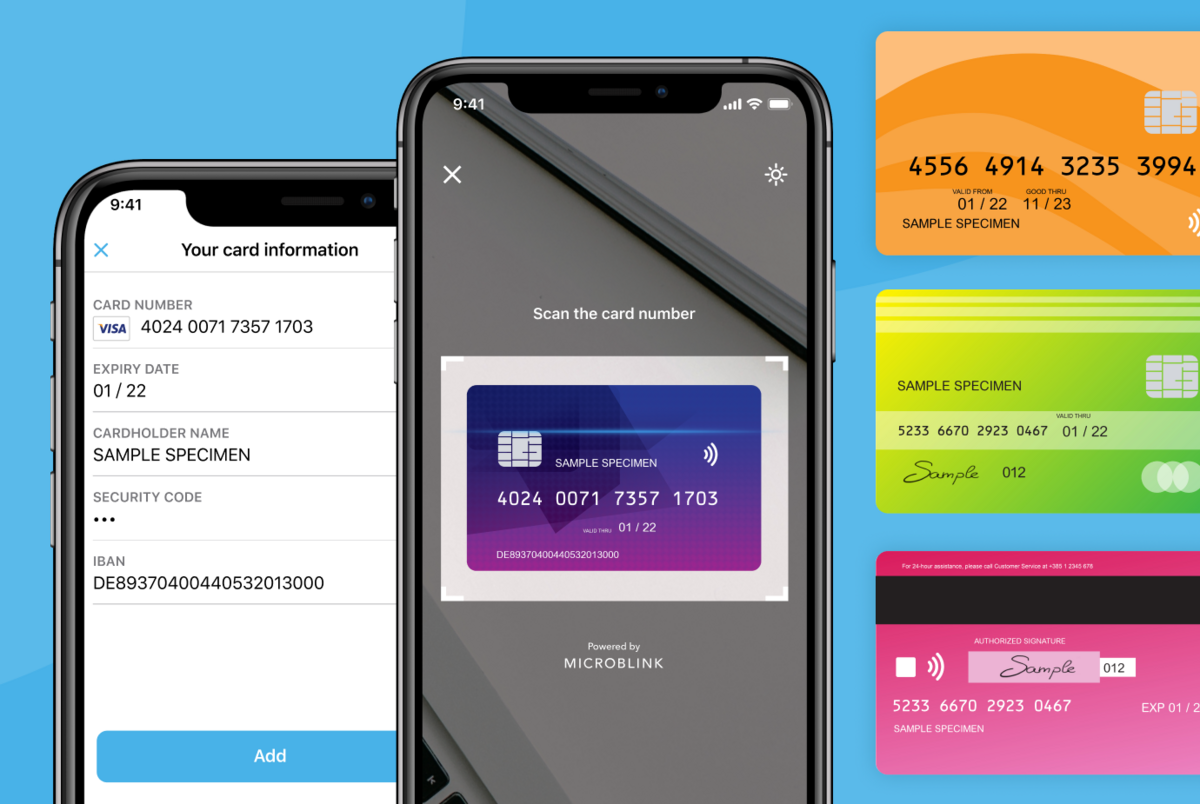

Making data entry effortless is essential for good UX, and it applies to e-wallet registration as well. For example, instead of manually entering credit card information, it’s better to support card scanning.

Source: Microblink

Setting up your e-wallet security is crucial, but you should also make it as quick as possible.

An easy way to do this is to use the phone’s native authentication technology, such as Face ID with iOS devices. This approach eliminates any additional setup.

But a frictionless self-registration isn’t limited to just users. It’s important to make it seamless for merchants as well. Doing this is a great way to attract more retailers, which, in turn, again helps get you more users.

