How to create a top-notch digital banking app

In 2020 alone, there are over 2 trillion online banking users worldwide, according to a Statista study. And that figure is set to increase by 24% in 2024.

No wonder that digital banking is one of the hottest niches in fintech today. It’s a playing field that includes the world’s largest financial institutions, challenger banks, and even tech giants like Apple and Google.

With such a tight market, releasing just any mediocre banking app isn’t going to cut it. Instead, your app needs to stand out with innovative features, tight security, and a stellar user experience.

Here are the steps to do exactly that.

Table of Contents

Decide on the type of digital banking app to create

First things first – what banking app would you like to create? What will its purpose be? What problems will it solve?

Answering these questions will help you come up with an overall plan for your banking app. This step is arguably the most important because, without it, you’ll end up spending more time creating an app that doesn’t solve the users’ needs 100%.

Also, not all banking apps are created equal.

Every bank and market has different needs, and you should prioritize the features that meet them.

In addition, you should also determine the areas where you can innovate – as we said, it’s a crowded market.

The best way to do this is through market research. Doing this will let you discover your target users’ pain points, biggest wants, and urgent needs. It will also tip you in on the shortcomings of other banking apps so that you can compensate.

But when it comes to features, there’s no need to reinvent the wheel. Instead, a smarter move is to look at what successful apps are already doing in the market, then adopt and improve on them.

