Stock market apps have taken the world by storm.

In April 2021, the monthly downloads of the Robinhood app reached 3.23 million globally.

WeBull, another investment app, counted 2.69 million global users as of July 2021.

Trading apps are popular because they make investing—once reserved for the wealthy—accessible to everyone.

That makes the industry especially lucrative. The market was valued at $8.59 billion in 2021.

Naturally, it also means it’s quite competitive. Apps can’t just offer the bare minimum and expect to succeed; they need to go above and beyond to stand out.

Here are some must-have features to get you there.

Multiple ways of login authentication

Logging in and authenticating users are the most important ways to secure a trading app.

And contrary to what most think, it’s not a hindrance to most users (at least for fintech).

Indeed, a study by PYMNTS revealed that 71.2% of financial services customers are satisfied whenever they encounter app authentication

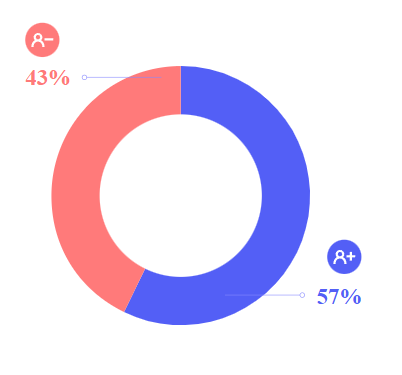

But on the flip side, an Onfido study concluded that 43% of users abandon app onboarding due to digital identity and authentication concerns.

Source: Onfido

So the best course is to balance security with convenience. You can do this by offering multiple convenient paths for login and authentication.

For instance, it’s common for apps to offer both biometrics and multi-factor authentication (MFA).

The good news is that these are easy to implement, thanks to APIs like Apple’s Face ID.

Another popular option is sending a one-time PIN (OTP) to the user’s mobile number to verify their identity—something common in credit card transactions.

The Interactive Broker app takes it further by providing a standalone authentication app.

With it, you can use your mobile device to authenticate not just your account, but also other users you have authority over (say, your children or other dependents).

Source: Interactive Brokers

In the same way, the app should also offer multiple ways to register for an account.

For example, a good practice is to allow a user’s existing social media account to log in, saving them from filling up long forms.

However, the best approach might be to delay logging in as far back into the process so that the user can explore the app first.

Doing this builds trust and engages the user, thus making them more likely to complete the registration with less friction.

