As Alex O’ Byrne, the co-founder of the Shopify Plus agency We Make Websites wisely put it: “Trust is the first principle of conversion.”

He’s right—trust is the foundation of every human relationship. Governments rely on it, and so do businesses.

In fact, brand loyalty is nothing more than customers trusting that a company will deliver a stellar product or service every time.

And for fintech apps that involve a person’s hard-earned money, gaining and keeping their trust is fundamental to success.

Here’s how you can do that in your app.

Increase trust signals on your website

You don’t build trust by doing just one thing. Instead, trust is the result of a series of small but multiple trustworthy acts and messages over time.

These are called trust signals, and they’re essentially visual proof that your app deserves a user’s trust.

The earliest mention of trust signals was in a March 2000 article by the Journal of Computer-Mediated Communication. These referred solely to “trust badges” from third-party accreditors like the Better Business Bureau or TRUSTe.

And although that piece was written more than 20 years ago, trust badges are still effective today. In fact, in a study on e-commerce buyers, 60% out of 146 respondents didn’t purchase from websites that lacked these logos:

Trust from a third-party authority is incredibly valuable, especially in the fintech space.

The knowledge that your app is approved by your country’s financial regulator or well-respected accreditor is proof that the users’ money is safe with you.

Of course, the most common and arguably most powerful trust signals are social proof metrics like reviews and ratings. Indeed, 91% of consumers trust online reviews to guide their decisions—almost as much as personal recommendations from friends or family:

It’s, therefore, crucial to encourage your users to leave reviews on your app. The simplest way to do that is through the app page on the Apple App Store or Google Play Store, but it can also be on third-party sites like Trustpilot.

Your content marketing is also an important trust signal. Consistently putting out great and useful content communicates that you know your stuff and helps establish relationships with your customers.

Coincidentally, these all satisfy the three elements of trust outlined by a Harvard Business Review piece:

On the more technical side, showing you have a safe and secure app is also an important contributor to trust.

The simple act of using Transport Layer Security (easily evident with the HTTPS in the URL) tells users that their data is safe with your app.

There are dozens of other trust signals you can use, including free trials, partnerships with other trusted organizations in your industry, great UX design, and even terms and conditions.

All of these help reassure your users and potential customers, which is particularly important in fintech.

Show off your compliance and security efforts

Fintech, by its nature, is a very risky industry. After all, you’re dealing with people’s money, so you can expect to be a juicy target for cybercriminals and hackers.

This has been especially true during the pandemic when more people conduct transactions online. Indeed, a VMware study found that 2020 saw a 238% increase in hacks targeting the finance industry.

Another study by IBM and the Ponemon Institute estimated that the average costs of financial hacks in 2021 are $5.72 million—a 10% increase from 2019.

To succeed, you need to focus on ensuring your app’s security and compliance—then putting it front and center for your users. It’s the best way to build trust, especially if you’re new to the marketplace.

