Fintech adoption is on the rise.

According to a Juniper Research study, nearly one-third of the world’s population relied on digital banking services back in 2021. And this figure is expected to hit 4.2 billion by 2026.

This is both an opportunity and an obstacle. As the potential user base grows, so will the potential competitors in the space.

As a fintech app developer, it’s not enough to have the best app to succeed. You also have to inform and convinceconsumers that you are!

In other words, you need to have a solid marketing campaign. Here are six strategies to get you started.

Focus on the mobile user experience

It’s a no-brainer to assume that your ideal users spend a big chunk of their day in front of their smartphones. Thus, if you want your marketing to reach them more effectively, start focusing on their mobile experience.

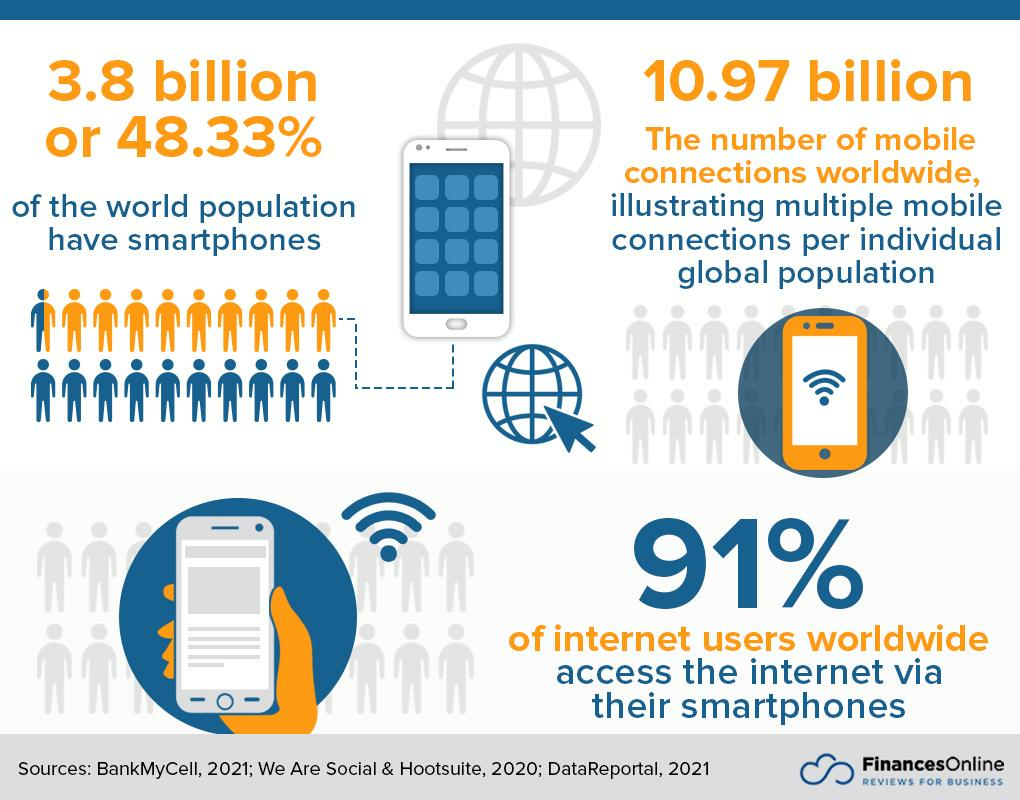

If you need more convincing, consider this: nearly 91% of all Internet users worldwide access it through their smartphone. And these smartphone owners comprise about 48.33% of the global population:

Source: Finances Online

That’s a huge chunk of the market and it would be foolish to ignore it.

However, the problem is that it’s getting harder than ever to get people’s attention nowadays, thanks to the oversaturation of content and advertising we see every day.

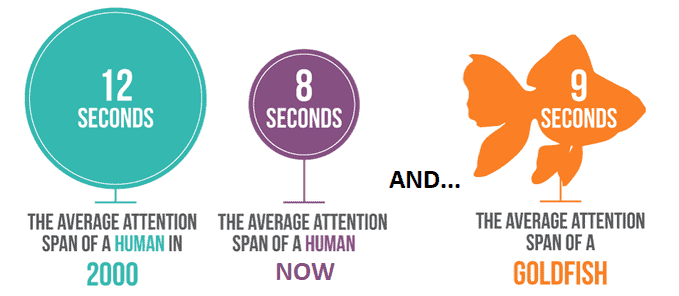

In fact, a Microsoft study concluded that the average person’s attention span today is at 8 seconds, compared to 12 seconds in 2020. That’s shorter than the attention span of a goldfish.

Source: Honest Pros and Cons

In other words, you only have 8 seconds to attract someone with your marketing message. And if they can’t consume or engage with it on their mobile phone, they’ll ignore it.

To ensure this doesn’t happen, a frictionless mobile experience across all your marketing campaigns is essential.

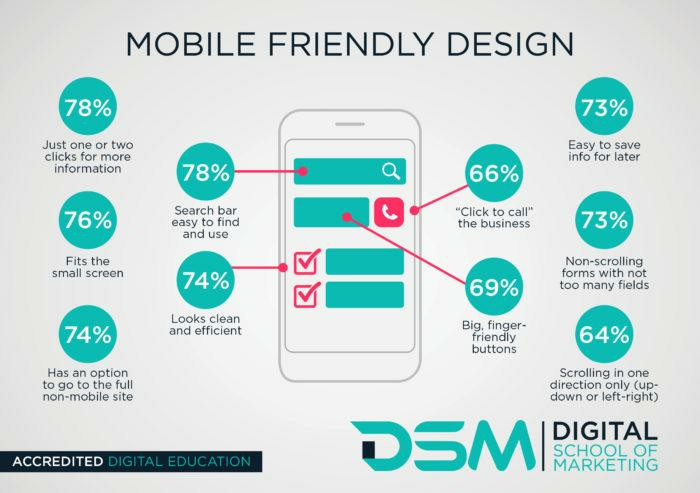

Start by making your website and ads mobile responsive. That means the content should fit the user’s screen, whether on a tablet or a phone. Navigation is an important factor, as you want to make buttons big enough for comfortable tapping. Don’t forget to optimize load times as well.