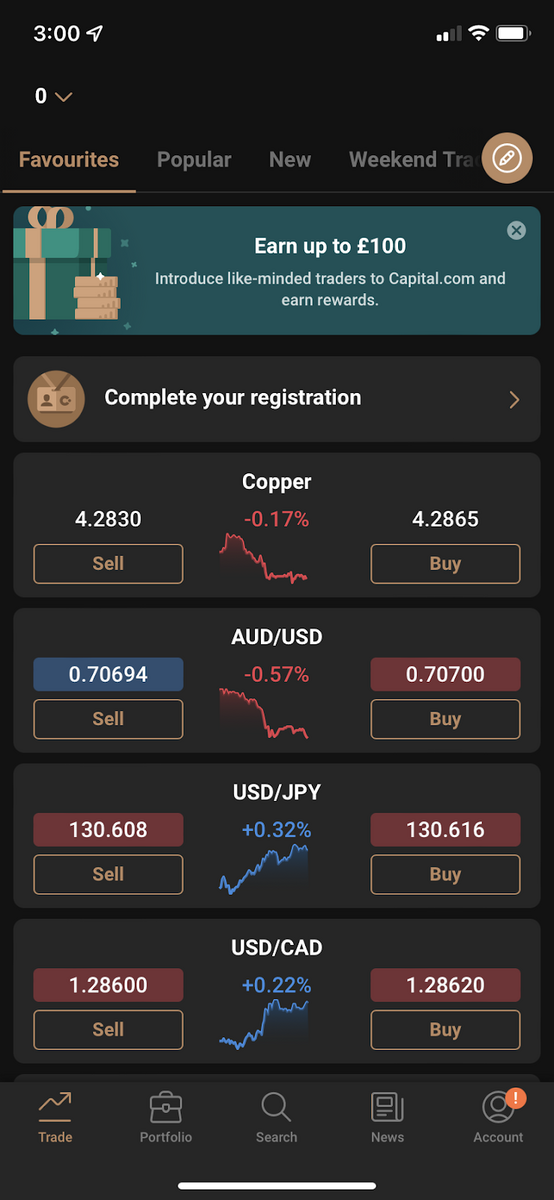

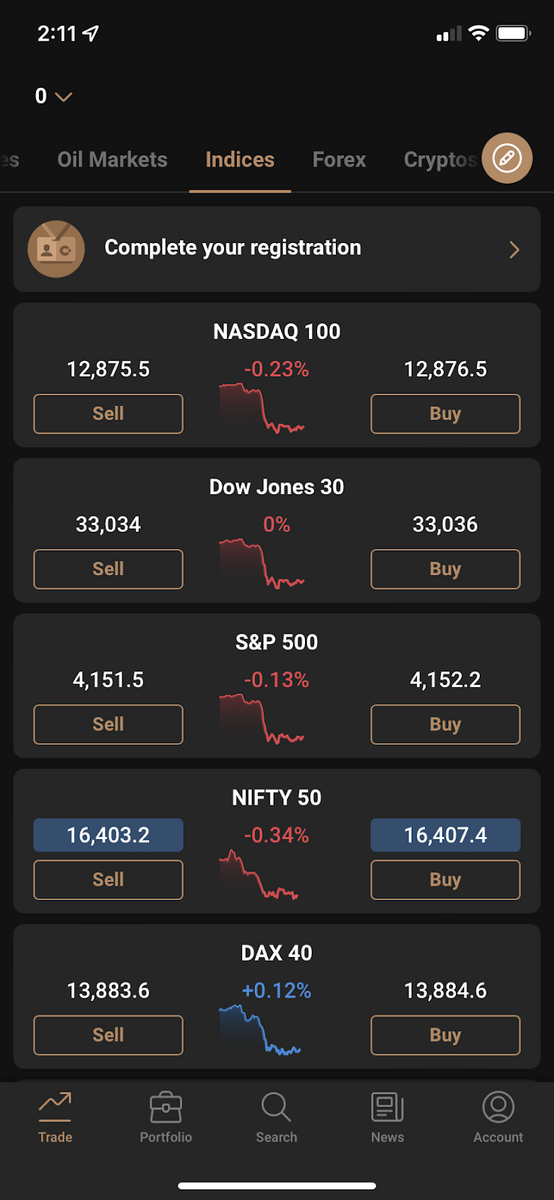

An app that does it well is Capital.com.

Notice how the app allows you to view stocks and the newsfeed without an account. It will only require it once you’re ready to place a trade.

Source: Capital.com

In short, the best thing to remember is to streamline the authentication process. Of course, security is still the top priority here, but if you can speed it up, that’s the best approach.

Access on various devices

Users should always have access to their trading account, wherever they are and whichever device they’re using.

In trading, timing is everything. Share prices can change in a matter of minutes, and that can spell the difference between profit and loss.

Hence, why any trading app should consider a cross-platform approach. At the minimum, it should have both an app and web version. However, they shouldn’t just be clones of each other.