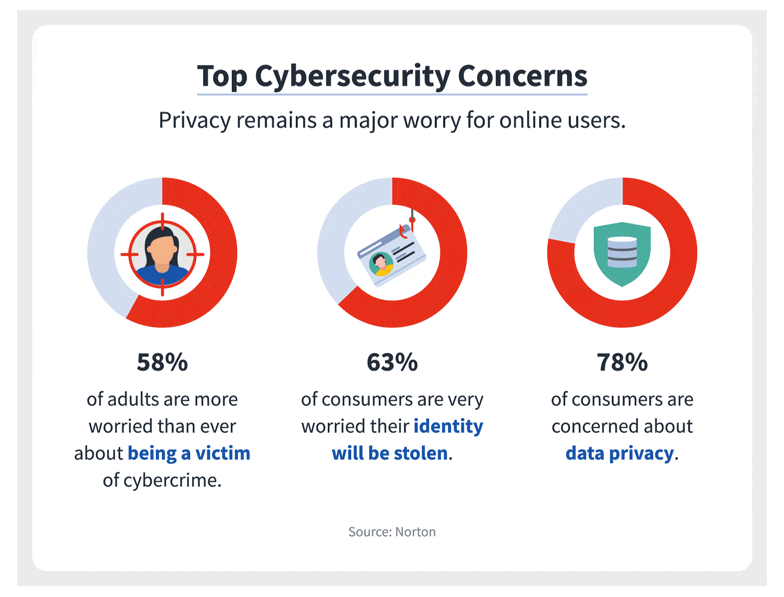

But where do you begin? First, it’s useful to know your users’ biggest security concerns. And this handy report from Norton sums it up nicely:

Source: Norton

Fortunately, these concerns can be addressed with the right security technologies in place.

For example, using encryption protocols like PGP and AES can help protect your users’ data and reduce the chance of identity theft. You can then mention this in your marketing or in-app to inspire confidence with users.

Users will also feel safer if you employ multiple authentication and authorization protocols in your app—even if some of them might feel it’s a hassle.

Layers like biometrics and two-factor authentication are evidence that you’re taking app security seriously.

Another good trust booster is to show that your app complies with regulations and industry standards.

For instance, the fintech platform Exabanque prominently features the fact that they’re PSD2 compliant. PSD2 is a European directive that helps make online payments more secure.

The DECODE team also complies with PSD2 when developing banking and mobile payment apps.

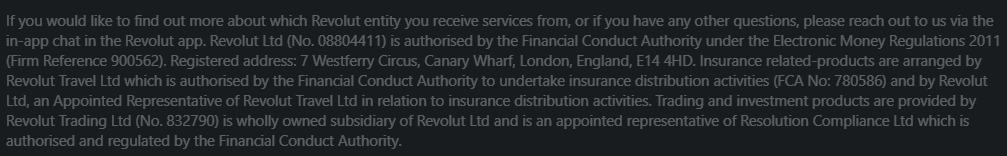

It’s also common for fintech apps and websites to display legal fine print that mentions compliance with government regulations, such as this one from the Revolut website:

Source: Revolut

You might think that no one reads these things, but you’d be surprised how many do. And even more people rely on them to check if your app is legit or not.

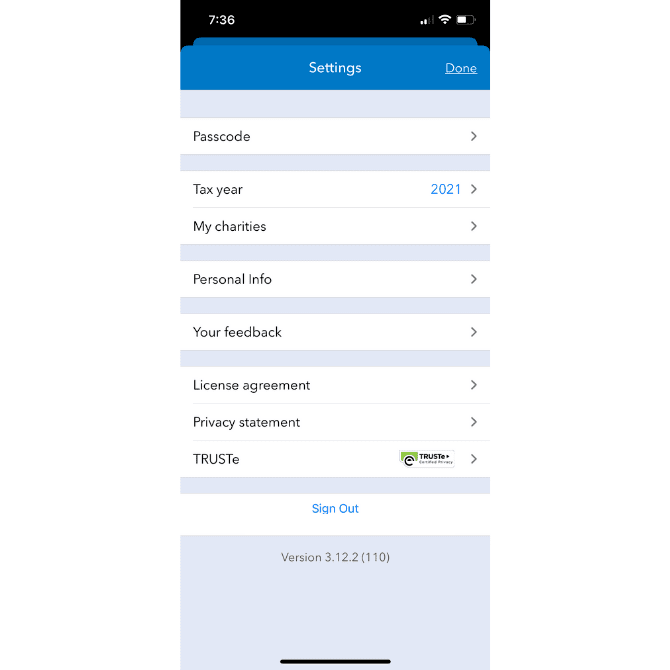

Lastly, if you have trust seals or accreditation from third parties, be sure to include them in key areas of your app, such as what many Intuit apps do with TRUSTe:

Source: Telerik

To sum up, your compliance and security efforts are what makes your fintech app trustworthy and safe.

