A 700% conversion rate?

It seems like an unbelievable feat, but one Texas bank managed to pull it off.

Their secret? Gamification.

Using game elements is one of the most powerful strategies to ensure app success. And many developers and entrepreneurs are also feeling the same way, as the gamification market is now valued at $11.94 billion.

But how exactly does gamification help a fintech app? Here are some of the benefits.

Gamification helps attract new customers

One of the most attractive reasons for gamifying your fintech app is that it will dramatically improve your profitability. This occurs through a two-step process: getting new users, then keeping them long-term.

Let’s start with the first step—acquisition. Here, gamification is often incorporated in referral programs.

Referral programs are, of course, nothing new. Almost every company and industry on Earth has used a referral system to some degree. There’s also no shortage of statistics that show how effective they can be.

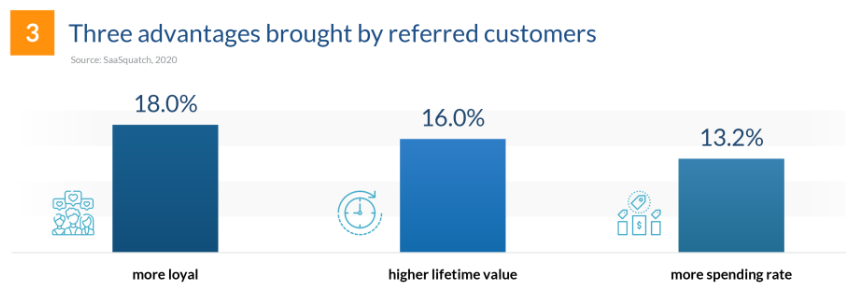

According to the 2020 State of Referral Marketing study by SaaSquatch, referred users are 18% more likely to be loyal to your brand. They also tend to spend up to 13.2% more and have 16% higher lifetime values.

Source: Finances Online

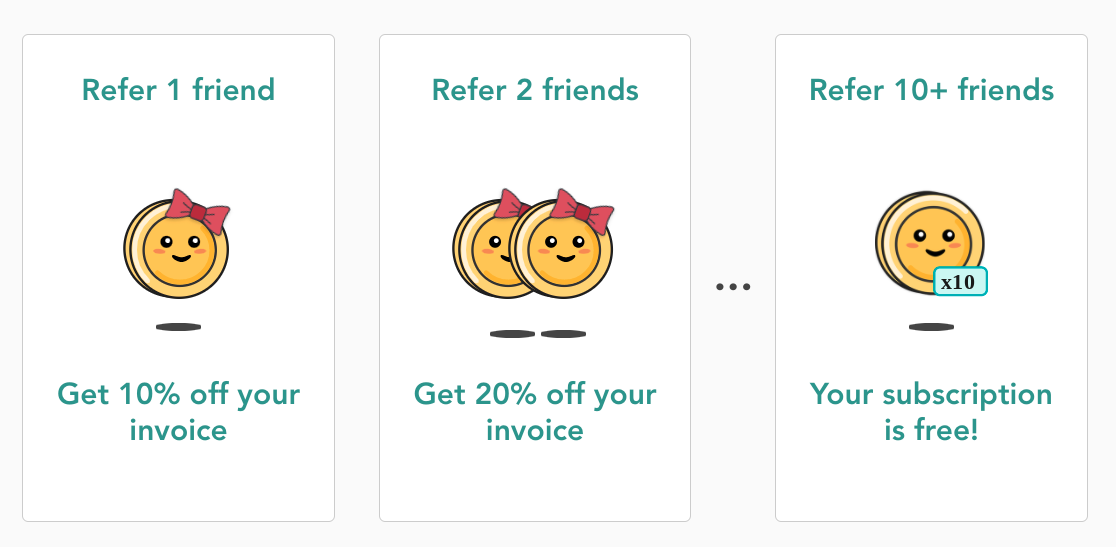

One fantastic example of a gamified referral program is the one used by the budgeting app Lunch Money.

It features a tiered-reward system that gives users increasingly lucrative rewards the more people they refer, ultimately granting a free subscription.

Source: SaasQuatch

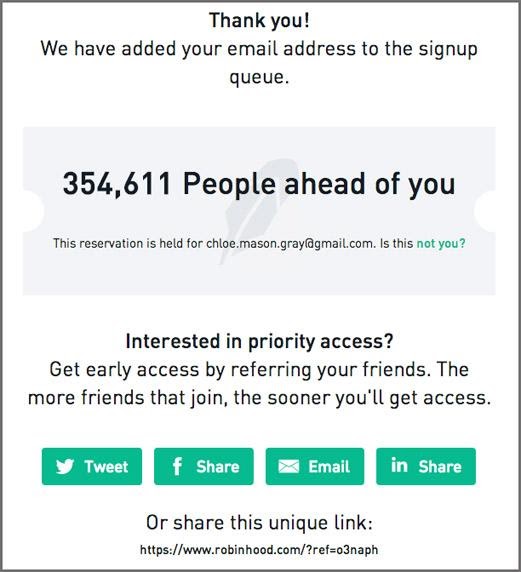

But probably one of the most successful referral programs ever devised in a fintech app was implemented by the trading app Robinhood.