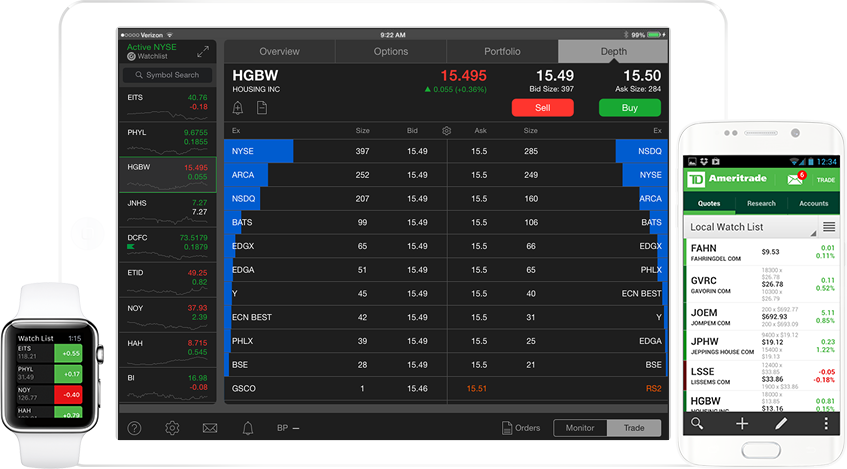

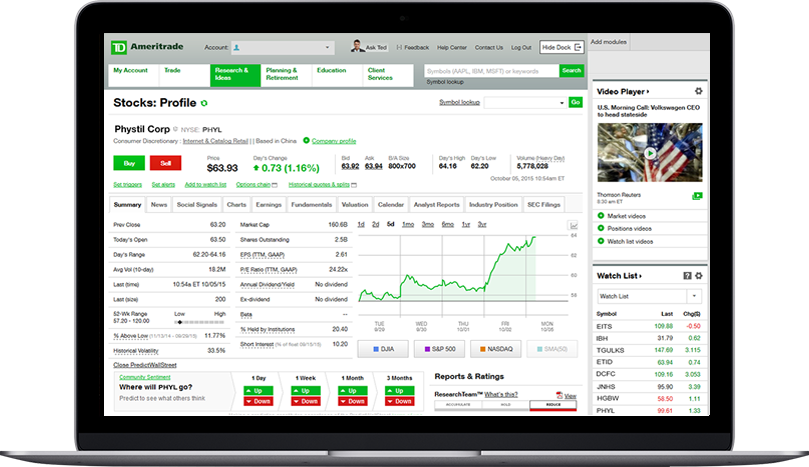

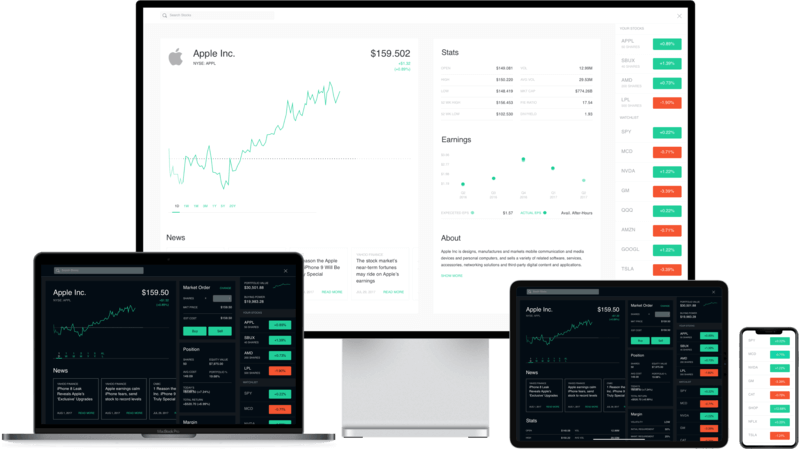

To illustrate, let’s look at TD Ameritrade’s various platforms:

Source: TD Ameritrade

Notice how every version looks different. That’s because, ideally, each serves a distinct purpose.

For instance, the mobile app is for executing trades on the go.

It’s for glancing at a stock’s share price or placing an order to capitalize on a sudden price movement or time-sensitive opportunity.

Smaller screens often mean that only the basic features are included.

Source: TD Ameritrade

On the other hand, the tablet, web, and desktop versions are for more in-depth analysis and research.

Therefore, they’re more suitable for planning your next trades or managing your portfolio. The larger screens offer more space for data and charts to help you with this.

Source: TD Ameritrade

Of course, you can place trades in the web version, just like you can research using the mobile app. They’re all connected to the same trading account, after all.

But by optimizing each platform to a specific purpose, you can make your trading app much more functional for your users.

Newsfeed

Trading involves heavy research.

After all, you need to look at a stock’s past performance, financial standing, management, and other metrics to decide if it’s worth investing in or not.

That’s why many apps integrate a newsfeed feature which lists down all the relevant news that might impact stock performance.

That way, it saves users from switching to another app or website to get information.

Fast access to financial information is one of the top needs of many trading users, according to Josh Elman, VP of Product at Robinhood:

“Our research has shown that our customers are looking for more information about what’s going on in the financial world.”

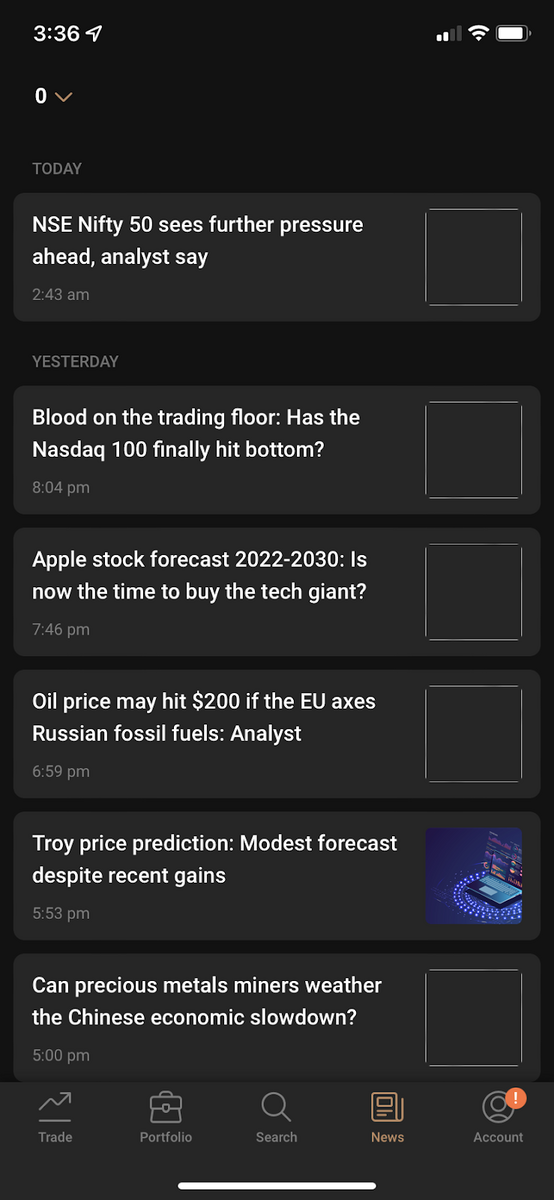

At its most basic, a newsfeed is nothing more than an aggregate of the top news critical to a stock, like with Capital.com‘s newsfeed.