However, unless you actively share what steps you’re taking to protect your users, it’s impossible for them to know how seriously you’re taking compliance and security. Therefore, don’t be modest and brag about your efforts!

Be transparent about the information you ask for

Fintech apps need a lot of financial information to work properly, from an overview of the user’s income to their bank account number. But, of course, you need a high level of trust if you expect people to part with such sensitive information.

This becomes especially challenging since users need to provide such data during the onboarding phase—where trust is barely established. So unless you’re a big financial institution, how do you go about this?

The key is transparency.

In other words, you should explicitly ask permission from your users to collect their data and explain why you need it.

The latter part is important.

Explaining how you’ll use their data can help allay their concerns over privacy and misuse. Psychologically, it also increases the chances that people will agree to what you ask of them, according to Influence author Robert Cialdini.

But remember that everything you’re doing should always visibly be to the user’s benefit.

For instance, we all know that asking for a user’s email is an excuse to send them marketing promos. But you can frame it differently: as a way for users to receive important updates or reset their passwords if they forget it.

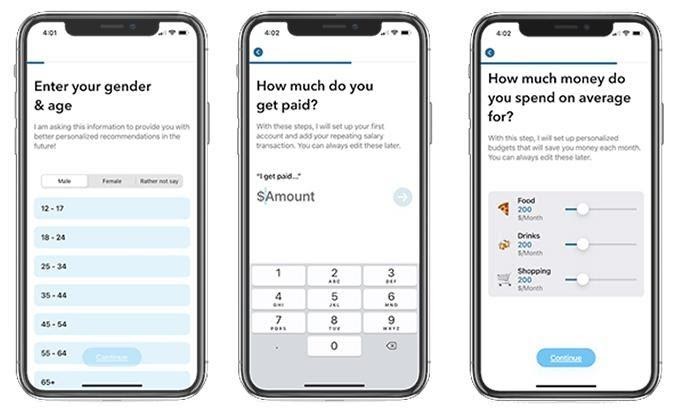

The MoneyCoach app is a great example of this practice in action.

For every piece of data the app asks, it makes a point to explain the reasons why it’s required. And it’s always framed with the user in mind:

Source: Telerik

Ultimately, however, gaining trust is more than just being transparent. Your users should feel that they’re in control of their data at all times.

For example, many apps, such as Mint, include a Privacy Control feature. This allows users to opt-out of personalized ads, which are served to them through their data. While it might reduce your ad revenue, certain users will greatly appreciate the option.

Overall, transparency should be integrated throughout your app, not just when dealing with their data. When your app is transparent with everything from its features to the pricing, it can add a layer of trustworthiness.

Create a seamless app experience for users

Creating a stellar user experience is vital for establishing trust. And it starts with a fundamental question—why should they even use your app?

Here, banks have a clear advantage over fintech, as most people know what banks are for. A McKinsey study found that people actually trusted banks a bit more than fintech platforms:

Source: McKinsey

So, how can you reverse this trend?

The first step is clearly explaining what your app does and how it can help your users.

Next, you have to convince people that your app can solve their problems, help them reach their goals, or make their lives easy. Only then will they embrace your app and give you sensitive financial information willingly.