Using a gamified signup system, they were able to onboard one million users before the app even launched! That’s mighty impressive, to say the least!

So how did they do it?

A year before they launched, Robinhood offered users early beta access to its app.

To do so, users needed to enter their email on a waiting list. The higher you are on that list, the earlier you can use the app.

Now here’s the kicker: you can virtually jump the line and get access sooner by referring people to sign up, too!

The more new users you refer, the higher up on the list you get. And to further drive competitiveness, you get to see where you are on the list at a given time.

Source: Viral Loops

It was pure genius. It spurred people into a frenzy of referrals, resulting in a mammoth 1 million signups pre-launch.

While referrals are the most popular gamification approach for acquiring customers, it’s not the only one.

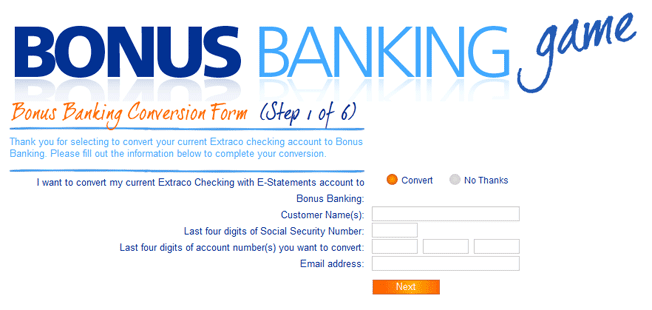

Remember the Texas bank we mentioned in this article’s introduction? The one which managed to achieve a 700% improvement in their conversion rate?

That bank was Extraco, and they did it by getting creative with their customer acquisition strategy.

What the bank did was to create a game to ease customers into changes of its checking account.

Source: Neil Patel

The results were spectacular. Of the 4,250 people that played the game, 14% converted and opened an account. Normally, they only got 2% conversions—an impressive 700% improvement!

Indeed, gamification is a powerful tool for getting customers. But as many developers know, it doesn’t end there. Retention is far more crucial for fintech app success.

Gamification can help retain customers

More than just an acquisition tool, the real power of gamification is in keeping users in your app for the long haul.

Just look at the micro-investing and robo-investing fintech firm Acorns. Thanks to their gamification strategies, they have achieved a truly impressive 99% monthly retention rate, and they’re on track to double their subscriber base to 10 million by 2025.

And the reason gamification works so well is simple: people have a psychological tendency to play games.

So, the more gamified elements you have in your app, the more users will engage with it to “beat the game.”

There’s no shortage of techniques and case studies to show how gamification has increased retention numbers for many fintech apps.

The French fintech app Shine gives an example of how even the simplest and subtlest of gamified elements can make a huge difference.

At first glance, the app’s gamification might not be readily apparent.

But as early as the onboarding, you’ll see these elements at play: the progress bar that lets users know of their progress, great animation to give the feeling of interactivity, and a checklist that acts as the set of goals that the user must achieve to “win” the onboarding.

Source: Shine Blog

The result? Shine boasts an 80% completion rate for their onboarding sequence—impressive numbers, indeed.

But while simple tactics like these work, it’s introducing rewards that truly ups the effectiveness of gamification.

This is true regardless of whether the rewards are extrinsic (i.e., gifts and physical prizes) or intrinsic (i.e., pride and achievement).