Source: Capital.com

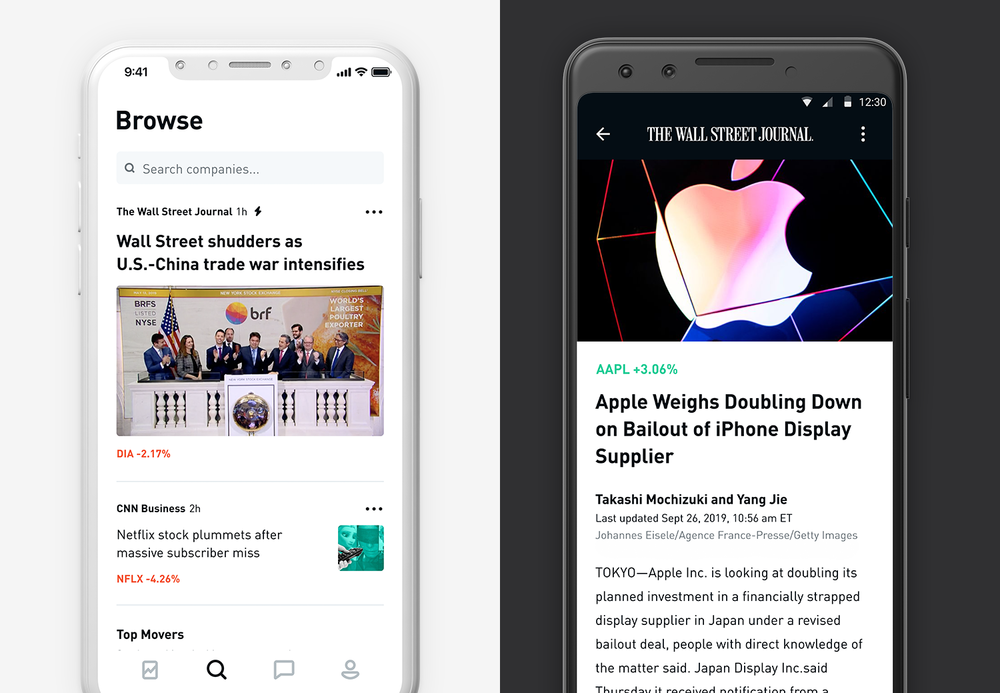

Some newsfeeds, like Robinhood, only show news of stocks in the user’s portfolio.

That way, information is more focused and relevant. In addition, the app also throws in video content from mainstream outlets like CNBC.

Source: Robinhood

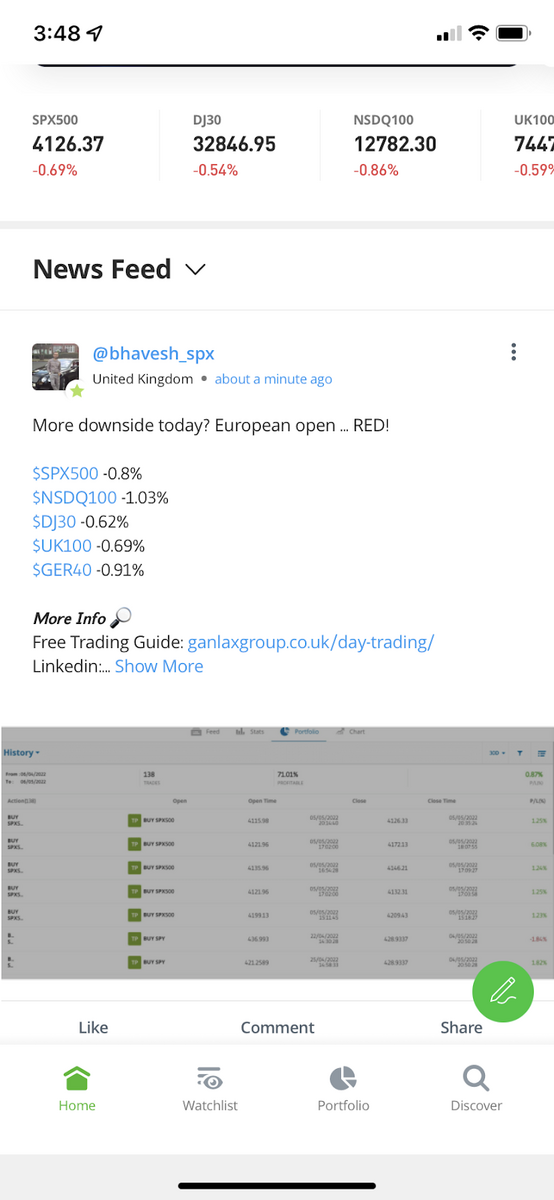

But it’s social trading apps like eToro that truly redefine the meaning of newsfeed. That’s because mainstream news isn’t the only source of trading information.

Market experts and even fellow traders can also be a wellspring of data.

As a result, eToro’s newsfeed looks more like a social media feed:

Source: eToro

Like a typical Facebook page, it’s a mix of mainstream news and rants/musings from fellow casual investors.

True, it can be overwhelming, and it does need a more discerning judgment to separate the real information from fake ones.

However, it does give a complete picture of the market sentiment of a particular stock.

And that’s what a newsfeed is for—to bridge investors with the information to make better decisions.

In a way, notifications also achieve that same goal.

Smart notifications

When done right, notifications can do wonders for your engagement rates. A study revealed that it could even boost retention by 190%.