Source: Digital School of Marketing

As a bonus, mobile responsiveness is also a confirmed Google ranking factor. This can boost your SEO efforts and potentially rank your websites higher on searches.

When it comes to the mobile experience, conciseness is key.

Copy should be just the right length, while still conveying vital information. Clever use of visuals is also effective for quickly relaying meaning and emotion without words. Eliminate pop-ups and other unnecessary content as much as you can.

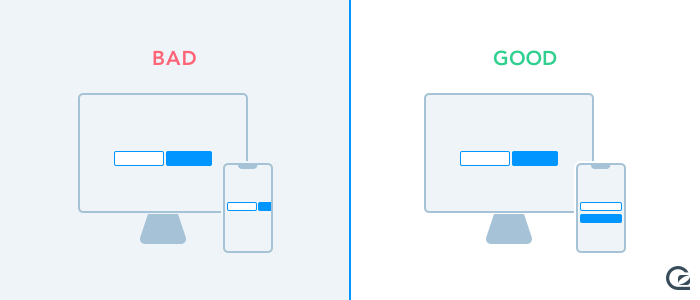

One good approach is to start with a mobile-optimized website first, then expand the desktop version from there. This ensures that the mobile experience doesn’t feel forced. It also helps avoid CTA/button placements like this:

Source: Go Squared

Remember, a great mobile experience is all about delivering your marketing messages to mobile users in the fastest and most efficient way possible. People nowadays simply don’t have the time to internalizedata; thus, you need to make it easy for them to consume it.

Achieve this, and you’ve cracked one half of the equation. The other half is ensuring your message is valuable enough to read in the first place.

Create valuable content

Content is king, as the saying goes. And nowhere is this more true than with fintech.

That’s because the goal of fintech is to take a boring and complex concept (finance) and turn it into something easy and relatable to users. Accomplishing this requires plenty of financial education through content.

For example, Canadian fintech firm Wealthsimple has an online publication called Wealthsimple Magazine. Its goal is to explain complex financial topics like cryptocurrencies, taxes, and NFTs to regular folks.

Source: Wealthsimple Magazine

The magazine does a great job weaving financial concepts into everyday stories – much like how a regular magazine works. One notable feature of the magazine is Money Diaries, where celebrities and personalities share their personal finance stories.

Now, imagine when Wealthsimple Magazine readers become savvy enough to require financial services; guess which firm they’ll go to? There’s a big chance that it’ll be Wealthsimple.

Articles are just the beginning, however. Videos, ebooks, and webinars are other popular content marketing tactics. Interactive quizzes are also effective, especially when dealing with some number crunching.

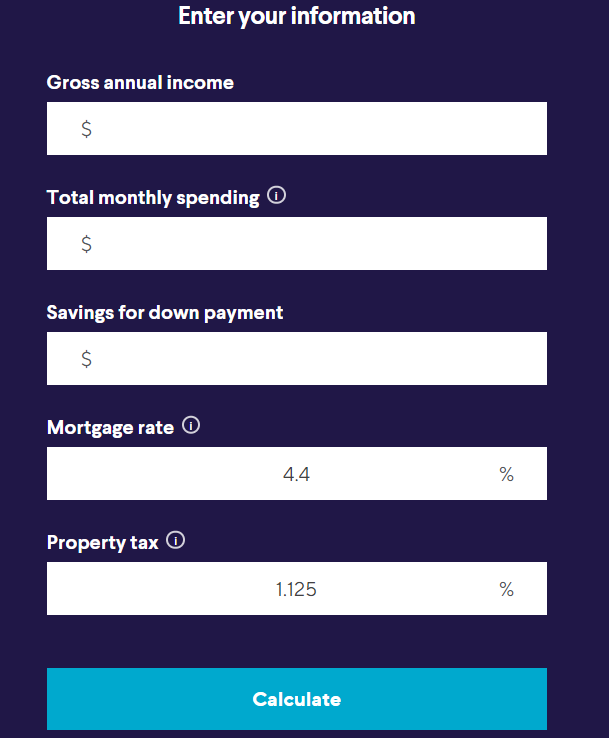

A great example is the banking app SoFi. On top of blogs and video content, they also have calculators for everything from student loan refinancing to life insurance. For example, here’s a screenshot of their home affordability calculator:

Source: SoFi

For regular folks who have no idea how things are computed, SoFi’s financial calculators are a lifesaver.

But valuable content is more than just education. It’s also for building trust and driving retention—before users even open your app.