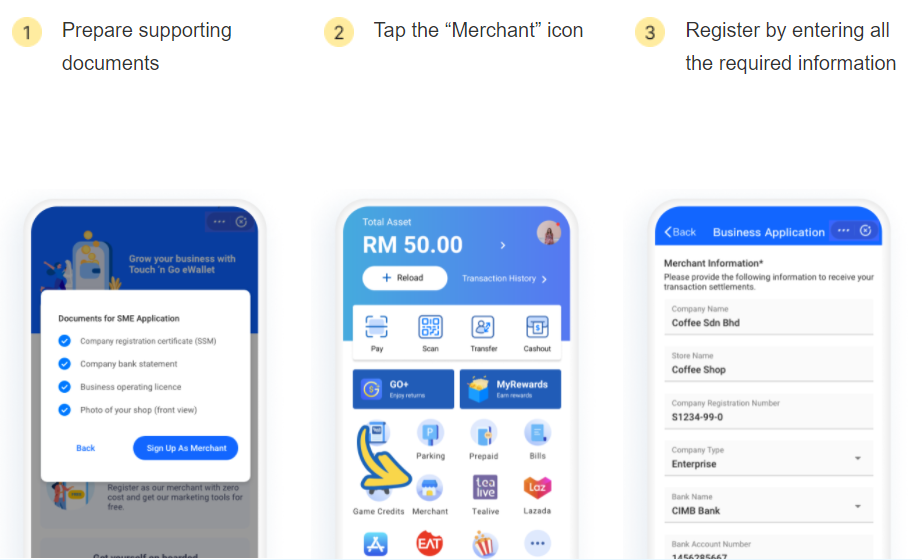

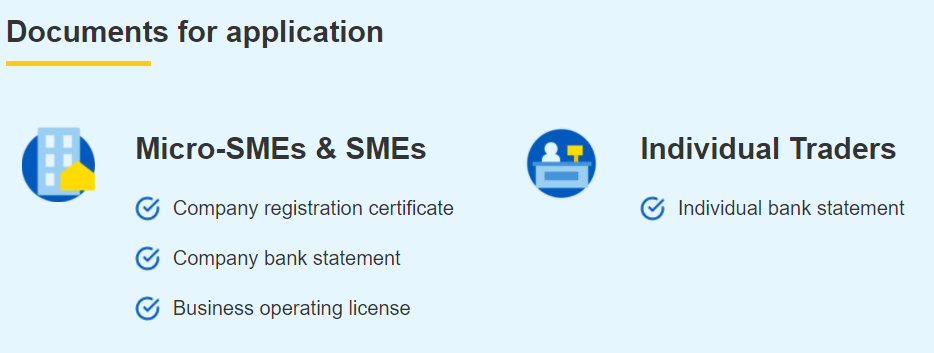

The Malaysian e-wallet Touch ‘n Go offers a good example of a frictionless merchant registration process.

Source: Touch ‘n Go

Note that the document requirements are relatively minimal, needing just the business license and a bank statement. Moreover, registration is free, and the merchant even gets subsidies and other incentives to sweeten the deal.

Thanks to its easy onboarding process, the Touch ‘n Go platform has over 410,000 merchants where the wallet can be used. No doubt, this has played a part in helping the app garner over 16 million users.

One important lesson here is to include businesses of any size, as Touch ‘n Go did. They even accept individual traders who sell items informally.

Source: Touch N’ Go

At the heart of it, though, frictionless self-registration isn’t that different from a great onboarding sequence. The same principles can be successfully applied to both of them.

For more app onboarding tips, check out our excellent articles here and here.

Analytical dashboards

A good e-wallet is more than just a way to make payments. It should also help users track their spending.

Overspending is a big problem worldwide. For example, a US Federal Reserve survey revealed that 25% of its respondents couldn’t pay their monthly bills consistently due to always exceeding their budget.

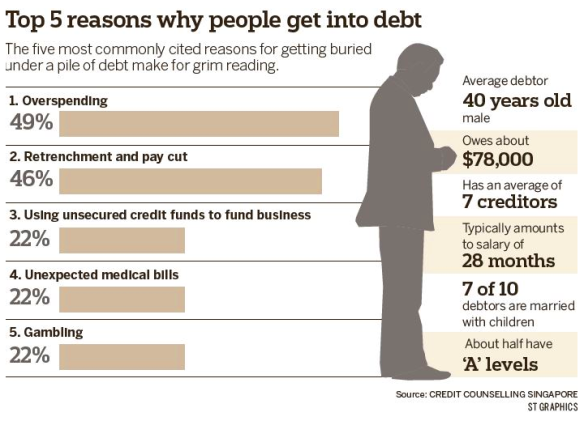

It’s also one of the top reasons people get into debt. A study in Singapore confirms this, and the situation everywhere else in the world isn’t that far off.