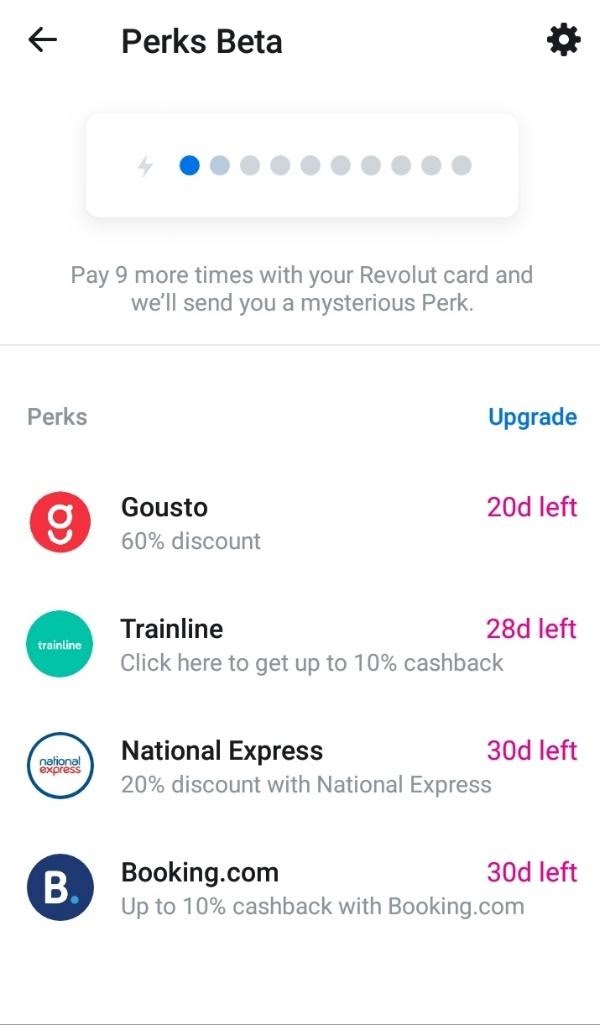

One of the apps that do this well is Revolut and their rewards program called Perks. The idea is simple: the more users swipe using their Revolut card, the more rewards and cashback they’ll unlock.

Source: Revolut Community

Every set amount of swipes unlocks a new perk for several days, which is indicated in the app.

And they make it a point to partner with innovative companies with highly sought-after products and services, which makes the rewards much more worthwhile to get.

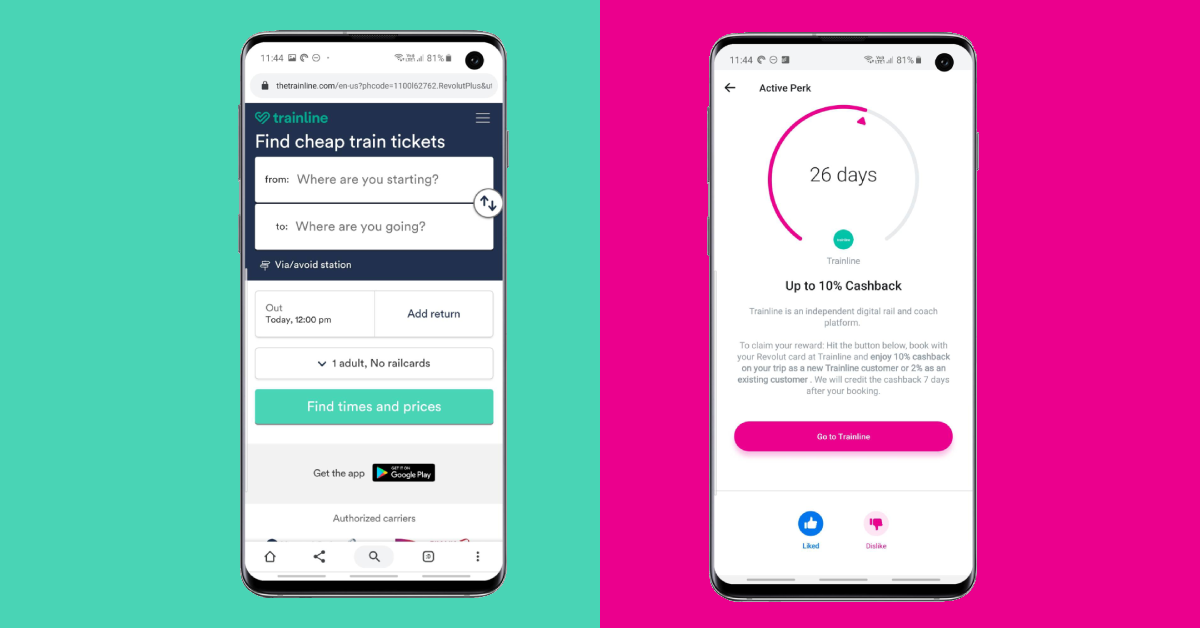

For example, Revolut partnered with the train booking app Trainline.

The result of this partnership is that over 120,000 users availed the Trainline reward, which helped both that company and Revolut increase their transactions.

Source: Revolut

Still, whether it’s for acquisition or retention, true gamification works when it helps the user succeed.

Gamification helps customers succeed with the app

At its core, fintech apps exist to solve a problem for the user, either by helping them save more money or increase their wealth. Gamification, therefore, should always be in the service of this goal.

It would be absolutely unacceptable to use gamification to encourage users to play the game even at the risk of their financial well-being.

Trading and investment apps are susceptible to this because turning stock trading into a game can be incredibly risky to users if not done right.

For example, Robinhood had to pay a $70 million fine in 2021 because they were liable for “widespread and significant” harm. Among its many errors was allowing users to trade on options, even if it was financially risky for these people to do so.

