Thanks to the pandemic, online payment platforms are experiencing incredible growth. And with things returning to normal, that trend is impacting offline retail as well.

In fact, 25.7% of POS payments were made through mobile wallets in 2021. Estimates suggest that this could increase to 33.4% by 2024.

So, if you’re looking for a good fintech niche to get into, mobile wallets might be a great pick.

However, before you do, it would be wise to study the landscape first. And that starts with knowing the five most popular mobile wallet types currently dominating the market.

Closed wallet

A closed wallet is called that way because it’s tied to only one company or brand. Thus, funds inside the wallet are exclusive for transactions involving that company or its affiliates.

One good example of a closed wallet is Amazon Pay. It’s a platform that enables users to pay at partner merchants using the payment information stored in their Amazon accounts.

While it does allow consumers to pay at external sites, everything is coursed through Amazon, so it still counts as a closed wallet. This is evident in the fact that there is no standalone Amazon Pay app; instead, it’s integrated inside the main Amazon app.

In some regions, Amazon Pay has features that make it a more full-fledged digital wallet than others. For example, the Indian version of the platform allows users to scan QR codes, send money, and pay for bills.

Source: Times of India

Because of their exclusivity, closed wallets can be limiting. Once the money is in the platform, it cannot be used elsewhere.

This inflexibility is their biggest drawback. The lack of options means it’s hard to reach the same number of users as a semi-closed or open wallet. The only way a closed wallet can succeed is if it’s tied to an already popular brand like Amazon or Starbucks.

However, closed wallets are exceptionally beneficial from a loyalty standpoint. That’s because it’s easy to implement rewards programs there, encouraging repeat purchases.

This is what Walmart achieved when they launched Walmart Pay. The app allows customers to pay at Walmart self-checkout counters using a linked credit, debit card, or Walmart gift card.

The app was a big success. A study concluded that nearly 88% of the company’s sales came from repeat buyers using the Walmart Pay app.

Source: Walmart

Closed wallets also give companies insight into spending habits, consumer behavior, and purchasing patterns. This is valuable intel for helping brands improve their marketing and offerings.

Starbucks is a good example of a company that utilized its wallet data to great success.

A Harvard Business Review study noted that the company fed data from their Starbucks app into a dynamic menu board, enabling stores to shift offerings based on customer demand.

Not to mention the rewards program in the Starbucks app that contributed to 26% of its sales in 2021.

Source: Indigo 9 Digital

Using a closed wallet also eliminates hefty merchant fees that might come with using a third-party open wallet. Paypal, for instance, charges around 2%—3% plus a fixed fee per transaction.

In a nutshell, closed wallets aren’t as restrictive as they seem to be, so going this route is smart if you want to prioritize user loyalty and big data over volume.

Semi-closed wallet

A semi-closed wallet offers a wider selection of offline retailers and online e-commerce websites. Like a closed wallet, only merchants who have a previous agreement with the wallet issuer can accept payments.

But unlike closed wallets, semi-closed wallets have more features beyond just payments. For instance, they allow users to send money to other e-wallets within the same network.

Some apps, like Zelle, can even send money directly to a user’s bank account.

Many semi-closed wallets also support easy bills payment. Google Pay India is a great example of this. Instead of manually entering payment information for each bill, the user can simply select them from a list.

Source: UPI Payments

The only limitation of semi-closed wallets is that users cannot withdraw cash directly from them since they’re offered by non-banking, non-financial institutions.

But thanks to more choices and better features, semi-closed wallets are the most widely used and available type by far. In Canada, for instance, the market size of semi-closed wallets dwarfs that of open and closed ones by a wide margin.

Source: Global Market Insights

In contrast to closed wallets, it’s harder for merchants to implement loyalty programs with semi-closed wallets. This lack of consumer behavior data can be a dealbreaker for some firms.

Fortunately, some platforms like Google Pay offer an API that allows companies to implement rewards programs in the app.

Although, it’s going to be limited at best. For simple loyalty schemes, this should more than suffice. But if you’re after a tailored experience like the Starbucks app, you’re better off with a closed wallet.

Source: Google

Another hiccup is that most semi-closed wallets require KYC (Know Your Customer) verification. While the process is crucial to help keep users safe, the added step can be a hassle for some.

One workaround is to only require KYC for specific transaction amounts or if users want to unlock extra features.