Source: SG Best Investments

By allowing your users to track their spending with your e-wallet, you’ll help them avoid overspending and going into debt. This is the best way to retain them long-term.

Now, your e-wallet doesn’t need to become a full-blown personal finance app to help your users track their spending (although that would be best if you could do it).

Even incorporating just a few basic features can go a long way.

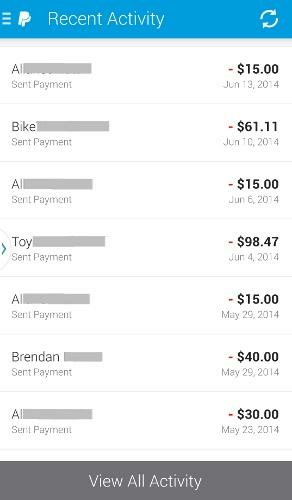

At the very least, your app should have transaction history, like this one by Paypal:

Source: PC Mag

This is crucial for tracking not only expenses but also the cash flowing into the e-wallet. This is invaluable for people who receive salaries digitally, such as contractors or freelancers.

What’s more, they’re vital for enabling users to catch any unauthorized transactions or potential breaches.

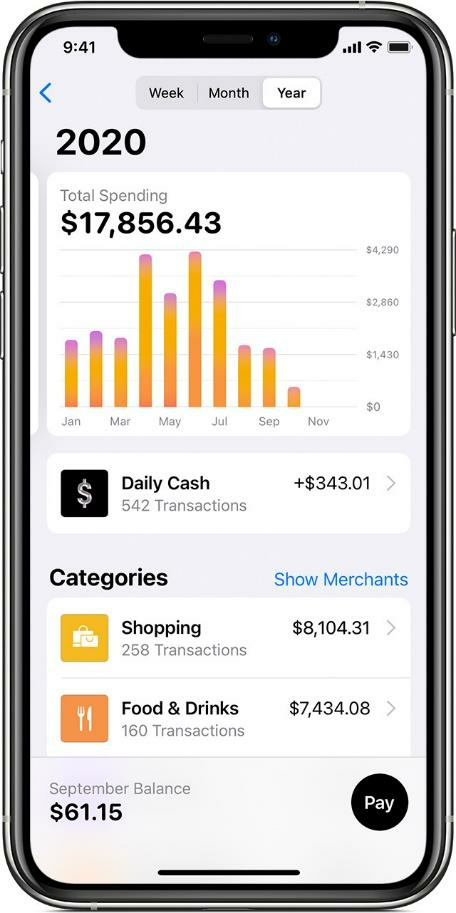

To make your transaction history even more helpful, you can visualize it for your users.

Doing this gives people a better glimpse of their spending habits and patterns.