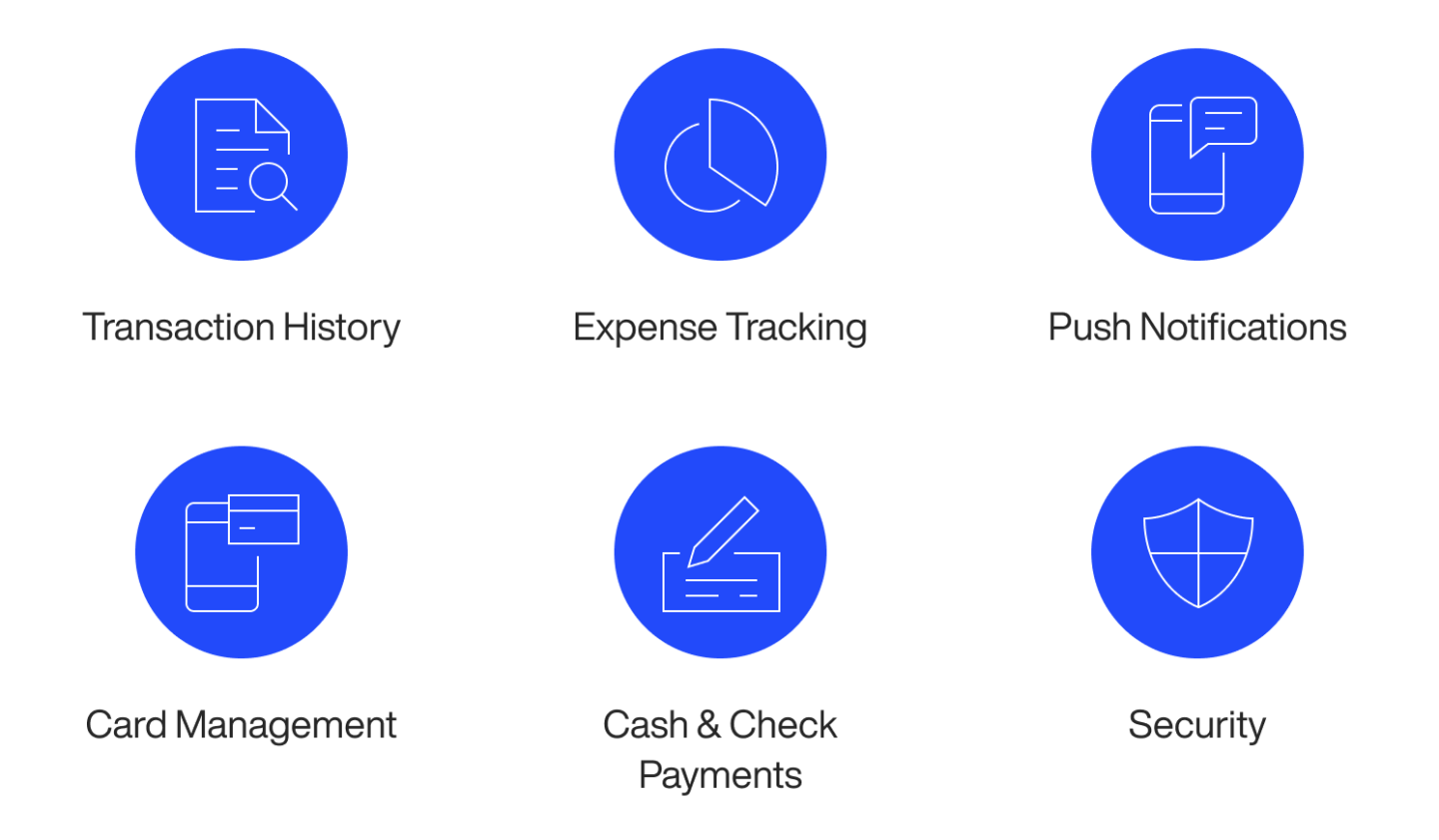

To give you an idea, here are some of the must-have features of any digital banking app:

Banking app must-have features

Source: DECODE

These are the features that either users expect or are mission-critical for the app’s proper functioning.

A comprehensive transaction history, for example, is essential for users to monitor the flow of money from their accounts.

And with the COVID-19 pandemic accelerating cashless payments, the ability to send money through a banking app is now seen as necessary.

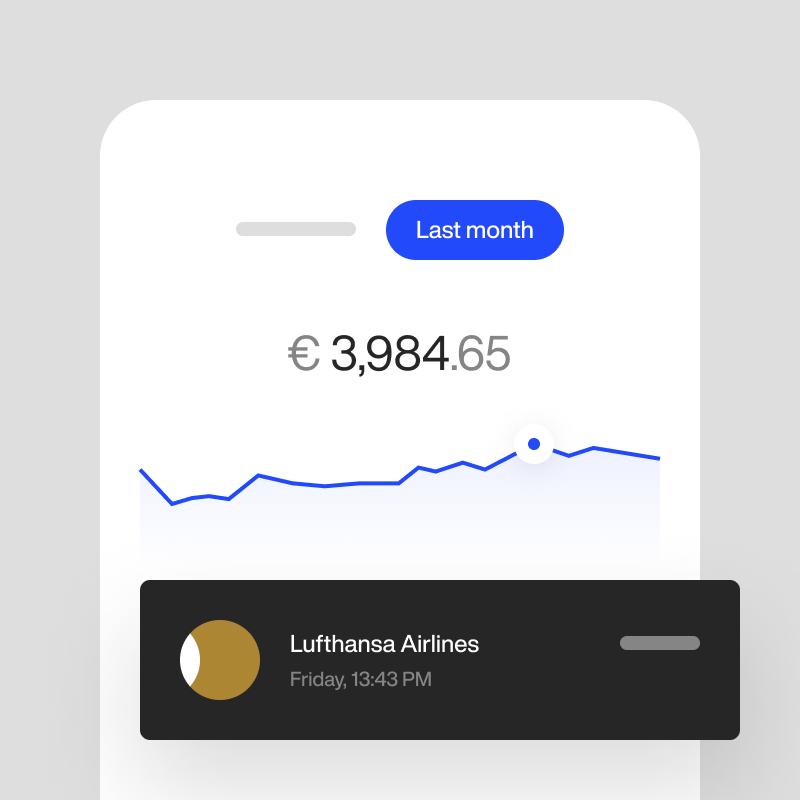

Beyond these fundamentals, there are plenty of innovations that you can incorporate to make your app stand out.

Integration with other fintech apps or financial institutions through APIs like Open Banking is especially popular and can extend the utility of your app.

Chatbots, cardless ATM access, and customizable dashboards are other advanced functionalities worth exploring.

But whatever you do, never start building your banking app without a concrete plan first. You risk creating a result that’s a bad fit for your users.