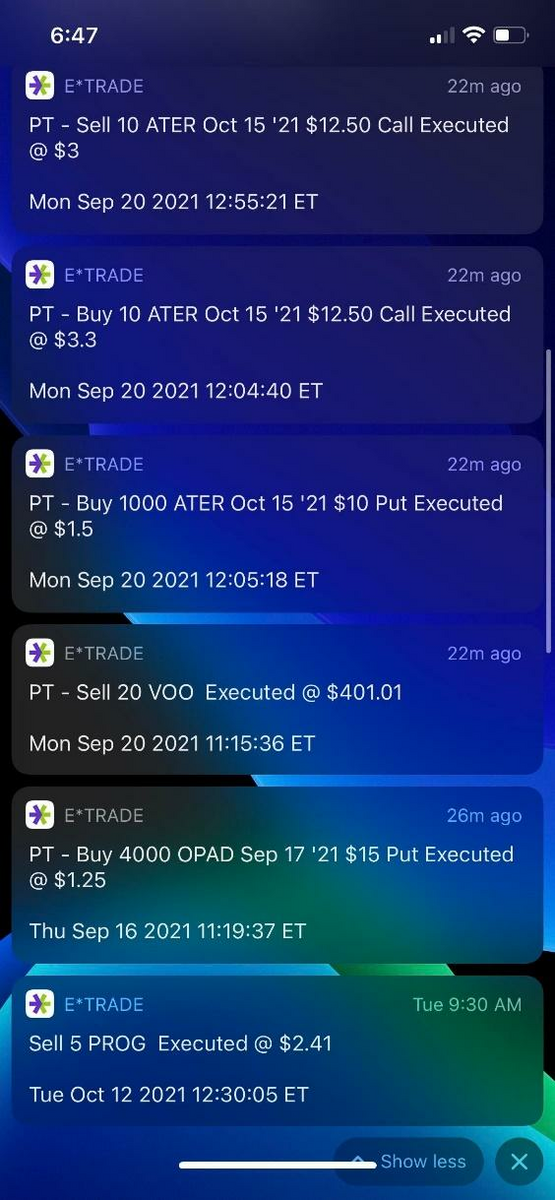

It’s no different with trading apps. Only here, notifications play a much more crucial role since they help users keep track of their orders.

Remember that trades aren’t made in real-time; thus, sometimes, the price fluctuates from when the order is placed until it’s executed.

Notifications are a great way to alert users when this happens:

Source: eTrade Reddit

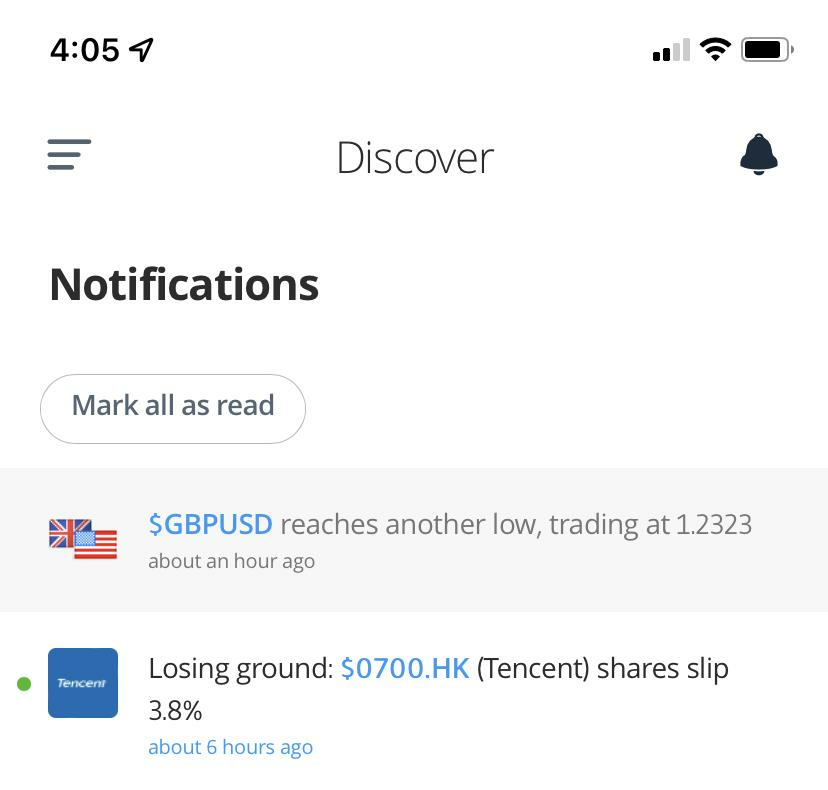

Notifications are also important so that users are always in the loop on their portfolios.

For instance, it can inform them of the price movements of a specific stock so that they can act appropriately.

This is especially crucial for day traders, who are more sensitive to hourly price swings than anyone else.