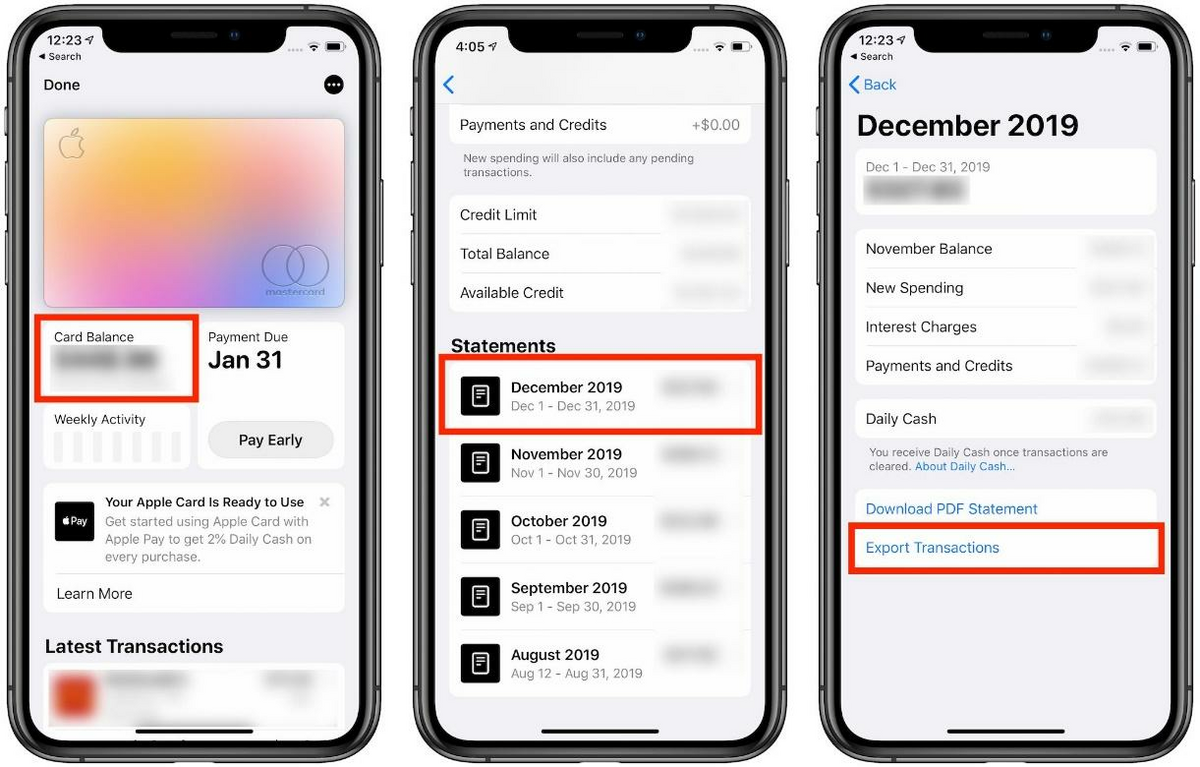

For instance, Apple Pay provides a chart of a user’s daily spending over a certain period. Users can also categorize their spending for easy review later on.

Source: Apple

Eventually, the number of transactions in a typical e-wallet will become overwhelming. Thus, it’s also best to incorporate a way of searching through the data.

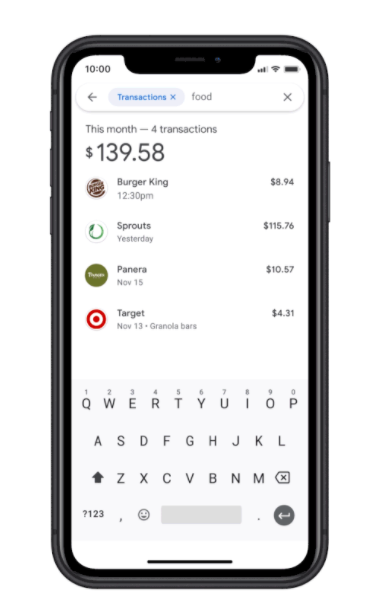

A good example is, unsurprisingly, Google Pay.

The app’s analytics dashboard, called Insights, allows users to search through transactions intuitively. So, for instance, type in “food” and the app will list all the expenses related to food.

Source: The Verge

Google Pay Insights even has a Goal feature where users can set goals and monitor their spending against them.

Indeed, the analytics of most e-wallet apps are not as feature-rich as dedicated personal finance apps. Nevertheless, the value is in providing basic yet crucial financial management options conveniently.

Integration with various devices

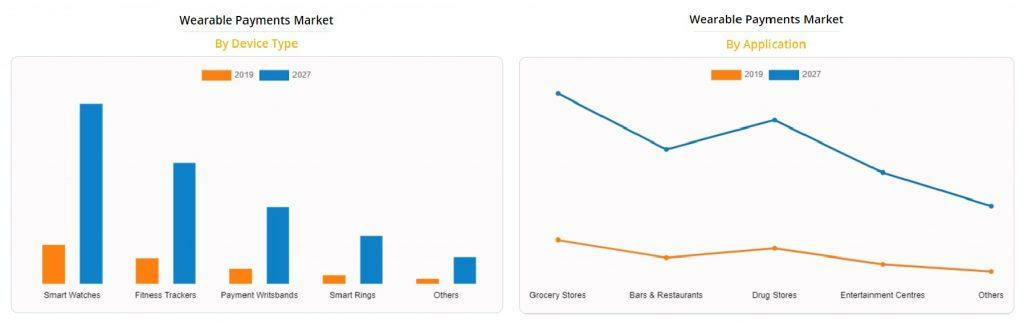

The best e-wallet apps need to be future-proof. That means thinking beyond smartphones and into the next big evolution of mobile wallets—wearable payment devices.

