The rise of the fintech industry has been meteoric.

In 2021 alone, there were more than 8,775 fintech startups in North America. Moreover, 500 of these are considered unicorns—firms with a market value of $1 billion. And that number is expected to rise further in the future.

As you can see, it’s an exciting time to be in the fintech field. But the sheer number of incumbents also means you need to stand out from the crowd.

Innovative features, a great user experience, tight security—all of these things matter. But you can only flesh these out with the right tech stack and programming languages.

Here are some to consider.

Python

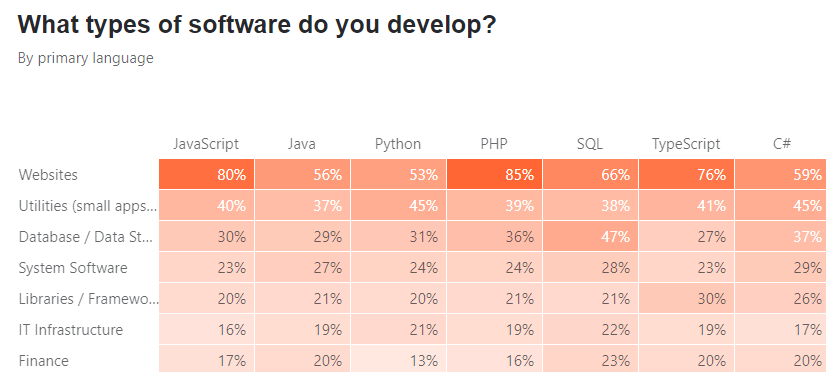

Python is quickly becoming one of the most popular languages not just for fintech development but also for apps and websites.

A HackerRank survey placed Python as the top fintech language and the third most popular in other finance projects.

Indeed, many top fintech apps rely on Python as an integral part of their tech stack. For example, the popular trading app Robinhood uses Python and Django. In fact, there are third-party Python libraries that allow you to interact remotely with the Robinhood API.

Venmo’s varied tech stack also includes Python.

So, why is Python so popular with fintech app developers?

For one, it is easy to learn and implement.

Its syntax is very simple and lean, which means it takes fewer lines of code to program something.

As a result, programmers spend less time debugging their code, which leads to faster development times with fewer errors.

For this very reason, Python is a popular prototyping language for creating minimum viable products (MVP).

Python’s fast development time is further enhanced thanks to its over 200,000 libraries. They include financial, visualization, machine learning, and data processing functions—all useful to have in fintech development.

Top 10 Python financial packages

Libraries like finmarketpy (backtesting trading strategies), ffn (quantitative finance functions), and panda (data analysis and manipulation) make it easy to develop advanced functionality without having to code it from scratch.

Libraries are also available for integrating into many popular banking APIs.

It’s also because of these libraries that, despite its simplicity, Python can be a powerful tool for developing advanced fintech apps dealing with big data, machine learning, and financial modeling.

Now, while the speed of Python is acceptable for everyday fintech users, it’s actually one of the slowest compared to other languages.

For example, based on the results of the Computer Language Benchmarks Game, Python’s 48.03-second processing time is nowhere near that of C++, which clocks in at an impressive 1.54 seconds.

Nevertheless, unless you need to process complex calculations quickly, Python suffices for most fintech applications.

Java

Java is perhaps the most popular language today, rivaled only by Python and C++.

Looking back at our HackerRank survey, you’ll see that Java is consistently in one of the top two spots.

Other surveys, such as JetBrain’s The State of Developer Ecosystem 2021, also confirm that Java is one of the most widely used languages in the finance sector.

Source: Jet Brains

Of course, this isn’t news at all. Java has long been the language of choice for the world’s biggest corporations, enterprises, and financial firms.

It was also the pioneering language for many early trading systems, like Island ECN and TD Ameritrade’s thinkorswim trading platform.

And the reasons behind this popularity are also why it’s great for fintech.

Source: Softensy

Among these is Java’s platform independence, or the “write once, run anywhere” paradigm.

In other words, programmers can create a program in Java and then implement it on any platform, cutting the need to re-develop for separate operating systems.

Time, widespread adoption, and an outstanding track record are also on Java’s side—giving it a rich selection of libraries and tools as a result.

There are even complete Java-based platforms you can implement directly, such as ta4j (for technical analysis) and Coin Trader (for crypto trading functions).