Source: eToro

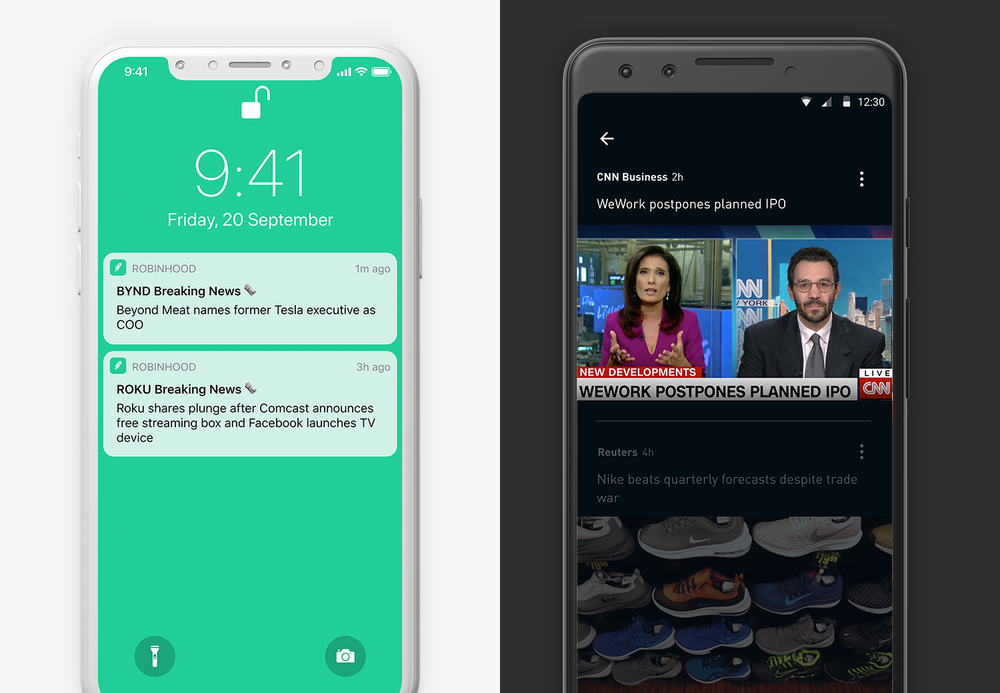

When combined with the newsfeed, notifications can also help serve valuable content to users.

The Robinhood app, for example, informs users of essential financial news via notifications.

Source: Robinhood

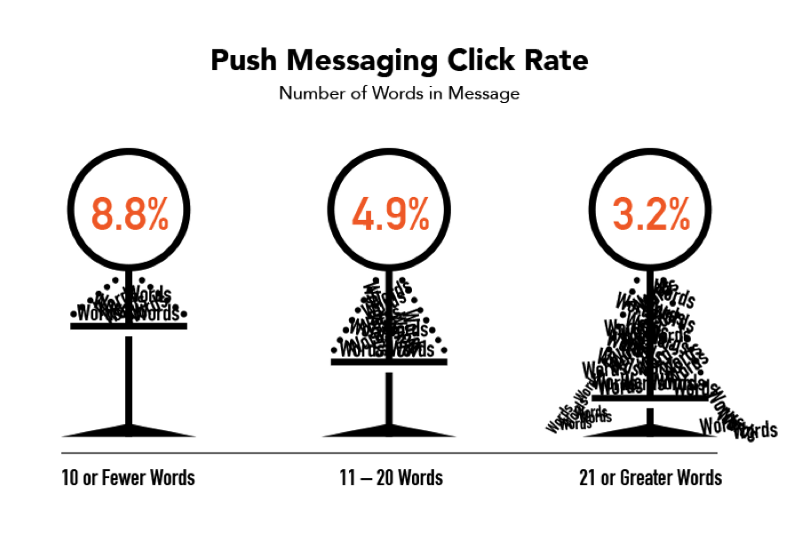

But however useful notifications are, you shouldn’t overdo them.

Frequency matters, but the length of the message is just as crucial. It’s best to distill the core message into just a few short words.

And that sweet spot is ten or less, according to a Localytics study.

Source: Hi5

Lastly, make sure you do push notification permissions right. Always spell out the benefits of turning it on.

By doing so, you’ll have a better chance of opt-in and acceptance from your users.

Tracking real-time market data

News and market sentiment might be important factors for sound trading. But nothing beats checking the price of the stock itself.

Price should always factor in every decision. Smart trading, after all, is knowing the right price to buy or sell.

Considering that some stock prices fluctuate during the day, it’s ideal that your app shows real-time price data.

For example, when I checked the Capital.com app, it showed stock prices that were changing every second.

Source: Capital.com

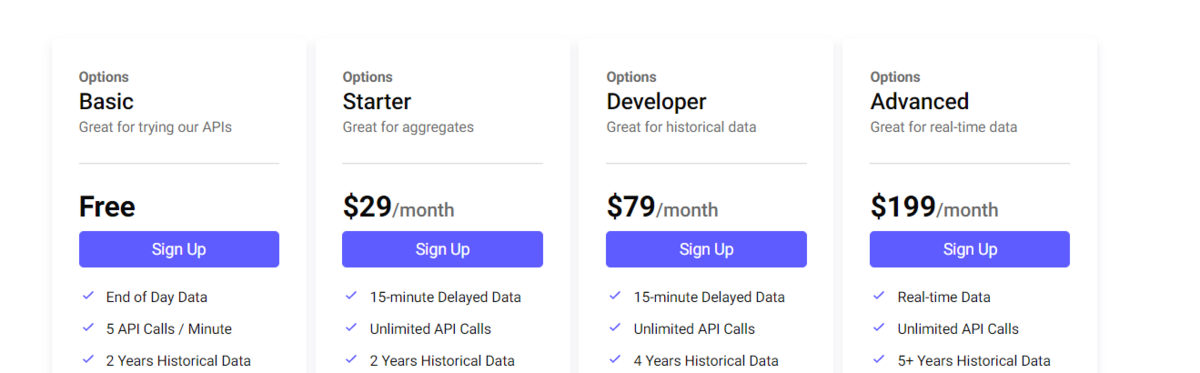

To implement this in your trading app, it’s crucial that you get the right stock market API.