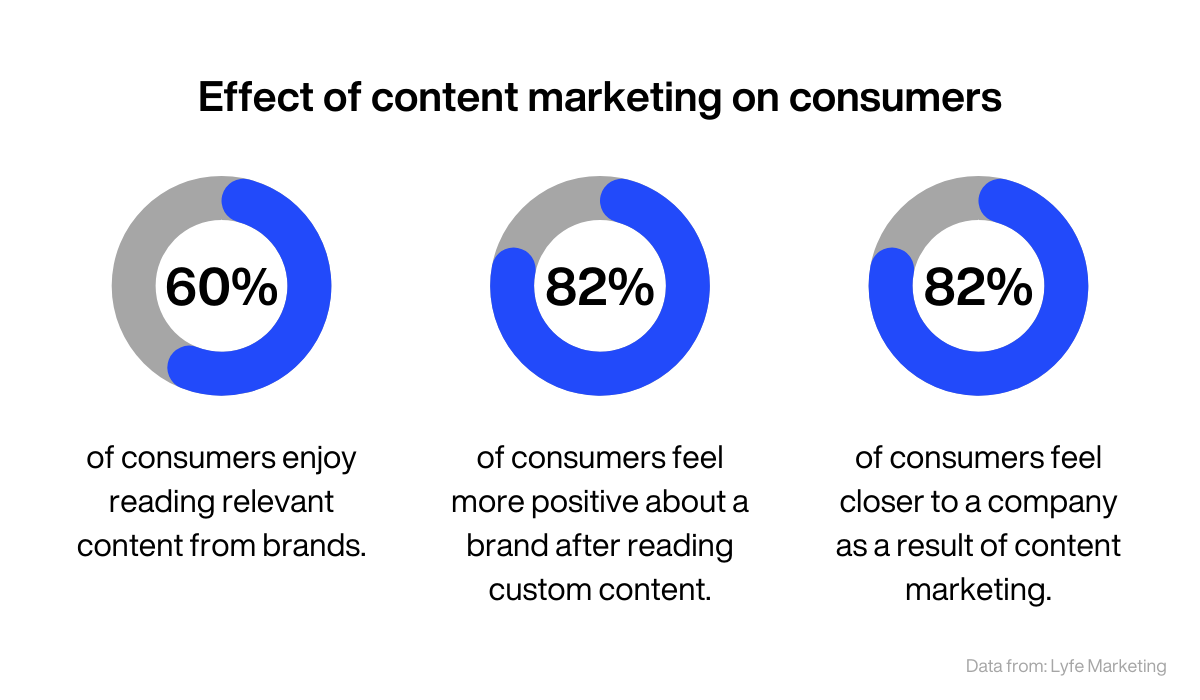

A study by Lyfe Marketing backs this up with the following statistics:

Source: DECODE

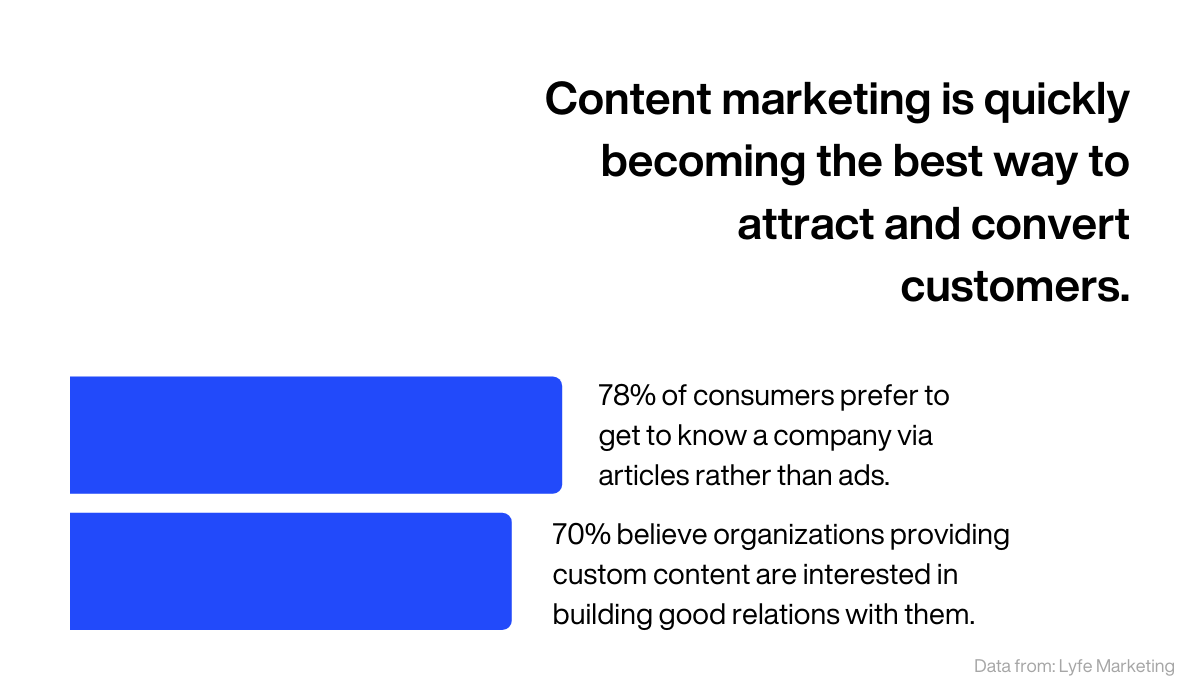

Here’s another set of findings from the same firm. It underscores a vital advantage of content: it’s much more natural and, therefore, more acceptable than ads.

Source: DECODE

And there’s no shortage of real-world success stories with content marketing. One notable example is Backlinko, which achieved an impressive 785% conversion rate in a single day—all because of a simple content update.

Indeed, content marketing is an effective strategy, but it’s by no means easy. It requires a dedicated team, a careful strategy, and constant analytics to pull off. It also doesn’t help that content marketing trends evolve quickly.

But if you have a unique brand offering or personality, you can capitalize on that to make your content efforts much more effective. Hence, it’s always worthwhile to differentiate your app from everyone else.

Differentiate your brand

In a saturated fintech market, standing out is key to success. The way you do this is by building a distinct brand.