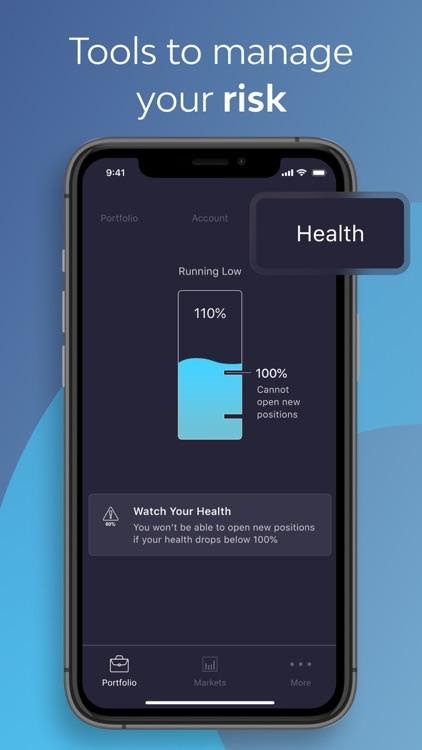

A responsible fintech app, in this case, should use gamification elements to introduce more friction—that is, make it hard for the user to commit financial mistakes.

An example of this strategy is tilting, a term borrowed from the casino industry.

It describes a situation where a player is becoming very irresponsibly aggressive—and the way the game should control the player at that point.

The most common tilting strategy is a stop loss, which kicks in to prevent a person from losing more than they can afford during a trade.

The Exinity trading app takes this a step further with its automatic risk assessment Health feature.

Source: App Advice

On a more positive note, gamification is also great for fostering positive financial habits in the user.

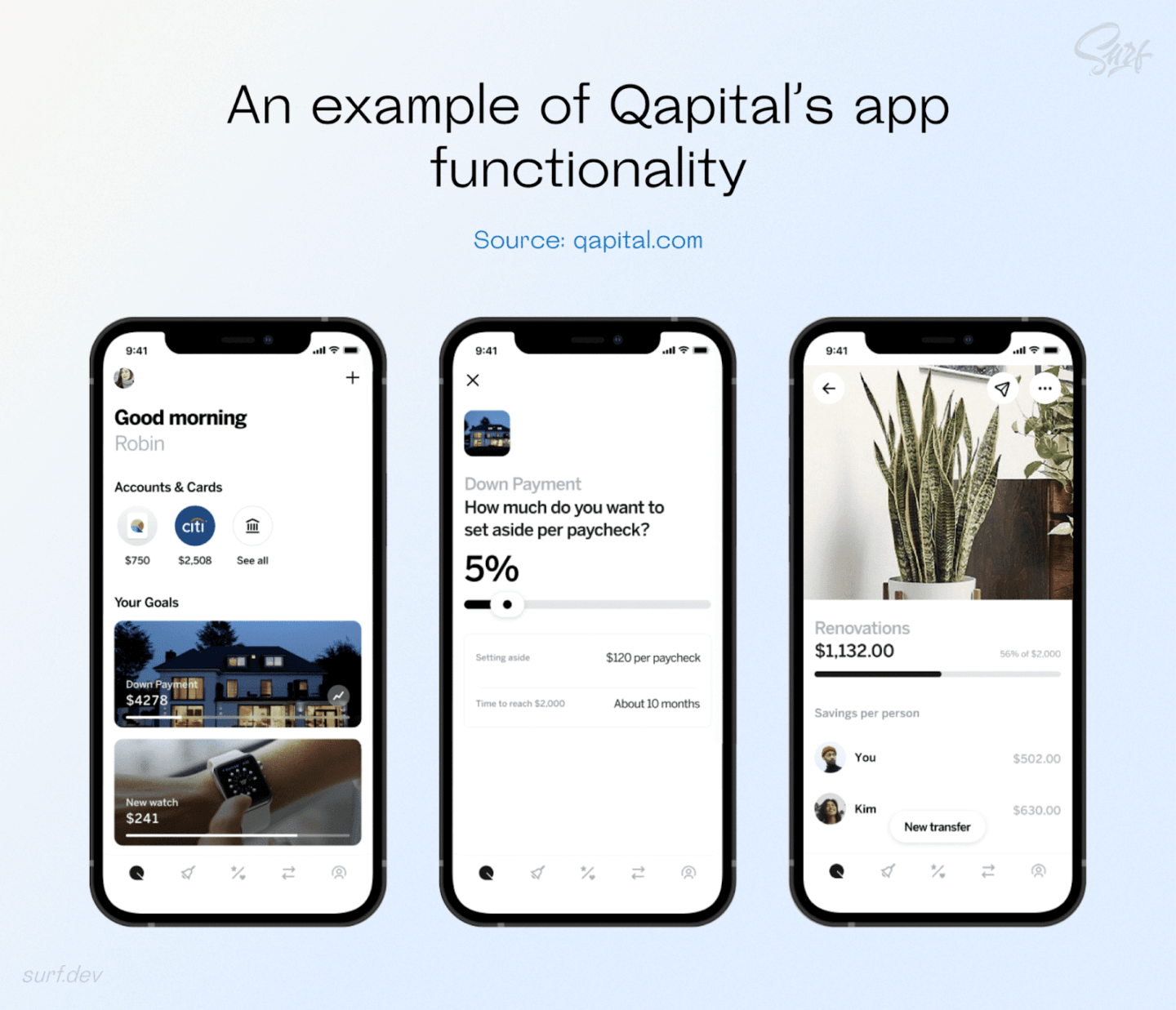

For example, the Qapital app helps users reach their financial goals by turning the chore of saving money into a game.