Unfortunately, not all offer real-time data; some provide only historical prices, and others have a fixed delay.

A good example is Polygon.io, a stock market price API. It has various pricing plans that correspond to how current its price data is.

Source: Polygon.io

Realistically, some apps can get away with delayed price data.

For example, if your app is focused on long-term investing like M1 Finance, then second-by-second price updates might be overkill.

Hence, you could probably get away with a 15-minute delay or even EOD data.

But for apps that serve day traders, you need to capture split-second price fluctuations that only real-time data can provide.

It all comes down to understanding your users and fitting your app to their needs. That’s the only way to create a usable app that will resonate with them.

But the stock price isn’t the only piece of information that needs to arrive in real-time.

Real-time analytics

Real-time charts, reports, and other data are an important part of a trading app. They give users the insights to understand the market, spot patterns, and trade more successfully.

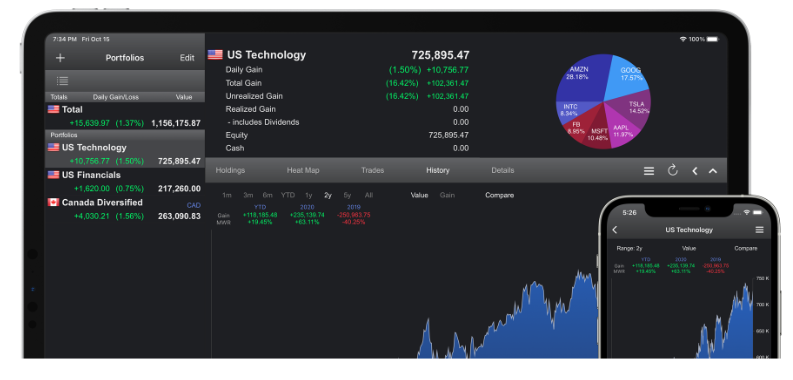

For example, the Navexa app allows you to view your portfolio at a glance. At the minimum, it shows you the total net worth of all your holdings, plus your ROI to date.

Source: Navexa

There are many more metrics that your app can cover, such as profit and loss, portfolio diversity, price change sensitivity, and managing multiple currencies.

Here’s a dedicated app that shows this wealth of data.

Source: Portfolio Trader

Fortunately, while real-time analytics might look complicated, implementing its logic can be relatively straightforward, thanks to existing APIs.

One example is Polygon.io, which facilitates creating charts and graphs from market data.

Source: Polygon.io

The real challenge here is balance. You want to present your users with as much data as possible.

But at the same time, you don’t want to overwhelm them or clutter the UI too much.

That’s why a sound approach to UX is key. An overloaded user interface is never good, especially in a financial app.

One way to do it is a modular view. In other words, you only reveal information as the user needs it.

More visualization like charts and graphs and fewer numbers/text is also a wise strategy.

But don’t overdo it either—one or two visualizations on the screen at a time should be enough.

Remember, too much information can cripple your users. Avoid that with smart UI design.