Moreover, many popular data processing utilities like Hadoop require Java knowledge.

Java’s performance is also a key selling point. It has excellent memory management, which is made even better with the inclusion of ZGC concurrent thread-stack processing and Elastic Metaspace in the latest Java 16 release.

However, probably the best reason to go with Java is security and reliability. It has evolved into a mature and safe language during its decades-long existence.

The Java Virtual Machine makes code more secure by managing critical performance tasks like type safety, garbage collection, and error handling.

In addition, the Java SDK provides many security libraries for cryptography, access control, SSL/TLS/DTLS protocols, and authentication.

This reliability and stability spurred German neobank N26 to use Java in developing its Android apps and backend systems.

And while they’ve since adopted Kotlin as well, the latter shares many of the same tools and libraries with Java.

The bottom line is, Java has been and will continue to be a top-notch tool in financial systems.

However, Java, for all its popularity, wasn’t without drawbacks. Low speed and a slow, verbose code come to mind. Improving these limitations inspired the development of JVM-based languages like Kotlin and Scala.

Scala

Scala, a portmanteau of “scalable” and “language”, is a programming language that was created specifically to cover many of Java’s weaknesses.

As such, it’s completely interoperable with Java’s libraries and code, and runs on the Java Virtual Machine.

Right now, Scala isn’t as popular as some other languages on this list, but that’s slowly changing.

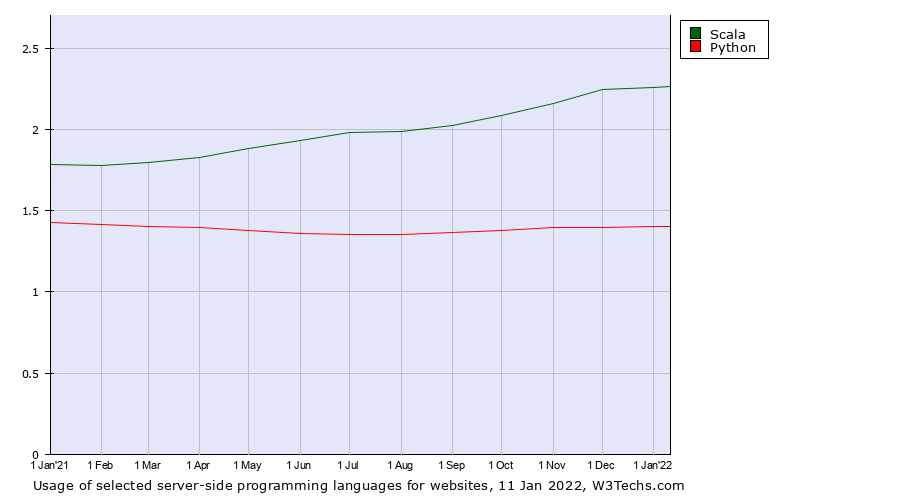

According to this January 2022 report from W3Techs, Scala is becoming a popular server-side programming language, just about overtaking Python:

Source: W3Techs

The recent increase in the demand for developers skilled in Scala indicates that companies are already making the jump. According to a 2019 Hired survey, Scala was the 2nd most in-demand language based on requests during job interviews:

So, why should you give Scala a try? What makes it different?

The way Scala improves upon Java is at the core of understanding the real strength of the language.

First, its code is much less verbose than Java’s. On average, Scala’s source code is two to three times more concise than its Java counterpart. That makes development time exceptionally fast.

Second, Scala is adept at processing large amounts of operations quickly and elegantly. Thus, it’s great for developing complex fintech apps.

Third, Scala uses a feature called type safety, which allows programmers to detect “errors while writing the code,” according to Jason Brown, CEO of fintech firm Tally. This further reduces debugging, as trivial errors are caught before the code is compiled.

Lastly, Scala has a powerful set of libraries that are well-suited for data processing, concurrency, and distributed systems.

This is why Scala is a top choice for creating blockchain applications, evidenced by the number of blockchain projects using Scala in Github.

Indeed, many popular frameworks in big data, such as Apache Kafka and Akka, are all based on Scala. So, no doubt, the language will continue to be a big fintech player in the future.

C++

C++ is perhaps the “granddaddy” of all the programming languages on this list. But despite its almost three-decade reign, there’s no indication that its popularity will be waning any time soon.