A progress bar allows users to visually track their performance, while the automatic savings option sets aside a portion of the person’s paycheck at every payday.

Source: Surf.dev

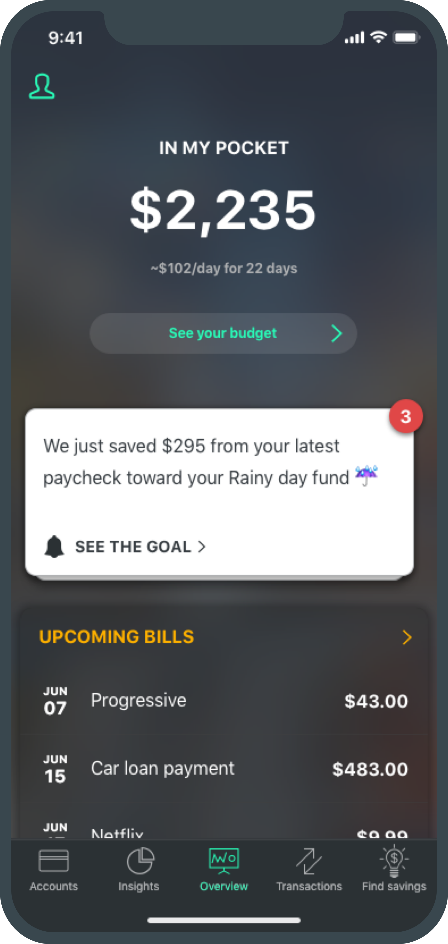

Another great fintech app that builds positive habits is PocketGuard, an app that’s effective at curbing overspending.

It does this by analyzing a user’s income, bills, and expenses, then coming up with “disposable income” that they can use for non-essential spending.

Source: PocketGuard

The app also has useful features like Autosave, insights on expenses, and a Goals feature to help people hit their financial milestones.

Gamification provides useful customer insights

Gamification is more than just helping customers. It can also aid your company by providing valuable insights into the behavior, usage habits, and even preferences of your users.

Why is this important? You want to know what makes your users tick, so you can optimize your app and deliver better features. This can improve the user experience and drive better engagement and retention. It’s a win-win for everyone!

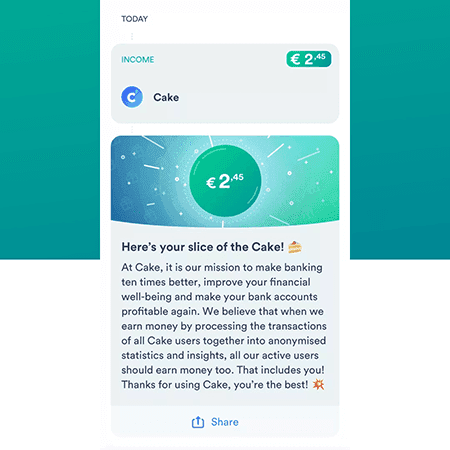

Some fintech firms, however, take this to the next level by gamifying the process of gathering data. A perfect example is the Cake app.

Among the app’s many gamification features is its unique profit-sharing model. In essence, the company anonymizes all the user transactions on its platform and turns them into analytics.

And whenever they earn money from these insights, they give a portion of it back to their users.

Source: Strive Cloud

Not only does this foster trust and transparency, but it also encourages the user to stick with the app more.