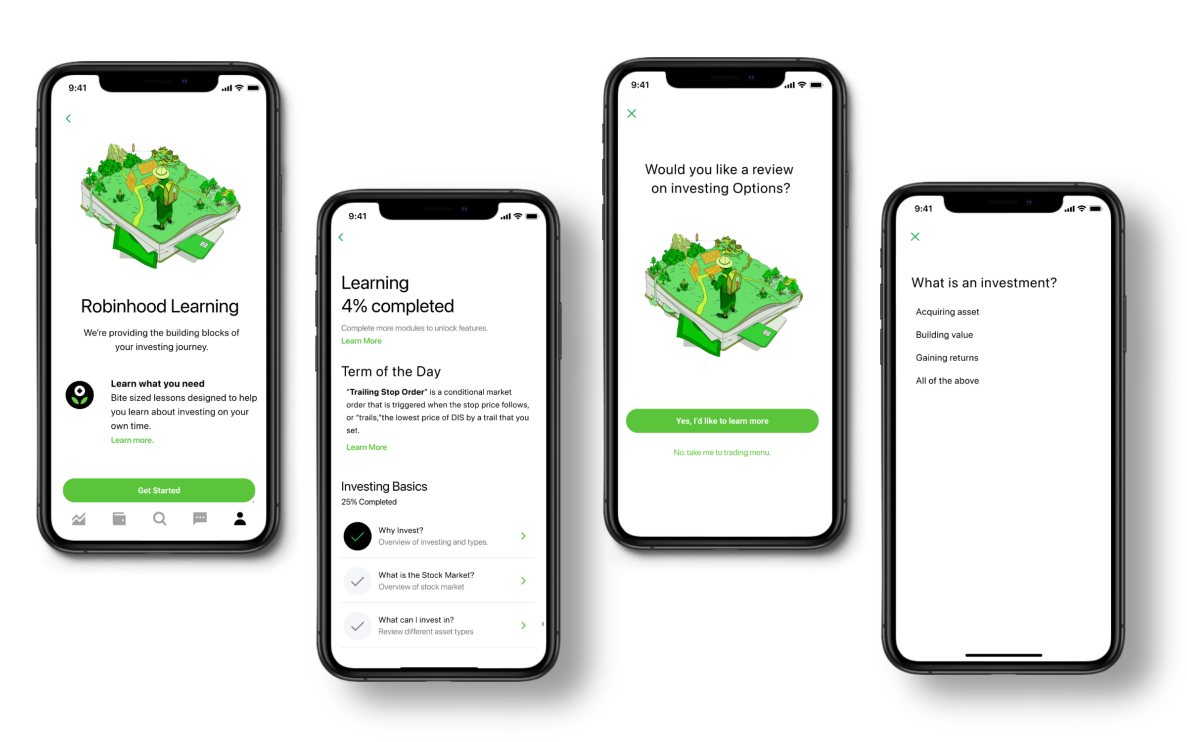

Educating your users through videos, tutorials, and articles in-app is an important step. For instance, Robinhood has a Learn the Basics feature that teaches beginners the important concepts every investor needs to know.

Source: Ilonah Pelaez

A fantastic onboarding sequence is another way to educate your users on the benefit of your app so they can use it much faster.

Of course, once users are in your app, you have to deliver on your promise through a seamless app experience.