Wearable payment technology allows devices to transmit payments just like smartphones do, but with greater convenience.

There’s no need to whip out your phone—simply tap your watch or ring near the reader.

Thanks to the popularity of the Apple Watch, Fitbit, and their many copycats, the wearable payments market is on a strong growth trajectory. It’s now worth an estimated $43 billion as of 2021 and is projected to hit $1.37 trillion by 2027.

Source: Payments Cards and Mobile

If you want your app to stay innovative and benefit from this trend, it’s crucial to consider multi-device integration early on.

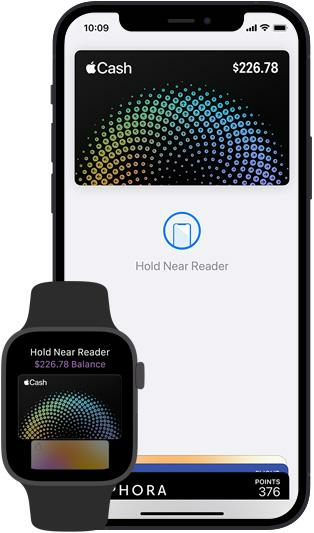

Apple Pay was one of the first payment apps to realize this. They designed the app to work on virtually any Apple mobile device, Apple Watch included.

Paying via the smartwatch is even more convenient, thanks to its wrist detection feature. That means there’s no need to enter a passcode if you want to pay as long as you’re wearing the device.

Source: Apple

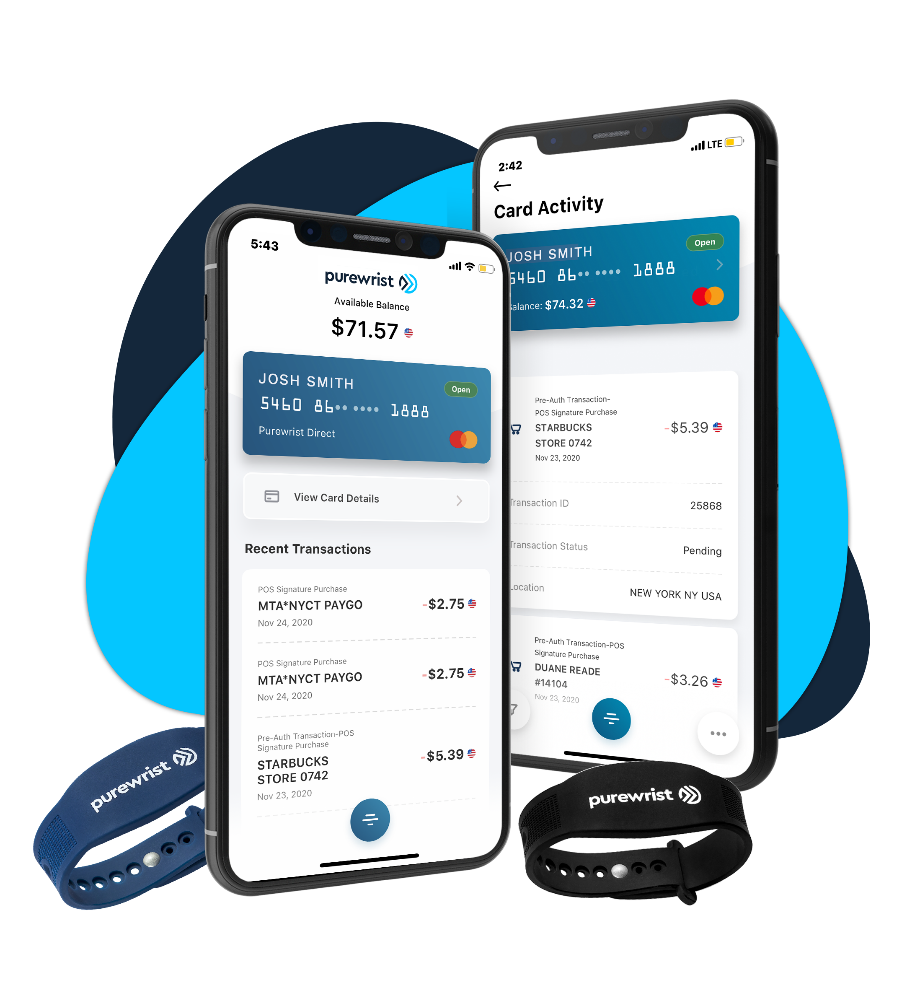

Another approach is using a payment device solely for initiating transactions at contactless readers or POS machines. Everything else, like loading or account management, is handled through the app.