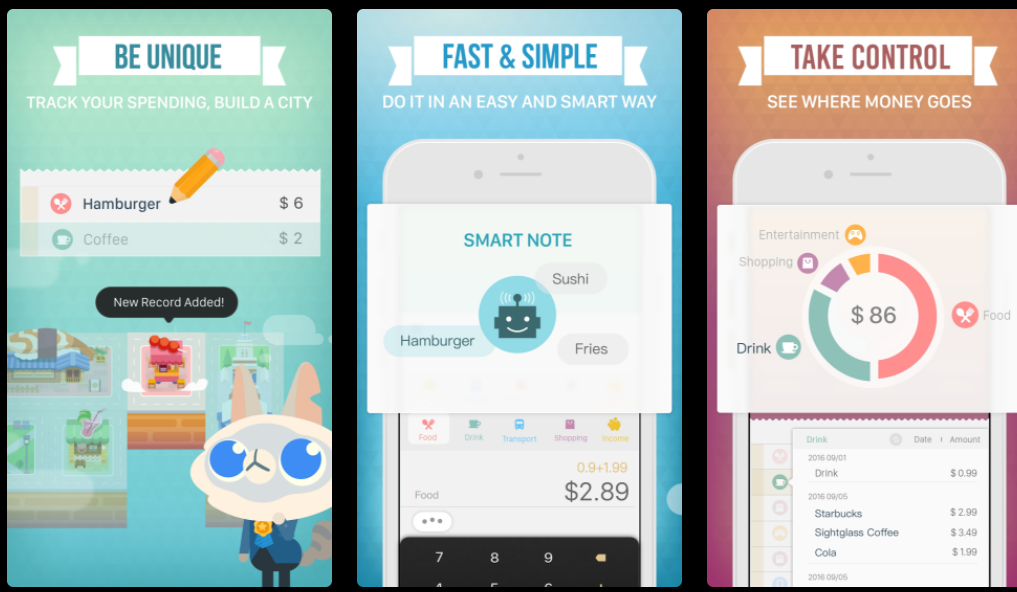

App insights also improve personalization. And nowhere is this more apparent than with the Fortune City app, as the user sees the impact of personalization in a fun manner.

In that app, you build a bustling virtual town solely with your in-app actions. This includes positive financial habits like accounting for your expenses and saving money.

Not only does it turn a chore into an addicting game, but you can also compare your progress with other people for added competitiveness.

Source: Fortune City

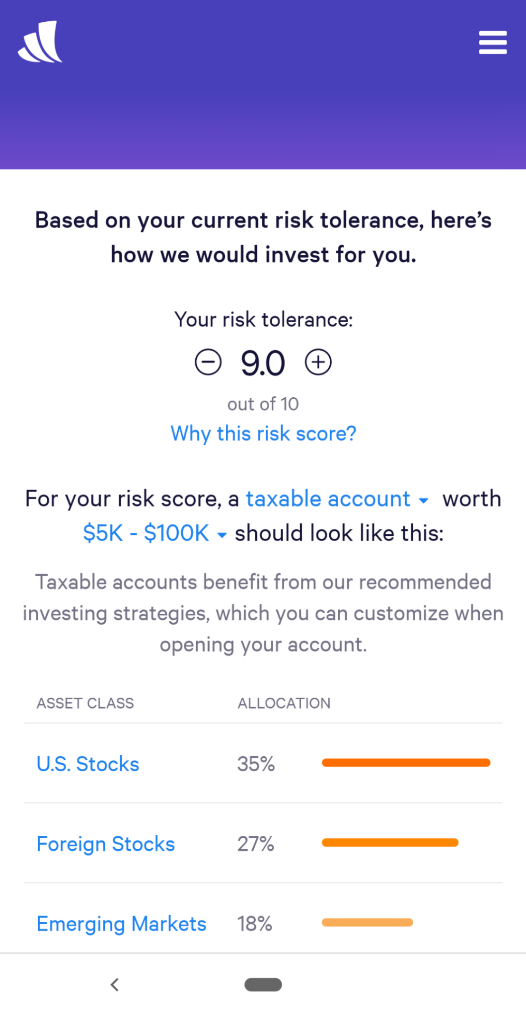

You can also combine user insights, machine learning, and AI to create automated recommendations for users, as the Wealthfront Investing app does.

The main draw of the app is that it automates investing for you, by selecting the best stocks and assets based on your risk profile.

This is determined through an interactive onboarding sequence that asks key financial questions.

Source: Really Good UX

While the onboarding is lengthy (which is appropriate in this case), the app does a great job of making it progress at a comfortable pace. The use of real-time estimates based on actual user data also makes the personalization much more accurate.

Source: Really Good UX

The use of smart investing in an app is a perfect example of autonomous finance. It’s just one of the many exciting new trends in fintech, which you can read more about here.

Gamification can help prevent compliance issues

One often overlooked benefit of gamification is that it can ensure that your app is compliant with the relevant regulations. There are many ways to do this.