Fortunately (or unfortunately, depending on how you look at it), there are many possible ways to differentiate yourself. It could be through a unique process that separates you from all the other generic budgeting apps out there. Or maybe a unique personality is your strategy.

To help you out with your discovery process, here are some fintech apps that managed to stand out from the crowd.

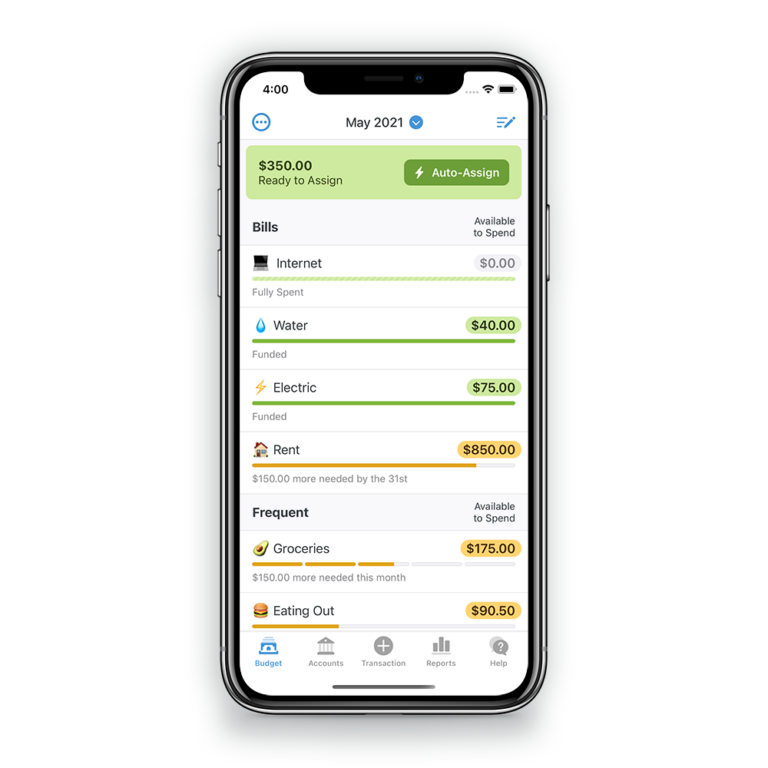

Let’s start with the budgeting app You Need a Budget (YNAB)

Source: YNAB

YNAB’s differentiating factor is its unique budgeting method called Give Every Dollar a Job. It’s based on four rules that help users become more purposeful with their spending and income allocation.

The method claims it can help make budgeting less restrictive—certainly a major pain point for most people trying to rein in their finances. They also reveal that the average user saves $600 in the first two months and $6,000 during the first year of app usage.

Source: DECODE

Exuding a quirky and unique personality can be a fantastic way to market a financial app, if done right. The Swedish payments and shopping platform Klarna pulled it off with a little help from some influencers.

One of their notable campaigns is the Smooth payments campaign, with famous rapper Snoop Dogg at the helm. He’s also the new face of the brand and a minor shareholder to boot.

Source: Forbes

The campaign perfectly shows the fintech platform’s irreverent and fun nature, which helps attract casual younger users unused to traditional banking.

The Ukrainian firm Monobank is another fintech app that banks on a unique personality—this time by using a cute cat as a mascot. Seeing this character immediately dispels the notion that finance is boring and sets expectations before users open the app.

Source: UA Retail

While these are inspiring examples, you don’t need to go to these lengths to stand out. Often, it’s just a matter of focusing on your value proposition, which is the biggest benefit users can get from your app.

Why should someone use your loan app from the dozens of other apps in the market? Do you offer good rates or have an easy process? Is it faster to get a loan from your app than others?

If you can communicate these clearly to potential users, then it’s a fantastic way to differentiate your brand.

Engage your audience

Effective fintech marketing is never a passive affair. It’s not enough that you regularly post valuable content or differentiate yourself in the marketplace. You should also recognize the importance of engagingwith your users.

And you know the best place to engage with potential customers? Social media, of course! That’s why social media marketing should always have a place in your fintech marketing efforts.