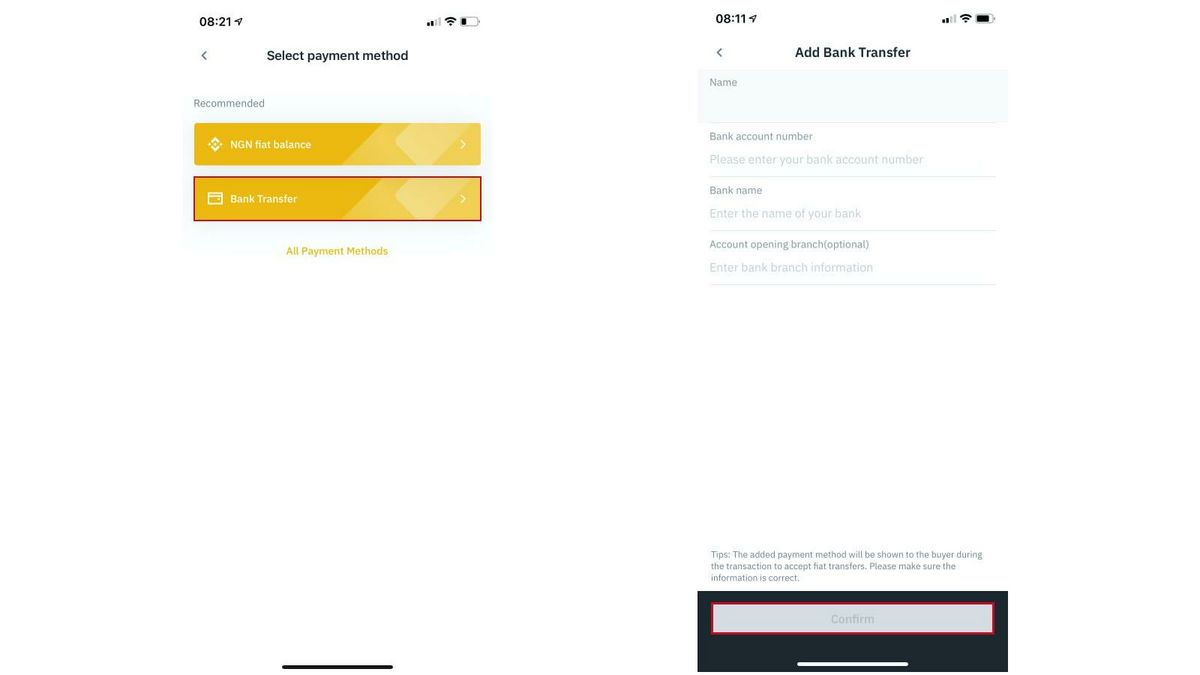

Multiple payment options

A trading account is useless if users can’t fund it. Thus, you should provide multiple ways to transfer money into the app.

The key driver here is convenience. Removing as much friction as possible during the funding process ensures a fantastic user experience.

The best way is to connect a user’s bank account to the app. This allows them to transfer money in the smallest number of steps.

Source: Binance

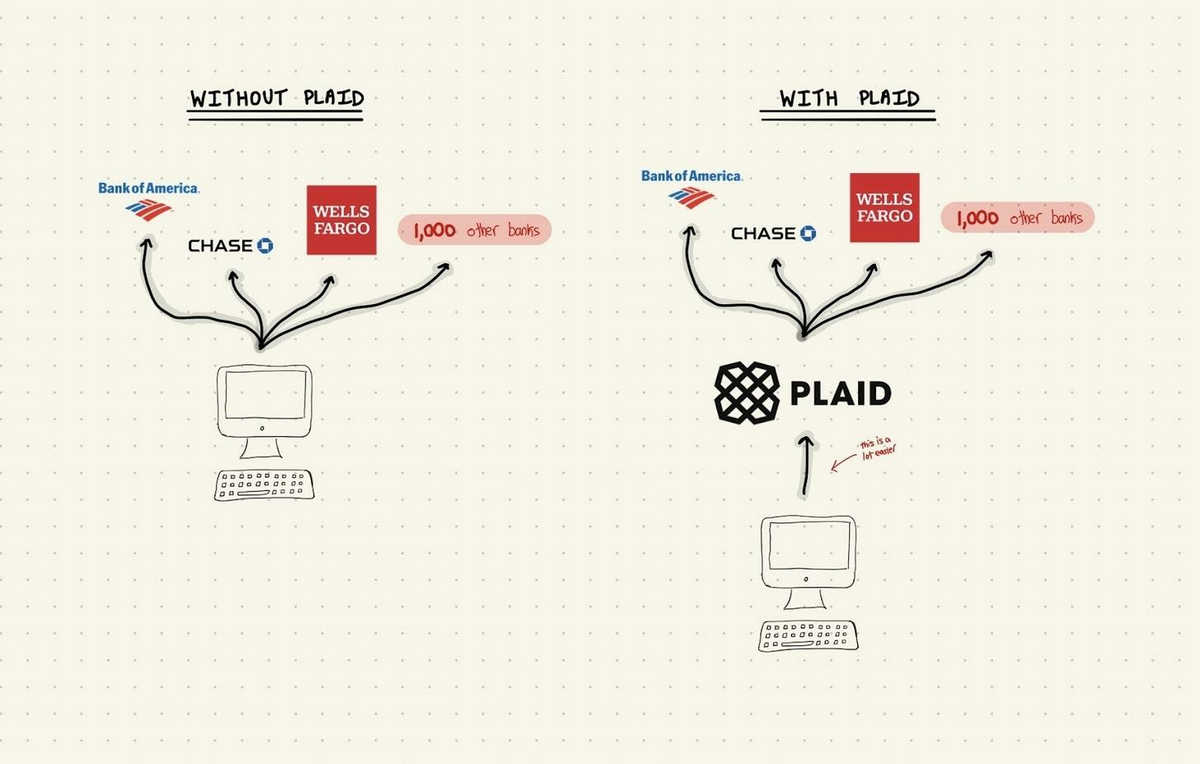

Again, there are third-party tools for this purpose. One of these is Plaid, a service that provides API that allows you to connect to hundreds of banks and financial institutions.

Doing this is much more efficient because you don’t need to worry about integration for every bank.

Source: Technically

On top of connecting bank accounts (or if it isn’t an option in your country), you should include other funding options like credit cards and online platforms like Paypal.

If you’re offering crypto, consider integrating with mobile wallets as well.

Implementing as many payment methods as possible is the easiest and most cost-efficient way to ensure you get the widest audience.

Ready to implement these features?

Knowing which features you should have in your trading app is the first step toward success. But the next step is arguably the more important one – implementation.

And this is where it gets tricky—because it can be challenging to transform an app feature from idea to reality. There are a lot of technical hurdles to pass through.

That’s why it’s advantageous to have an experienced mobile app development agency like DECODE by your side. We’ll help you navigate the waters and achieve app success.

Interested? Get in touch with us today, and let’s talk.