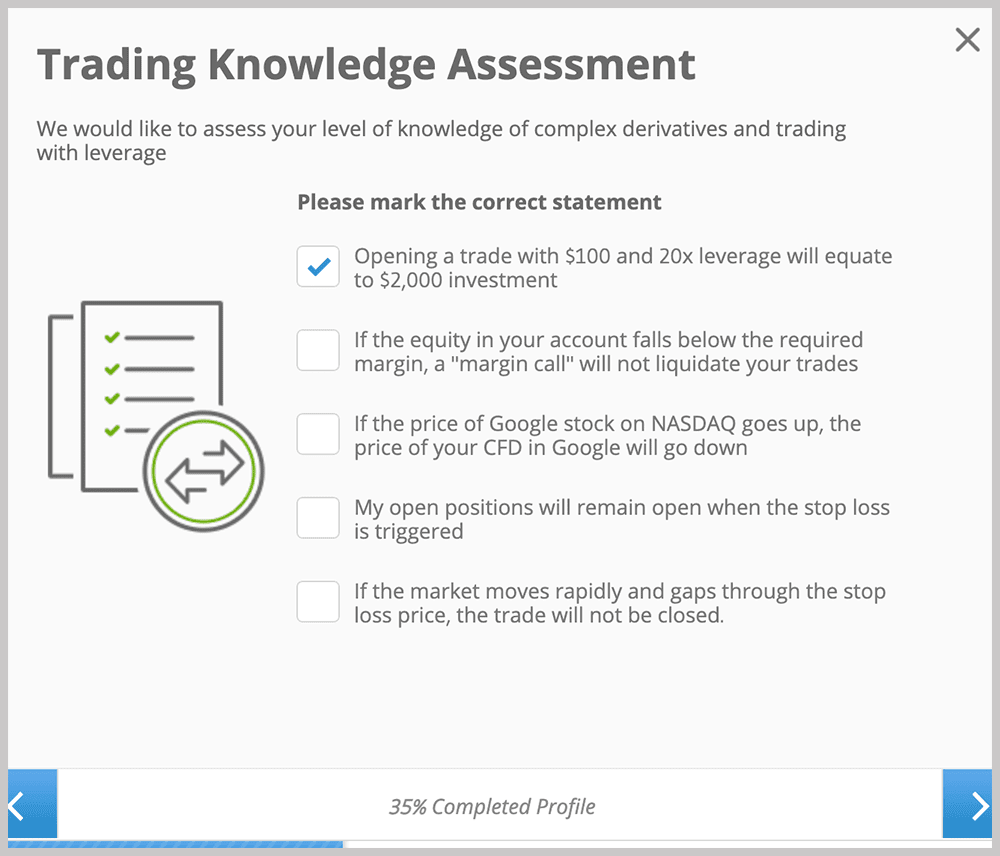

For trading apps, it can be a good way to screen potential users so they can be assigned the right trading profiles. This helps reduce users’ risk and prevent compliance issues similar to the ones Robinhood faced.

As an example, eToro uses a comprehensive onboarding sequence that asks users several questions to gauge their trading experience. It even includes a quiz that allows users to prove their investing chops.