A good example of this setup is Purewrist.

Source: Purewrist

Another variation is the Fuze Card, a card-shaped device that stores payment information. A smartphone app scans credit card information then saves it to the Fuze Card via a dongle. Then, to pay, simply swipe it just like you would a regular credit card.

Source: Fuze Card

Devices like Fuze Card and Purewrist are more convenient and durable than using your smartphone. Most are waterproof as well, which makes them suitable for paying in venues like bars or pools.

Regardless of how you implement device integration with your e-wallet, it’s something that you should prepare for as these devices are sure to attract more users in the future.

Ease of transactions

So far, we’ve been talking about useful features for e-wallet apps. However, there’s one critical aspect you should consider a must-have: ease of transactions.

In other words, sending money from an e-wallet to anyone should be as frictionless as possible. Get this wrong, and it could hurt your app’s user experience dramatically.

First of all, sending payment from one e-wallet to another should be instantaneous, assuming there are no problems with the transaction. At most, it should only take a few minutes.

Next, sending payments should ideally require minimal information. For instance, the digital wallet pioneer Paypal only asks for a person’s email address. Venmo follows a similar process.

Admittedly, it gets more complicated when sending payment to a third-party entity, like another fintech platform or a bank. But even then, there are ways to make the transaction smoother.

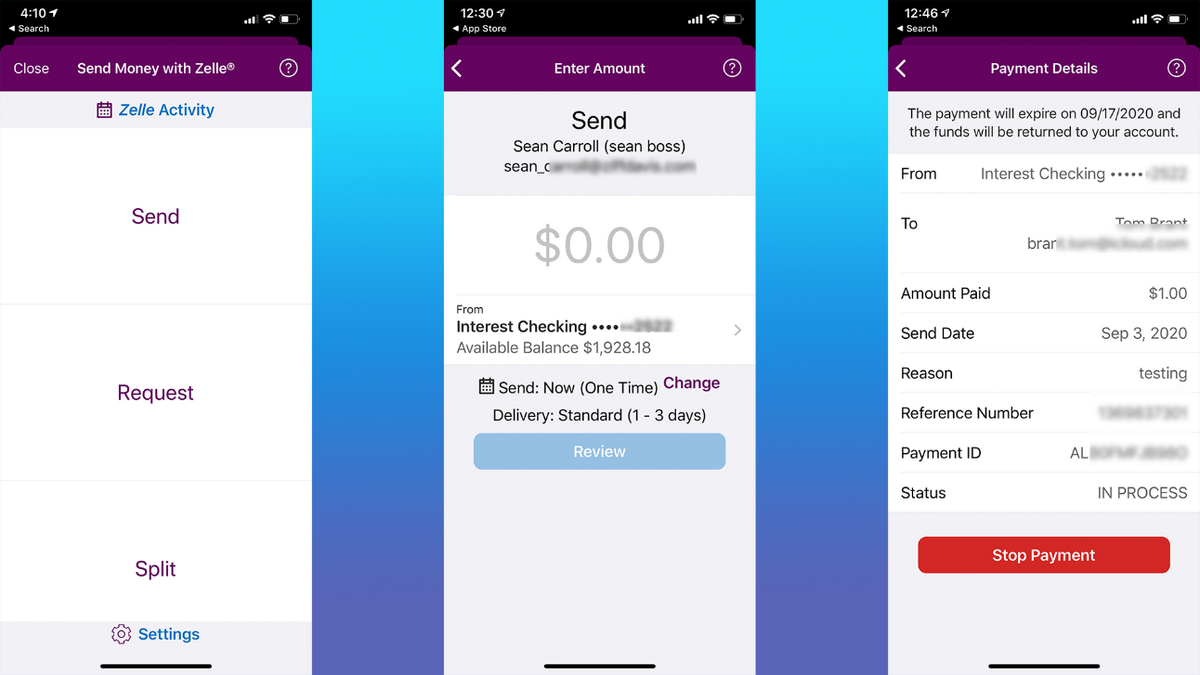

A good example is Zelle, an e-wallet focused solely on sending money between friends and family. It’s available both as a standalone app or integrated into over 100 banking apps.