Create a prototype for the app

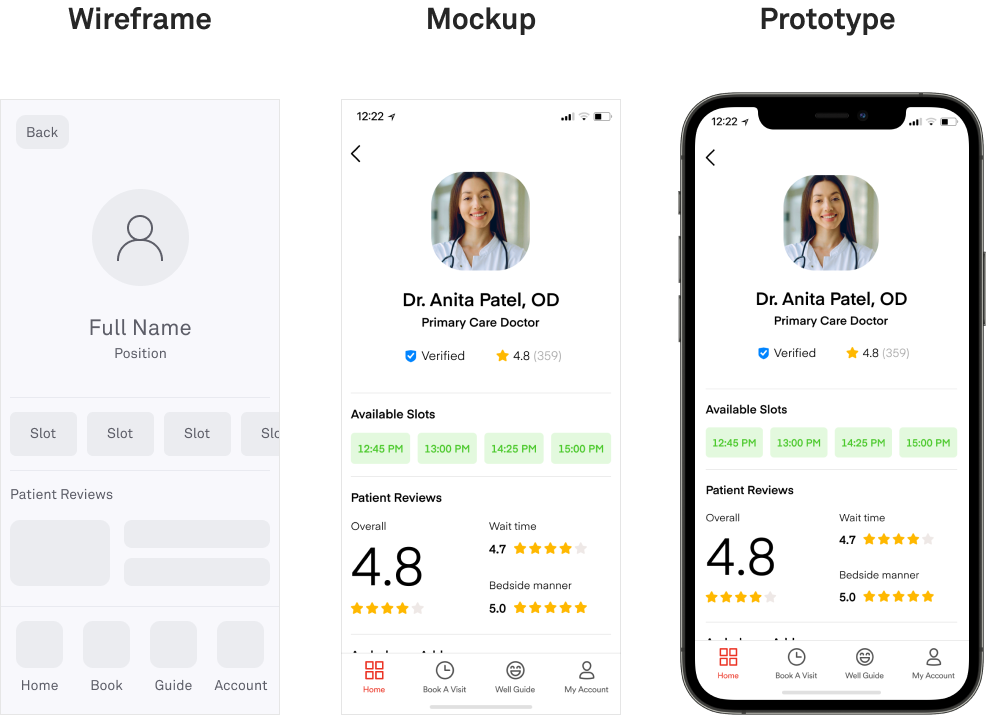

Once you have your app idea laid out, you might ask yourself: “how do I know if it’s any good?” Answering this question is the purpose of an app prototype.

A prototype is an interactive mockup that shows the look and feel of your app. It includes all the visual elements, such as screens and simulated functions, but without the underlying logic.

So in the case of a banking app, a prototype shows the features like transactions and payment without actually performing them.

At most, it will just be an interactive simulation.

The purpose of a prototype is to show it to others so they can validate your idea and test your assumptions.

The insights you’ll get are invaluable to help refine your app further. The result is an improved user experience (UX), better collaboration, and quicker development time.

Benefits of creating a prototype for a mobile app

- Improves UX

- Better focus and collaboration

- Saves time and effort

Creating a prototype is an iterative process that starts with a low-fidelity wireframe. This is a rough sketch of your app using pen and paper. The advantage of starting with this method is that it’s quicker and easier to create and revise.

Once you’re happy with your sketch, you transform it into a digital mockup with tools like InVision Studio or Adobe XD. Here, you add UI elements like buttons, stand-in images, and navigation components to make it look like the final product.

Finally, you integrate scripted animations and pre-programmed interactions to make it come to life, turning your mockup into a prototype.

Here’s what that process looks like in a nutshell:

Source: DECODE

When you launch your prototype, be sure to maximize it. Record your users while they’re using it and collect as much relevant data as you can.

Also, make it a point to share it with different demographics, and not just your development team.

The bottom line is that prototyping is an extensive process that a few paragraphs here can’t sufficiently cover. To learn more, check out our comprehensive guide on app prototyping here.

Set the foundation for security

Security is crucial for any app, but even more so with fintech. That’s because the financial sector is always a juicy target for hackers.

And the proof is in the numbers. According to a VMware study, February to April 2020 saw a 238% jump in attacks that target the finance industry.

But security shouldn’t be just an afterthought. Remember that security flaws are costlier to fix and have more severe consequences later on. This chart sums it up nicely:

Relative cost of fixing a security flaw

Source: Netguru

As early as the planning stage, you should already think about the cybersecurity safeguards you need.

Protocols like biometrics, encryption, and two-factor authentication (2FA) need to be intertwined into your app’s logic and not just sit “on top” of it.

Beyond the app itself, it’s also crucial to look at your app’s infrastructure as a whole.

This means securing the web servers and networks that power it with firewalls, anti-DDoS (distributed denial of service) platforms, and other cybersecurity solutions.

To achieve this, we recommend adopting the seven layers of cybersecurity. It’s an approach that fortifies your network infrastructure with multiple protective layers in the same way that walls and moats protect a castle during a siege.

You should also ensure enough time to do security testing. Using a framework like the software testing life cycle (STLC) ensures you test continuously and uncover security bugs much more often.