Source: Trade the Day

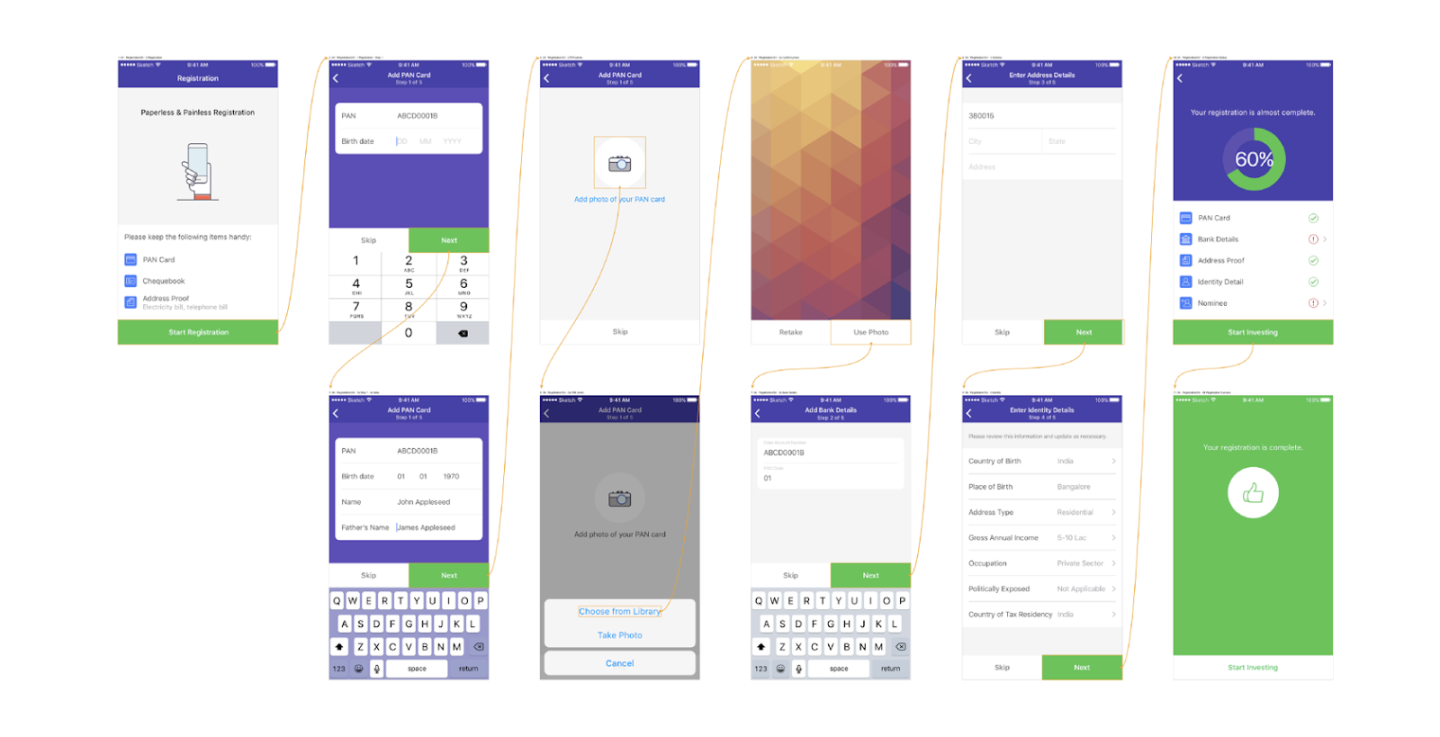

Another good application of gamification is to streamline the Know Your Customer (KYC) process. This is a requirement for most compliance laws, but it can be tedious for the users to complete.

The Fisdom app solved this dilemma by breaking the whole process into distinct steps, then adding gaming elements like progress bars and a list of milestones to accomplish.

It also helps that the KYC process came afterwards, when the user was already familiar with the app’s offerings.

Source: Toptal

Gamification can also be used on the other side of the spectrum – as an internal tool for training staff for better compliance.

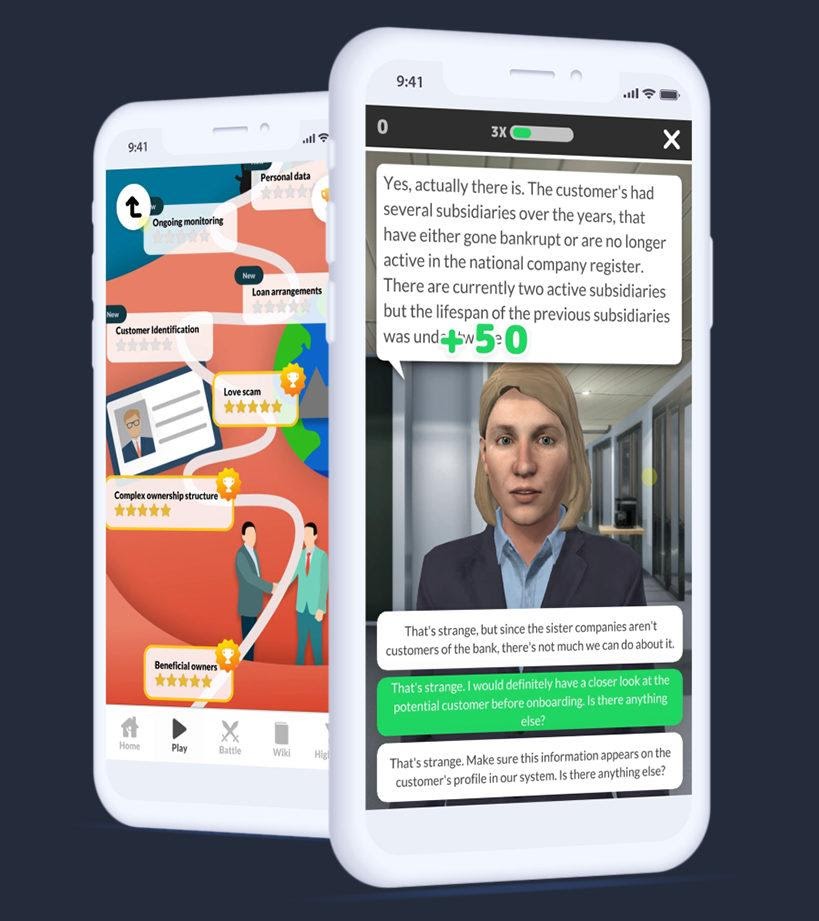

One of the best examples of this is the AML App by Erling Grimstad, a Norwegian law firm. It’s an anti-money laundering certification program disguised as a detective/mystery game.

It guides users through scenarios and dilemmas that they would face in the real world, and they need to solve them to progress through the game.

Source: Attensi

The results were impressive: the game cut the certification and training process to just a few days. And it’s now used by major financial institutions and banks across Scandinavia.

Developer Solve Johannessen had this to say:

“What’s interesting is that after people have continued to use it, they get better and achieve a higher score – almost like a competition—so they repeat the training for enjoyment and interest rather than a classroom where you attend just to get your qualification.”

So, you could say that the best outcome of the app is that people actually enjoyed using it.

Gamification is a cornerstone of the fintech industry

As you can see, gamification is a powerful strategy that can permeate every aspect of your app. It’s incredibly effective because it taps into a deep psychological need to play and achieve.

Therefore, for as long as humans are using fintech apps, gamification will continue to be a viable tool in a developer’s arsenal.

Want to know how to integrate gamification into your next app project? Speak with the DECODE team today!