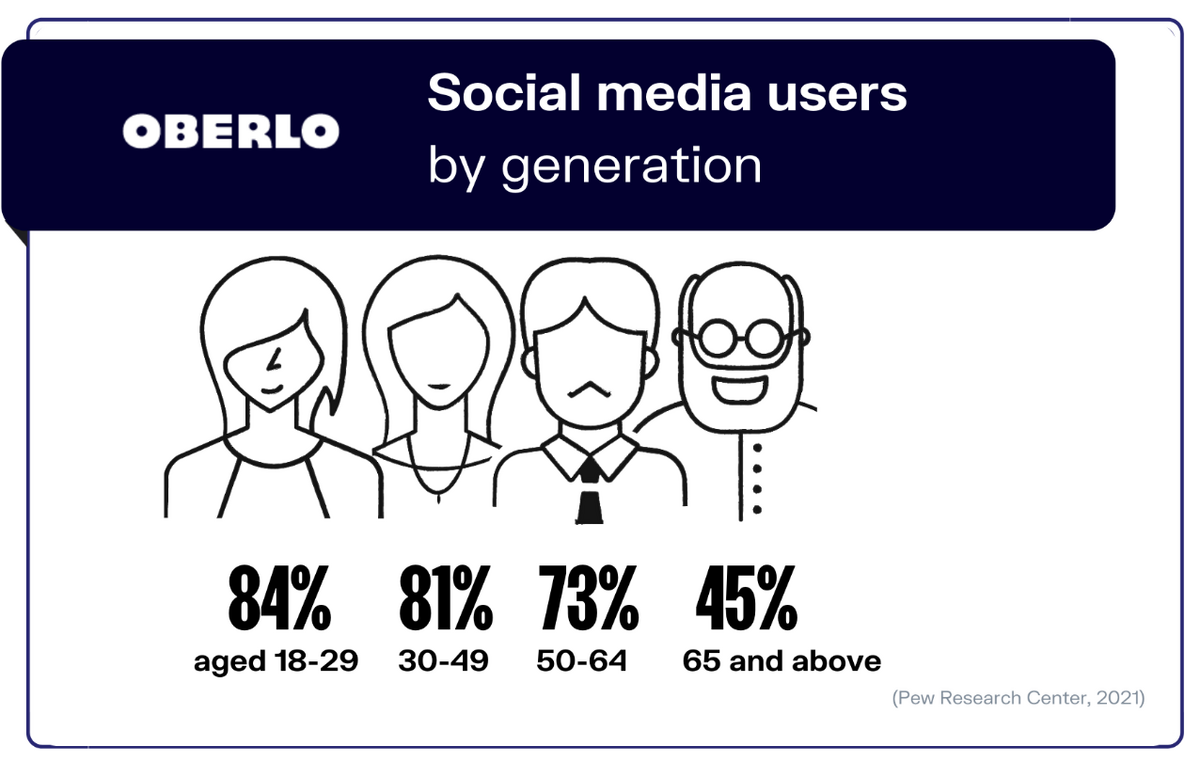

Now, if you think that only millennials are active on social media, think again. A survey shows that people of nearly all ages use social media daily—which means you’ll probably find your ideal users there:

Source: Oberlo

There’s no shortage of social media engagement tactics you can do. As always, we’ll give you some examples for inspiration.

One of the key social media strategies is authentic communication with users, which Curve excels at.

Their Twitter account is a platform for truly talking with their customers instead of pushing products and services. And they take the time to reply to comments.

Source: Curve

Another take on authenticity is the neobank Cleo. A quick visit to their website will immediately show the quirky personality of the fintech app. But it’s most apparent when you interact with their Instagram chatbot.

The Cleo chatbot mixes helpfulness with a little humor and irreverence. It might be offensive to some, but for the right people—their customers—it’s highly appreciated.

Source: Mint Studios

However, like with anything else in marketing, social media can be a challenge. Don’t think for a second that it’s enough to just post things, and it’ll all work out. An effective strategy, careful attention, and time investment are crucial.

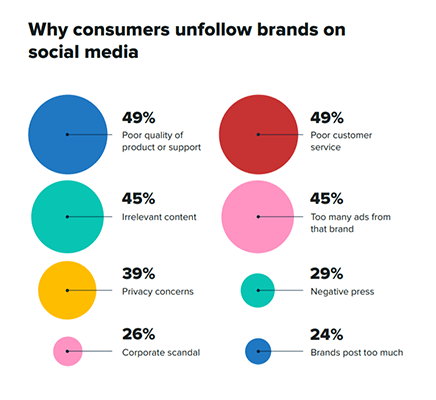

Just look at the reason why people unfollow brands on social media.

Source: Startup Bonsai

Notice that the top reason is poor customer service. That’s just the consequence of ineffective customer engagement.

So if your social media marketing isn’t up to par, or you’re losing followers left and right, poor customer service might be to blame. So let’s talk about that next.

Build outstanding customer service

It’s no secret that customer service is the bedrock of any company, especially in the financial services industry. Unfortunately, many banks are lacking in this area. That’s the reason why challenger banks exist in the first place.

Indeed, plenty of studies and statistics support this fact.

Source: Finances Online

On the flip side, prioritizing customer service will do wonders for your brand.

Not only is it great for keeping existing customers, but it can also boost your word-of-mouth marketing.

And in the world of digital advertising, word of mouth is considered by 64% of marketers as the most effective form of marketing.

Even if your app falls short, amazing customer service can save the day. Surveys show that 61% of consumers say that customer service can make them do business with a brand again, despite a previous bad experience.