Source: PC Mag

The popularity of Zelle is due to how easy it is to send money.

Funds are sent straight to a person’s bank account and not through a middleman, unlike typical platforms like Paypal or Venmo. That eliminates the extra time of moving funds to a bank account manually.

The recipient also gets the funds automatically without confirming through the Zelle app. In fact, they don’t even need the app at all. They simply need to enroll their account with Zelle.

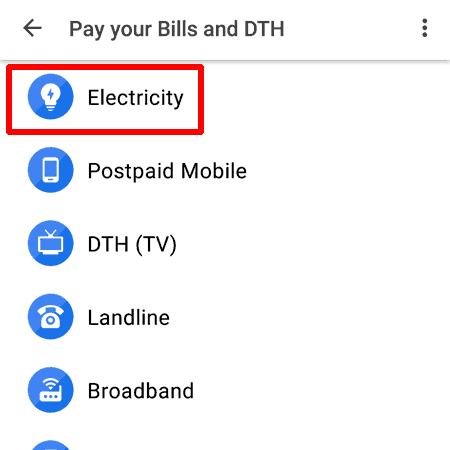

Bills payment is also a great feature to have on an e-wallet app. Instead of users having to enter each utility’s payment details manually, you can allow them to pick the corresponding bill from a list of categories.

Google Pay (specifically in India) is a good example of this feature in action.

Source: UPI Payments

You can even integrate automatic bill payments or reminders into your e-wallet app to make it even more useful.

Beyond these basics, there are even more advanced features to offer for your user’s benefit.

The popularity of Venmo, for instance, was thanks to its convenient features such as split payments. Paypal (with a debit card) also allows users to withdraw their funds straight from an ATM.

The key to success with e-wallets is to look at how your users are sending and receiving payments. Is there a pain point there somewhere? That’s what your app should tackle.

Safe data backup

E-wallets house incredibly sensitive financial data, so it makes sense to back them up regularly. This is especially true with crypto wallets since it’ll be next to impossible to recover them in case of theft or loss.

There are two approaches to backing up wallet data: online or offline.

Online backups often involve exporting the data, such as private keys, into a file, then storing it securely in a cloud server. The advantage of doing this is that it makes it easy to move your wallet if you switch to a new smartphone.

You can also export transaction histories and statements with most e-wallets, such as Apple Pay. This is great if you prefer to work with hard copies.

Source: Tidbits

Note, however, that some wallets don’t export sensitive data.

Apple, for instance, doesn’t back up Wallet data to iCloud. Unfortunately, that means you also can’t restore your wallet data should you lose your phone. While it’s done for security purposes, it can be a hassle.

Offline backup is another viable option, but it’s usually seen only with crypto wallets. The idea is to store private keys into an offline hardware device, such as a dongle or card, to isolate it from the Internet and thus make it unhackable.

A good example of this is the FuzeW Card, a hardware wallet specifically designed for storing cryptocurrencies, but not transactions.

Source: Fuze Card

Of course, the drawback is that if you lose the device, you potentially lose the wallet data (and the cryptos) there forever. It’s a risky bet, but if you take the necessary precautions, it’s the safer alternative.

As you can see, data backup might be a crucial feature of e-wallets, but it isn’t as widespread or well-implemented yet. On the other hand, that gives you a better opportunity to succeed.

Knowing is just the beginning

Figuring out the key features your e-wallet app needs to stand out is just one part of the equation. The other is implementing it—and that’s where the real challenges begin.

Fortunately, you can make your life easier by partnering with an app agency that’s already been there. And with our extensive experience in the fintech app space, we believe DECODE is the perfect fit for the role.

Ready to bring your e-wallet app to reality? Contact us today!