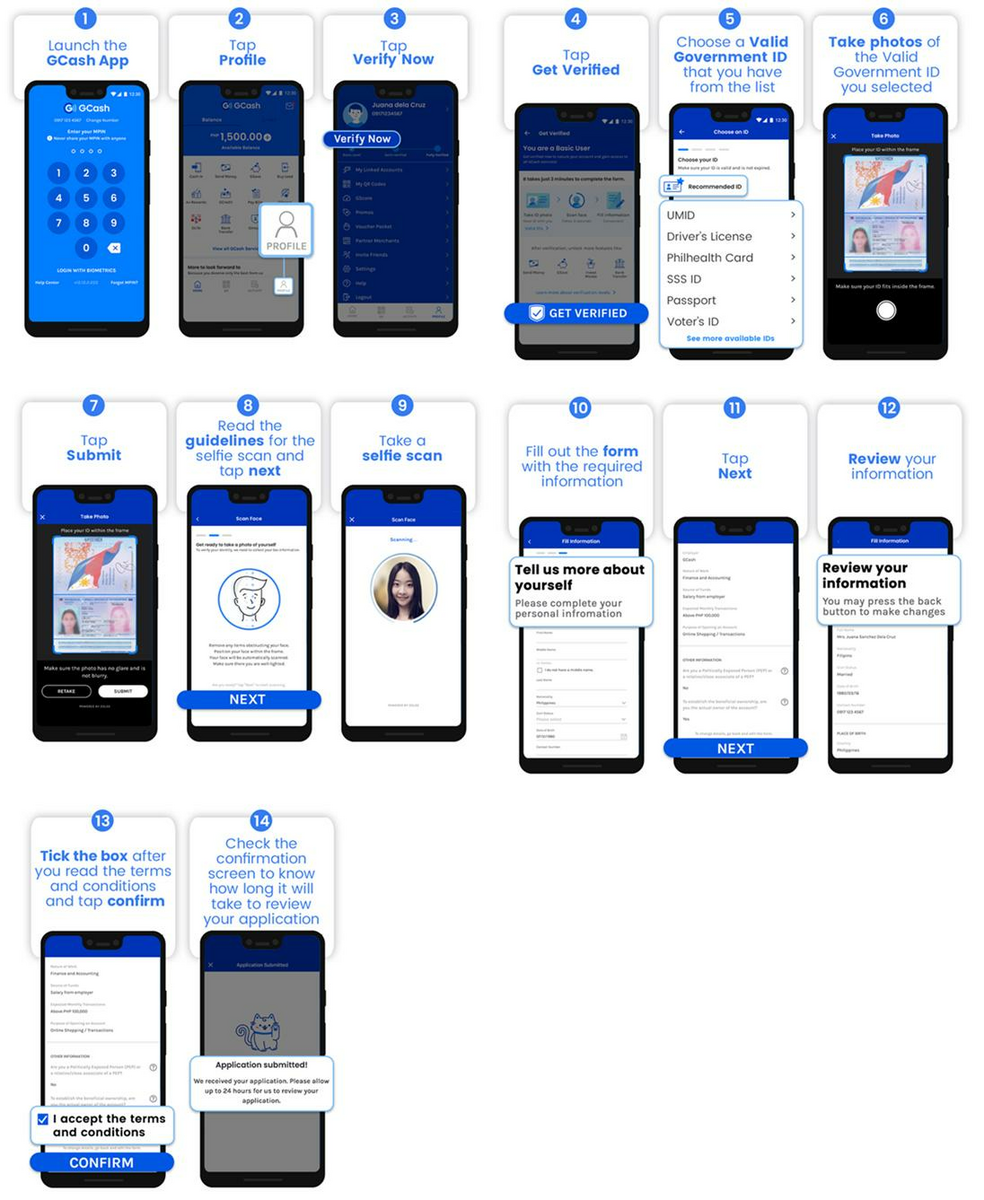

This is the approach taken by Philippine-based e-wallet GCash. When fully verified, users can keep a larger amount of funds in their wallet. It also opens up other services like investments, insurance, and bank transfers.

It’s a wise move since the KYC process for GCash is often lengthy and demanding.

Source: GCash

Despite these minor obstacles, semi-closed wallets remain very popular. And if your goal is to have a wide user base, this is the best path to take.

Open wallet

Open wallets are similar to semi-closed wallets; only they’re issued by a bank or a financial institution. Because of this, they have access to the full range of features in a digital wallet.

On top of what semi-closed wallets can do, they also allow users to withdraw money directly to an ATM, access financial services, and perform other banking operations.

Probably the most popular and widely used open wallet is Paypal. Using a PayPal Debit MasterCard, you can retrieve your funds from any ATM in the US. You can also transfer Paypal funds to any debit card for a minimal fee.

Another great example of an open wallet is Vodafone M-Pesa.

Source: App Agg

Compared to other e-wallets, M-Pesa is incredibly comprehensive and feature-rich. Users can send cash to just about any medium, including bank accounts, ATMs, or independent agents.

You can also invest, take out a loan, deposit in a savings account, and apply for insurance within the app.

Thanks to its flexibility and all-in-one nature, M-Pesa is currently the leading payment platform in Africa. It has over 51 million users and handles over $314 billion in transactions per year.