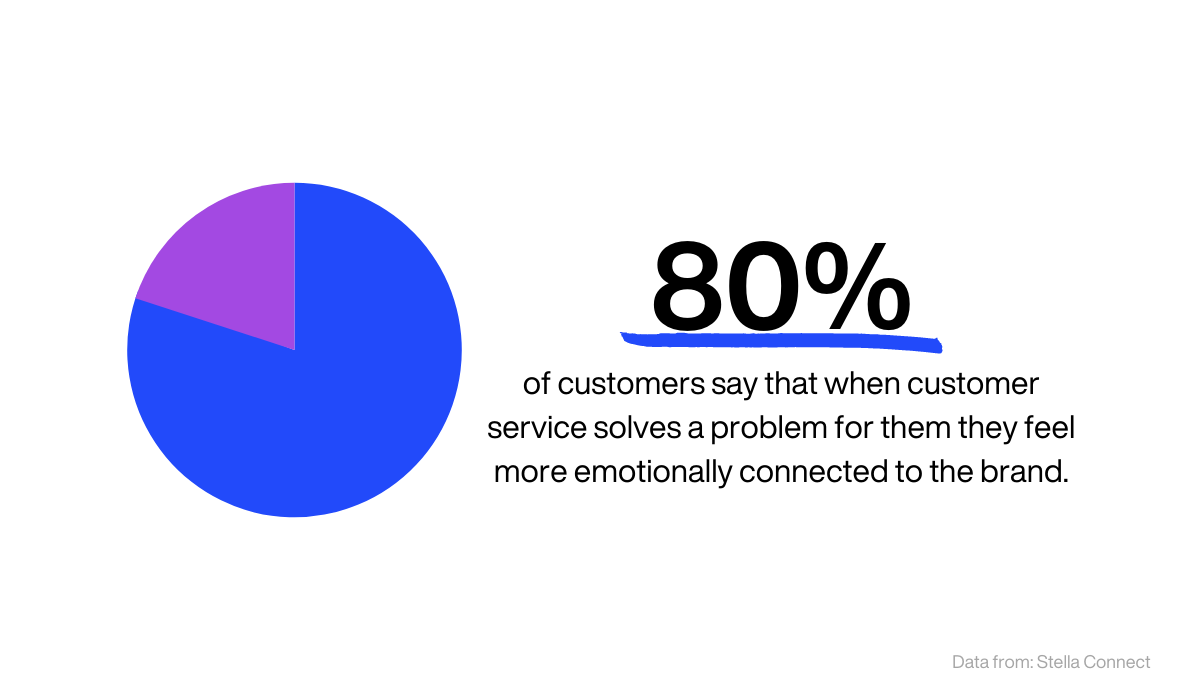

Not only that, but having their problem solved can actually make them feel emotionally connected to the brand.

Source: DECODE

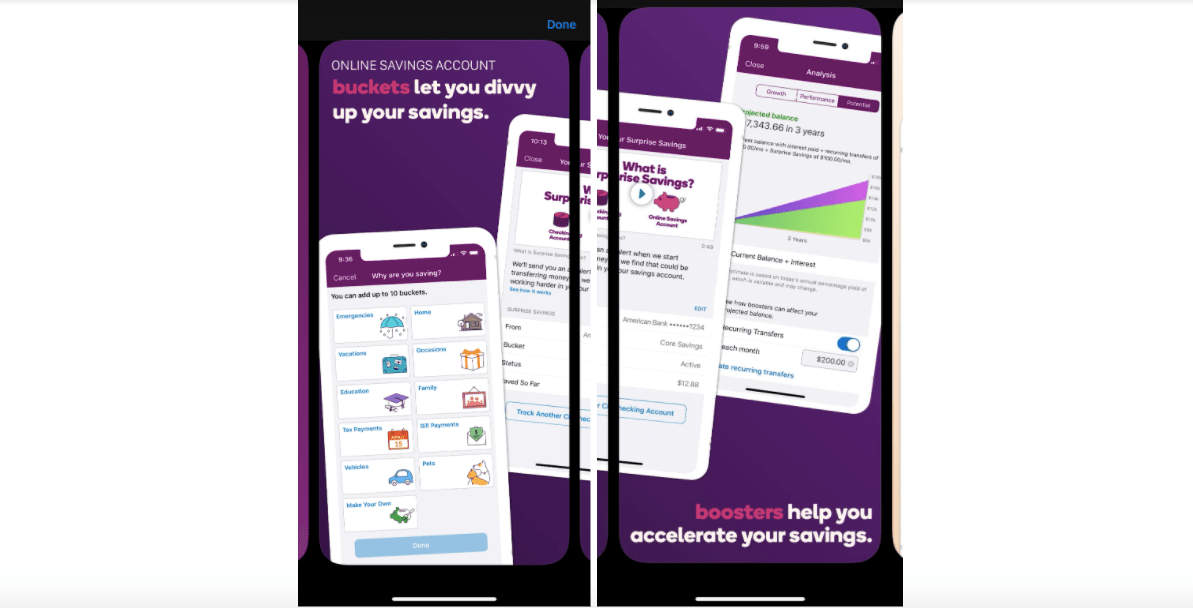

Some brands even go one step beyond and reach out to customers to find out their pain points, then use this data to craft features that address them.

This is what Ally Bank did. Its Ally Bank Lab team regularly sends representatives to talk with customers and gather insights. This data was then used to develop new app features, such as Buckets and Boosters.

This was a winning strategy as it helped users effectively solve their problems. At the same time, it also made product development easier and less risky for the developer because they were certain these features were something their users were interested in.

Source: Clever Tap

The bottom line is that customer service isn’t just a feature you add to your app. It’s the foundation of your app’s success.

Create smarter ad campaigns

The last element of any fintech marketing campaign is online advertising. This involves running ads on Facebook, Google, YouTube, and other relevant platforms.