Finally, it helps if you adopt the “security as code culture” of DevSecOps, or work with a team that does it. This ensures that security is seamlessly integrated into every step of the software development life cycle and the final app.

Source: Dynatrace

Fintech app security is a mammoth subject, and there are plenty of nuances and approaches to get it right. If you’d like to know more, check out our helpful guide here.

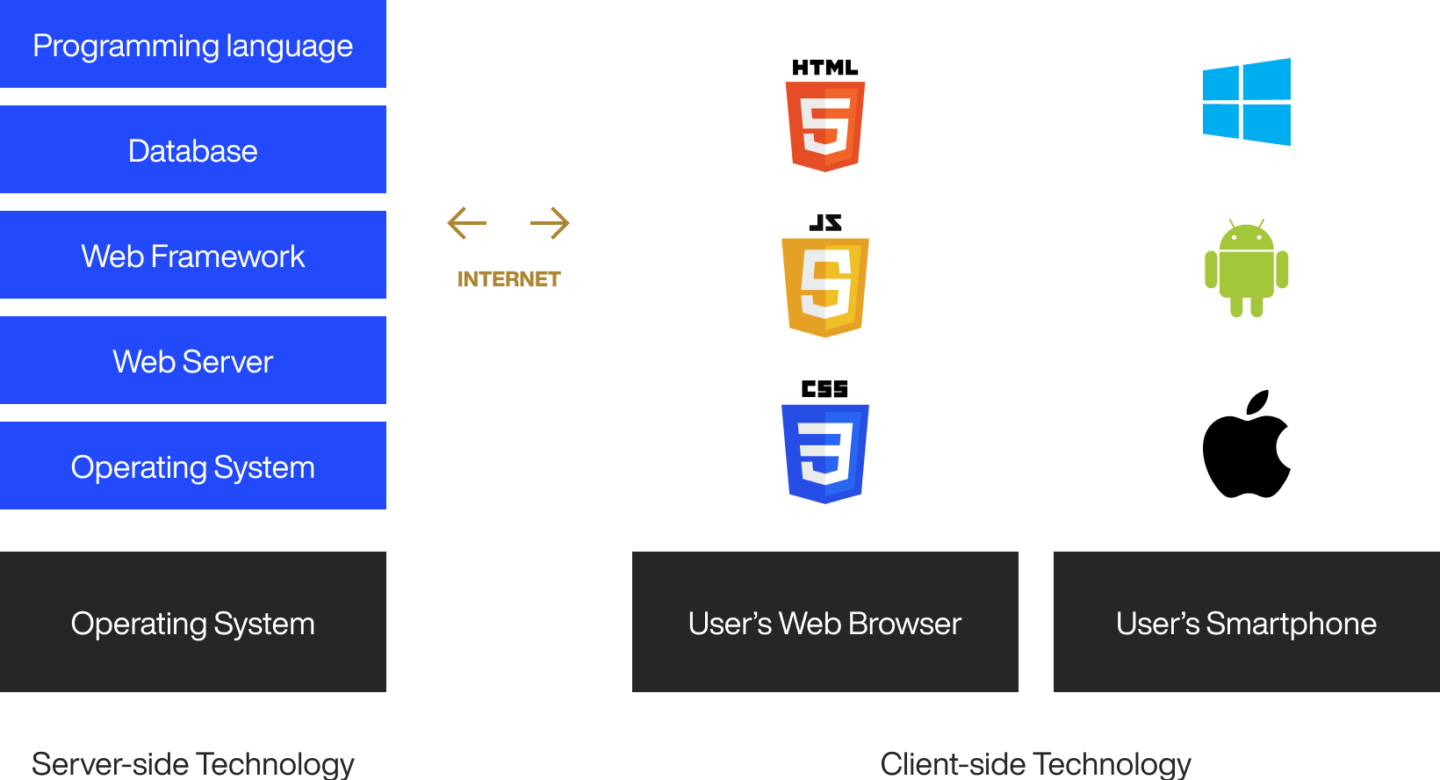

Choose your tech stack

Choosing the right tech stack is crucial for your digital banking app because it will determine everything from your development time to security.

Here are the typical components of a tech stack:

Source: DECODE

The foundation of your tech stack is your programming language of choice. In theory, any of the major languages can be used to code a banking app. But in practice, some are much more suitable for the task than others.

Python is arguably the most popular fintech language, thanks to its simplicity and low learning curve.