With such potential, you might wonder why open wallets aren’t more widely available than semi-closed ones.

There are several reasons for this. One is that existing leaders in the space, like Paypal, are already fully entrenched. That makes penetrating the market difficult.

For example, just compare how relative newcomers Apple Pay and Google Pay fare against Paypal:

Mobile payment apps brand perceptions; Forbes

But the biggest reason is that open wallets are only limited to banks and financial institutions. If you want to develop one, you’ll likely need a banking license or partner with a financial institution. This raises the barrier to entry significantly.

Nevertheless, opportunities still abound. For example, many parts of the world are still unbanked. These could be places where an open wallet app could thrive, such as the Indonesian e-wallet Dana, which promotes financial inclusion in the country.

Crypto wallet

Crypto wallets are designed specifically to store cryptocurrencies like Bitcoin or Ethereum. A crypto wallet keeps private keys associated with digital coins, which live on a blockchain ledger online.

The explosion of cryptocurrency trading has also increased the demand for crypto wallets.

Coinbase, one of the leading crypto platforms, has 73 million crypto wallet users, while another, Blockchain.com, has 79 million unique wallets in its system.

Crypto wallets are essential for keeping your digital currencies safe. That’s because, unlike regular cash or credit cards, losing them can be detrimental and irreversible.

If you misplace your private keys or get hacked, you won’t be able to access your cryptos. And the nature of the blockchain means there’s no intermediary like a bank that can recover it for you.

Indeed, a Chainalysis study revealed that 20% of the total Bitcoin supply is permanently lost. That’s equivalent to a staggering $163 billion (corrected based on the BTC price at the time of writing)

Source: Professional Crypto Recovery

Let’s get into a bit more detail on how crypto wallets work. We’ve already mentioned private keys, which are tied to specific entries on the blockchain that indicate how many digital coins you own.

But there’s also a public key, which is your wallet’s unique identifier and is visible to other people. So when someone wants to send you cryptos, they need to know your public key. The public and private keys must then match for a transaction to push through.

Source: Block Geeks

Now, you have two options with crypto wallets—online or offline.

An online crypto wallet works similarly to an e-wallet. Your private keys are stored digitally, either in a web-based hosted platform or a mobile app.

Most cryptocurrencies have their native wallet, such as the Bitcoin Wallet. This is preferable if you deal exclusively in one type of digital currency. But if you want to store multiple kinds, it might be better to get general purpose crypto wallets like the Coinbase Wallet.

The other option is to store your cryptos offline using a physical device. The advantage of doing this is that your cryptos are isolated from the Internet, making them impossible to hack. The trade-off, though, is the risk of losing the device itself.

Hardware-based crypto wallets come in many forms, including dongles and cards. A good example is FuzeW, a digital card that stores your coins wirelessly via a mobile app.

Source: FuzeW

Hardware crypto wallets are also part of another category of digital wallets, called IoT (Internet of Things) wallets. Let’s discuss that next.

IoT wallet

Mobile wallets are no longer limited to just smartphone apps. The next evolution allows payments from wearable devices, appliances, and even everyday objects.

Collectively, these are known as IoT (Internet of Things) wallets. And it’s starting to become a reality.

One example is wearable payments, which allow users to send money through smartwatches, bands, and rings. As of 2021, that market is valued at $43 billion. By 2027, projections say it is set to hit the $1.37 trillion mark.

Source: Payments Cards and Mobile

But that’s just the beginning. The emergence of smart home technology and digital assistants like Alexa can enable machine-to-machine (M2M) transactions. That means machines will be able to send payments between themselves autonomously.

Experts estimate that the M2M market will grow to $27.62 billion in 2023. But what will this look like in practice?

Imagine a smart fridge that can automatically order milk when it senses stocks are running out. If it has an IoT wallet, you can provide your credit card and allow it to complete the transaction without any action on your part; you’ll just be informed of it after the fact.

Of course, autonomous payments bring up several security concerns. For example, what prevents a machine from making unauthorized payments? Or worse, what if it gets hacked?

Right now, credit card companies like Mastercard and Visa are rolling out protocols to prevent these issues from happening. One of them is the EMVCo Secure Remote Commerce (SRC) framework, which addresses the security flaws of IoT payments.

Here’s what that process looks like in practice:

Source: Intellias

Indeed, IoT wallets are part of an exciting evolution of mobile payments. So if you want to be on the cutting edge of fintech, this is a great avenue to try.

Which mobile wallet will it be?

We’ve discussed five of the most popular types of mobile wallets, now and in the future. The question is—which one is the best?

The answer is that none of them are better than the rest. They all have their use cases, making each a viable niche to get into.

But regardless of which one you choose, the key to success is to have the right app agency on your side.

And with successful fintech projects under our belt (including a mobile wallet), we believe DECODE fits the bill nicely.

Interested? Contact us today, and let’s talk!