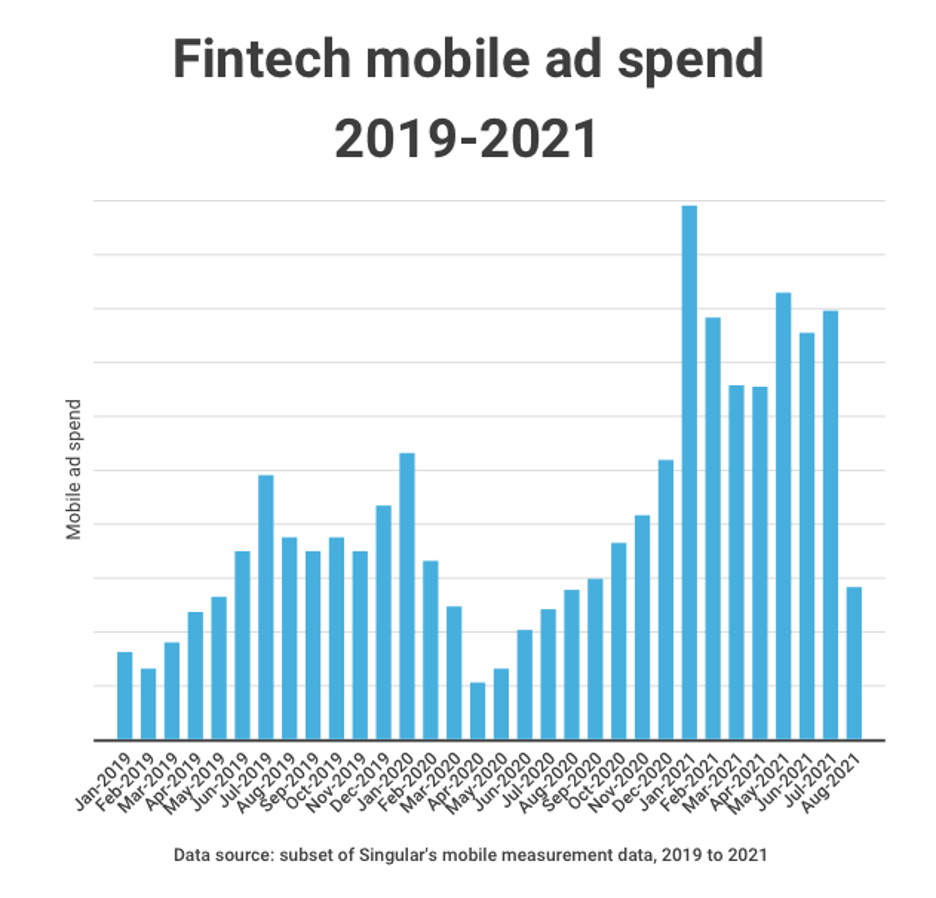

It turns out, however, that fintech advertising is a relatively new trend. Before 2019, ad spending within the fintech industry was generally low. But that all changed when the pandemic hit, and fintech adoption soared:

Source: Singular

As more people favored contactless payments and digital banking, the race to acquire customers intensified. This fueled a surge in fintech ad spending, which peaked at $24 billion in 2021.

There’s no question about it: to compete in today’s fintech market, you need to up your advertising game.

However, it’s not as simple as putting together some visuals and a headline copy and cranking ads on Facebook. You need proper budgeting, detailed targeting, and the right keywords to be successful.

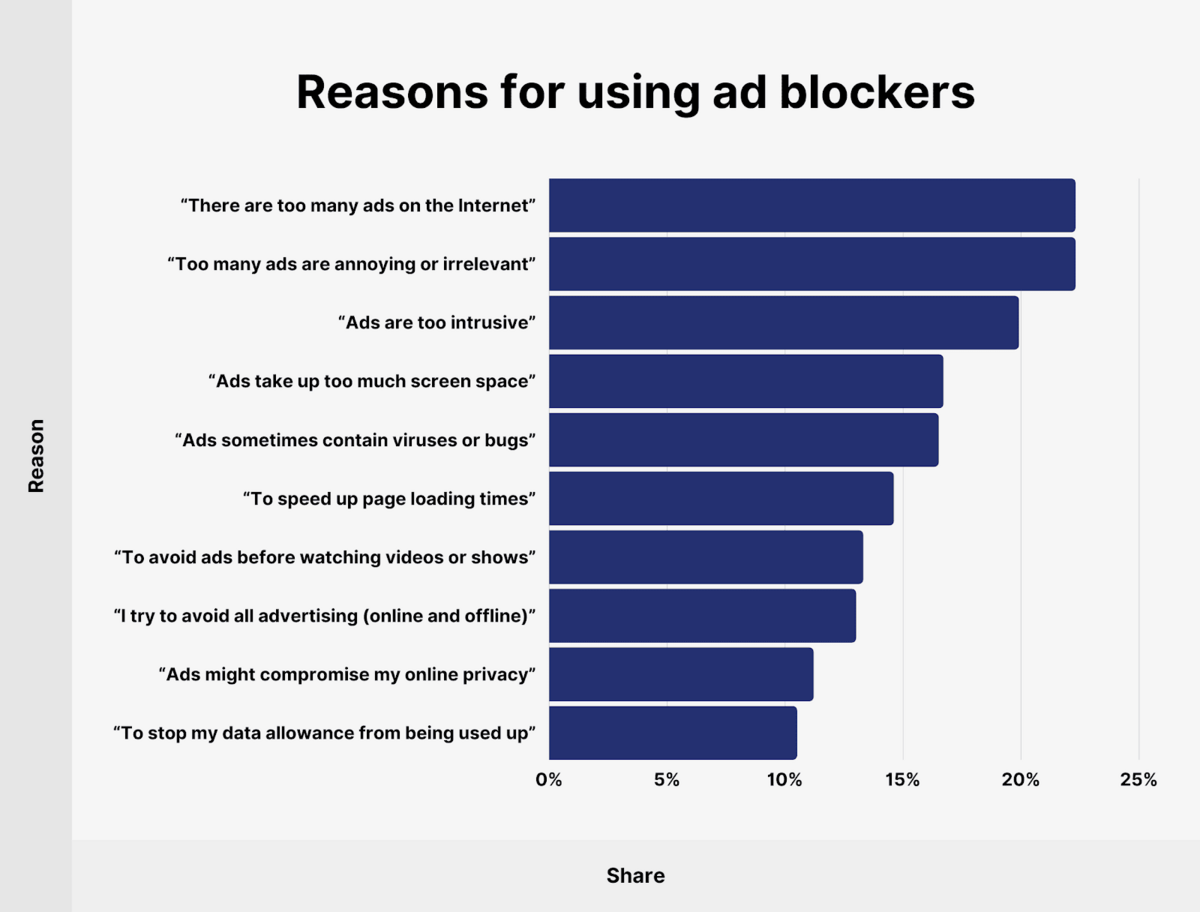

There’s also the right way to advertise, and it’s often a case of what notto do. For instance, take a look at this survey by Backlinko. It lists down the top reasons why people use ad blockers.