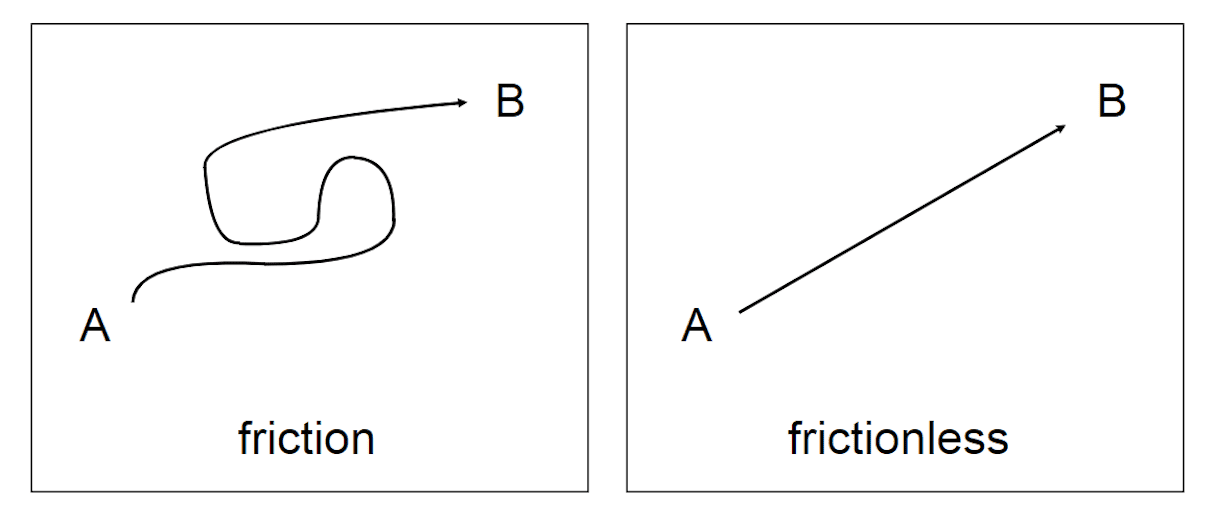

Making a simplified flow that makes sense is probably the most important approach here. This ensures that people are making the least steps to get from point A to point B in your app.

Additional steps will only confuse or burden your users and cause unnecessary friction that leads to churn.

Source: Shopify

You can only offer a great flow with an equally great, clean, and attractive user interface. Furthermore, you can also leverage color psychology and use certain colors, like blue, that evoke a sense of trust and reliability.

Source: BidCreative

These are just some of the ways to create a seamless app UX. There are dozens of other tips and tricks you can use, which we cover in this excellent article.

Send trustworthy notifications to users

Push notifications are a double-edged sword that can annoy your users if not used right. However, with fintech apps, they can be a great tool for further developing trust.

In fact, we’ll go as far as saying that they’re crucial to the entire app experience.

That’s because notifications alert users of any transactions or changes to their account. If it’s something unauthorized, a push notification will allow them to act fast and (hopefully) reverse the hack before it’s too late.

This is a common feature of many banking and payment apps.

Paypal, for example, will notify you of any money transfers that came in. The app will also alert you of critical events, like logins from an unknown device.

That latter notification is crucial because it can be a red flag that someone’s trying to hack you. Knowing this enables you to put up extra precautions and protect yourself quickly.

Notifications are also more trustworthy if they help your users succeed. For example, that’s the case with stock trading apps releasing timely updates on stock prices or other events.

In the end, it all goes back to a seamless customer experience. If push notifications help contribute to that, they will be better received (and trusted) by your users.

Provide great customer service

Ultimately, users trust you because they expect a fantastic experience using your app. So, to maintain and gain that trust, you better deliver on that promise.

That’s why customer service is an important component of a fintech app, even if it technically happens outside of it. It’s especially crucial if you consider that the fintech industry grew because it was more customer-centric than traditional banks.

Having a robust customer support infrastructure is powerful for fostering trust with your users. Moreover, with today’s technology, you can even do it 24/7, thanks to solutions like chatbots, automation, and knowledge bases.

However, it’s a critical mistake to rely on automation completely. In finance, it’s still important to have the human element in play.

Some people might prefer to put their questions forward to a human, or entrust them with solving their problems. Furthermore, some issues can be tackled much faster by a human rep.

Speedy resolutions are still one of the best ways to gain (or regain) trust.

One thing to remember is that an app is a business. Thus, customer service principles that worked in other industries should also apply to the business of apps.

And there are plenty of great stories you can draw inspiration from.

Like how Adobe responded to a service outage even before the complaints came in, or the way Zappos replies to every customer email they get.

Then there’s the amazing company policy of the Ritz-Carlton that empowers its employees to fix guest problems with a budget of $2,000, at their discretion.

At its core, trust is all about delighting your users by going the extra mile. There’s no better way to achieve this than with fantastic customer service.

Trust is a continuous process

Gaining a user’s trust isn’t a one-time thing.

It requires conscious effort, intentionality, and going the extra mile. And all it takes is for a single negative experience to break that trust, so you need to protect it at all costs.

Still, fostered well enough, trust is the key to the success of any fintech app.

With DECODE’s experience in developing award-winning fintech apps, we know a thing or two about earning your user’s trust. So talk with us today, and let’s work on your next big app project.