If you look back at the HackerRank survey we referenced earlier, C++ is going strong in the finance industry, overtaking even Python.

The biggest ace in the sleeve of C++ is its processing performance. It’s considered the “closest to the machine” compared to other programming languages.

Without intermediaries or virtual machines in between, C++ code runs exceptionally fast.

The long tenure and age of C++ have another hidden benefit for fintech apps. It turns out that many large financial firms have legacy systems that still use C++.

Therefore, the knowledge of this language can allow one to access and integrate new additions to these systems.

C++ also has an impressive number of libraries and tools that can help make fintech development much easier.

For example, the QuantLib package contains many crucial functions for quantitative finance apps.

Because of this, C++ is often the tool of choice for apps that require rapid calculations of complex operations. Thus, C++ is quite popular with quantitative finance and big data applications.

In addition, trading platforms, which require nanosecond-level speed, are also popular targets for C++ development.

There are, however, two crucial drawbacks that hold back C++ from mainstream fintech app development.

For one, it is not easy to learn the language. C++ has several technical quirks and intricacies that take years to master.

Second, it’s much more difficult to make secure code in C++ since it has few built-in safety features.

The complete freedom and flexibility given to C++ developers also mean they have to be careful with their coding.

Nevertheless, C++ is still a relevant language in fintech development, especially if complexity and execution speed is the top priority.

SQL

SQL is unique because it’s not a general-purpose programming language per se, compared to the others on this list. Instead, it’s a language with a very specific goal—to retrieve and work with information on a database.

Indeed, SQL is often called the “language of data” and is considered a basic skill in any developer’s toolset. So it’s no surprise that SQL was ranked #4 in Statista’s survey on the most popular developer languages worldwide in 2021.

And since all fintech apps deal with data, SQL is a critical part of any financial tech stack. It’s especially essential in apps that deal with big data, trading, quantitative finance, and data modeling.

The great thing about SQL is that it works with various relational database systems. So whether you’re going with an open-source database (such as MySQL) or a paid option (like Oracle), SQL is the language they have in common.

However, SQL isn’t without problems. Being the de facto database language, it’s often the target of hackers and cybercriminals.

One popular attack that exploits it is an SQL injection. This happens when an attacker sends unauthorized SQL queries to a database, giving them access to sensitive data.

It’s now ranked as the third most dangerous risk for apps and websites, according to the 2021 Open Web Application Security Portal (OWASP) List.

Incidents like this are reason enough to prioritize the security of the SQL code, because it’s the final layer standing between attackers and your financial data. Here are some best practices you should follow:

SQL server security best practices

They represent the fundamentals of what you should do if you want to enjoy the benefits of SQL without fear of attack.

Ruby on Rails

Ruby on Rails (RoR) is a server-side web framework based on the Ruby programming language, first developed by Yukihiro Matsumoto in 1995.

Nowadays, it’s the fifth most popular framework for building web applications and backend systems, according to a March 2021 survey:

Source: Manpreet Singh / Medium.com

While it’s not as popular as some other languages (placing second to the last in the TIOBE Index as of December 2021), it’s still a worthwhile fintech language in its own right.

In fact, there’s no shortage of fintech projects that include Ruby on Rails in their tech stack.

One high-profile example is the payment platform Square, which uses it for backend maintenance. Insurance startup CoverWallet also features RoR heavily in its systems.

The biggest draw of Ruby on Rails lies in its model-view-controller architecture, which allows teams to work on the data, UI, and resource components of an app simultaneously.

In addition, code sections can be inserted and deleted easily for quick iterations.

Rails architecture

RoR also provides plenty of libraries, third-party tools, and packages called gems. These are like add-ons that allow developers to implement features into their projects without writing a single line of code.

All of these make RoR development among the fastest of any language. It’s further enhanced with built-in safety mechanisms against common attacks such as Cross-Site Request Forgery (CSRF) and SQL injection, which is a boon to any fintech app.

Programming languages are merely tools

As important as programming languages are, they’re only just a means to an end.

On their own, languages can never build the next big fintech app. Instead, they need a skillful and knowledgeable hand behind them—one that steers the code into something innovative and exciting.

And as the top developers in the fintech sphere, we’re more than happy to be this helping hand on your next project.

Contact us today, and let’s start talking!