Source: Backlinko

These are great insights, but how do you make them useful to yourself?

First, implement ethical advertising practices, like Omar Jenblat or BusySeed. That means avoiding pop-up ads and doing away with scammy practices like clickbait headlines. When you run an ad and promise something there, make sure you deliver on that.

It also helps to refine your keywords so that you’re only targeting interested users. This increases the chance of targeting only people receptive to your advertising.

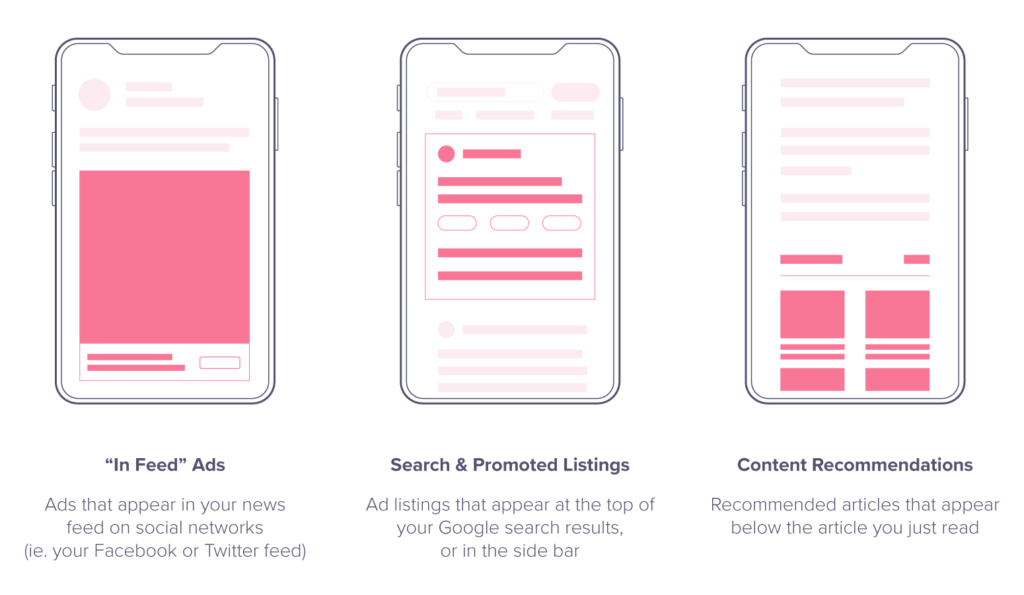

You should also try to use native ads. These are ads that match the form and appearance of the environment it’s in. For example, a video ad that runs in between YouTube videos is a native ad.

Source: Match 2 One

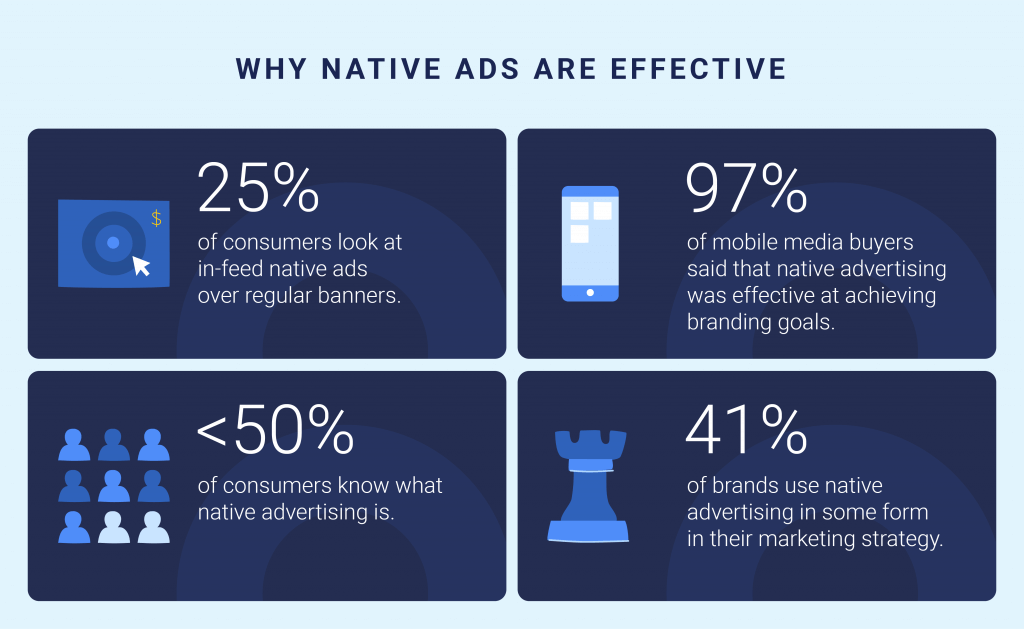

Native ads are great for ensuring that the ad is seamlessly incorporated with the content the person is watching, making it less intrusive. Indeed, many metrics point to the effectiveness of native ads. Here are some of them:

Source: SimilarWeb

This is just scratching the surface of the many advertising strategies fintech developers must know. In any case, the key to success is to focus on a positive user experience—as with every part of your fintech marketing strategy.

Marketing starts with a great app

There’s one truth many people forget. Marketing only amplifies your app’s good points. It cannot cover poor app features or the wrong market fit.

So your marketing strategy should begin even before you roll out your app. Being rigorous with your market research to refine your app idea can pave the way for successful marketing campaigns later on.

And if you need help with refining and implementing your app idea, DECODE is here for you! So contact us today, and let’s talk.