It also has an extensive library and robust features that make it perfect for fintech, among other things:

Benefits of python in fintech

Source: CleverRoad

Java comes at a close second. Thanks to its reputation as the language of choice for enterprises and financial institutions, it’s a suitable fintech language as well. It excels in security and cross-platform operation but can be slower overall than Python.

The other big fintech language is C++. It’s a classic and powerful language that’s fantastic for computing complex financial calculations rapidly. However, its main drawback is the steep learning curve.

You also have the programming languages on the app side. The choice is relatively more straightforward here, as it depends on whether you go with native or cross-platform development (you can read all about that topic here).

Finally, you have the tech stack on the server-side, including your database management system, web server technology, or container orchestration solutions like Kubernetes if you plan to use one.

Find the right team to code the app

Execution is arguably an essential part of your app equation because you can’t translate your app plan to reality without it. And to ensure proper execution, you need the right team to do it.

You have plenty of choices here, from creating an in-house team to hiring freelancers. In addition, sites like Upwork, Linkedin, and Toptal allow you to easily connect with a global pool of professionals that can work on your project.

However, we believe partnering with an experienced mobile app agency is still the best approach (this article makes an excellent point on why this is so).

But regardless of which route you take, you should be stringent with your screening process. This increases the chance that you only work with reputable agencies that are a great fit.

The best tool here is reviews and testimonials.

Looking at what past clients thought of them gives you a pretty good indication of their work ethic, commitment, and output quality.

Of course, if you can talk to these clients, that’s even better.

However, working with a reliable and professional agency isn’t enough with something as mission-critical as a banking app. They also need to have the right technical skills and experience to match.

After all, you wouldn’t want your fintech app to be their first project. That would be too risky.

Need further help looking for a reliable fintech app agency?

You can use DECODE’s procedures and practices as a template on what to look for. Or you can check our track record of fintech projects to see if we’re an excellent match for you.

Select third-party integrations

One final consideration before you create your digital banking app: what are the integrations you need?

As a mobile banking platform, your app will undoubtedly need to connect with other financial services to provide a seamless user experience. So, carefully plan any APIs required to achieve this.

One of the most important integrations is the Open Banking initiative. This API allows third-party apps to retrieve data from big financial institutions securely.

This is crucial for digital banking, as, without it, the app can’t access a user’s bank balance.

Source: Fortunesoft

It’s also a good idea to integrate with existing financial services. This allows you to extend the capabilities of your app without having to develop it, thus saving you time and effort.

In addition, API integrations can be easily swapped without having to modify your app’s code heavily.

For example, you can easily integrate payment features into your app through third-party providers like Stripe or Paypal. In addition, tools like Plaid allow you to access dozens of financial services, while Authy can be used for authentication.

Release and maintain the app

The retention rates of most apps drop by an average of 65% after the first month of usage and decline steadily from then. This is just one of the findings of Apptentive’s 2021 Mobile App Engagement Report:

2020 Monthly consumer retention

Source: Apptentive

While these retention rates are more optimistic compared to previous years, it still highlights one crucial fact. Your job doesn’t end once the app is done. The real work is in launching and maintenance.

Having a great initial launch starts with getting approval from either the Apple App Store or Google Play.

It’s not always a straightforward process, though, as there’s a long list of factors that will get your app rejected (you can consult our cheat sheet here).

Once your app passes Apple’s or Google’s standards, the marketing work begins. You can use numerous tactics here, including SEO-optimized content, Facebook ads, and app demo videos to show potential users.

But a successful app launch won’t ensure user retention. That can only be achieved with proper maintenance tasks like fixing bugs, monitoring performance, and introducing new features.

Above all, constant maintenance shows users that you’re committed to delivering the best experience to them. That can help attract new users and keep old ones.

Banking apps are straightforward – but never easy

The journey from a digital banking app idea to a fully working version is a simple step-by-step process. But in reality, it’s never that smooth sailing.

Numerous compliance challenges, poor user experience, cybersecurity threats, and a host of other risks can make the road bumpier.

Fintech app developers →

Major businesses trust us to handle their mobile banking solutions, and we help agile startups disrupt mobile payments, stock trading and the rest of the rapidly evolving sector.

That’s why it’s vital to have an experienced fintech app agency that can help you navigate these pitfalls.

And with our extensive experience developing top-notch fintech and banking apps, we might be the perfect partner you need.

Contact us today, and let’s talk about your big app idea!