How do you create a digital banking app that stands out on the market? Here are the steps to take to build a top-notch digital banking app.

7 Essential fintech app types you need to know

Saying you’re developing a Fintech app is like telling someone you’re creating marketing software.

“What kind exactly?” is the most probable question you’ll get.

That’s because Fintech has evolved into a mammoth field, with lots of sub-niches and trends. And it’s set to super-niche further, creating even more categories.

So, if you’re looking for the next big Fintech app idea, you’ll have plenty to choose from. But then again, it’s that variety of options that can be overwhelming.

If that’s the case with you, remember that you can always rely on the basics. So, here are the seven essential Fintech app types you need to know.

Table of Contents

Loan Apps

Loan apps facilitate the lending process by connecting the lender and the borrower directly. The platforms manage everything from the application process to loan payments.

What’s innovative about loan apps is that they’re not limited to just banks and credit unions. Some apps also support peer-to-peer (P2P) lending, which allows an individual to lend money and earn interest.

How P2P lending works?

Source: Finextra.com

The way P2P loan apps work is simple. It all starts with a user registering for an account. Often, they need to qualify for one, either by showing proof of income or having a minimum credit score.

Once the borrower has an account, they can submit a loan application to the app platform.

Then, using a different version of the app, lenders browse through the submitted applications and select the ones they want to approve. In some cases, the lender can get in touch with the borrower directly to negotiate the interest rate and other loan terms.

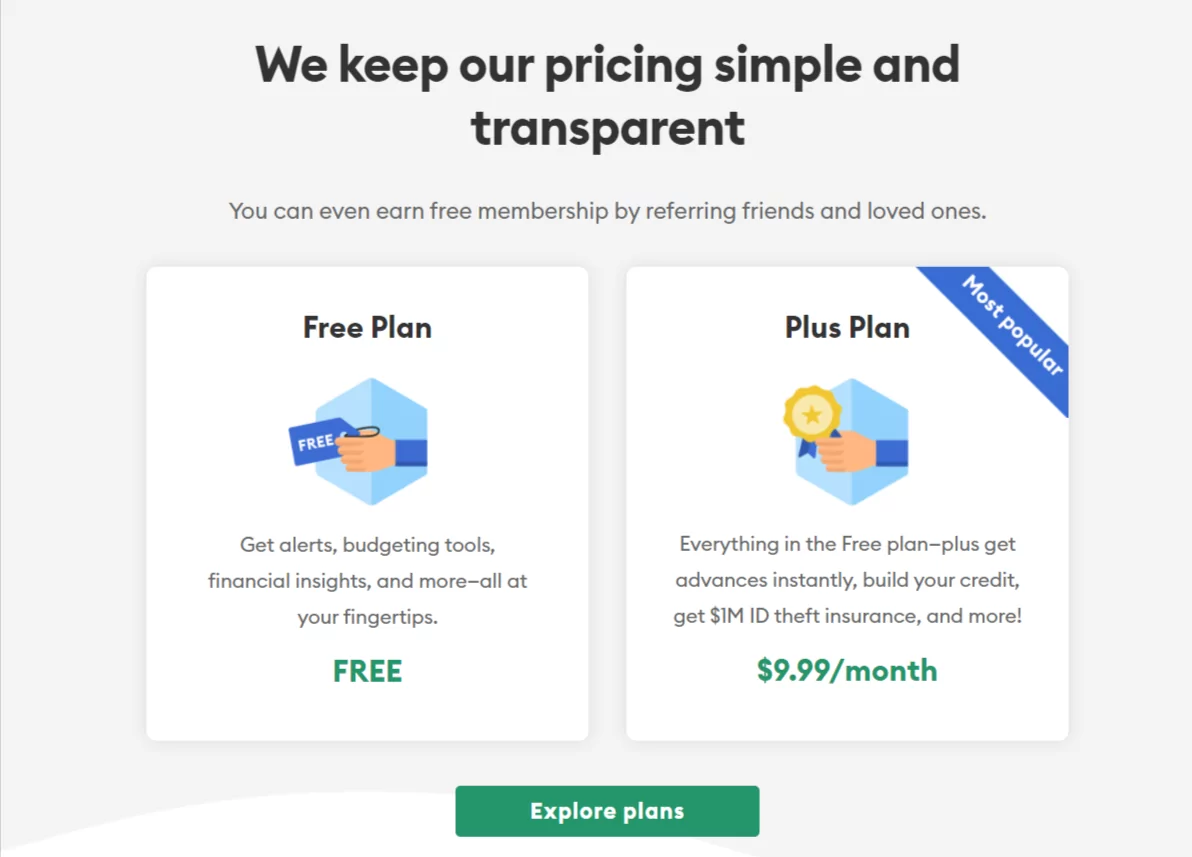

After a loan is approved, the app enforces it to ensure that the borrower pays the lender regularly. In return, the platform takes a percentage of the loan as a fee. Some apps, like Brigit, charge a membership fee instead.

Source: Brigit

Whether P2P or from financial institutions, loan apps are beneficial because they can radically improve the experience for borrowers and lenders.

For example, instead of waiting several days for approval, you can get a loan from loan apps in as little as 24 hours. Thus, these platforms can be a reliable source of emergency cash for short-term needs.

Approvals are also much fairer to the borrower, thanks to big data. Loan apps use a person’s bank balance, monthly bills, credit rating, and other financial information to more accurately gauge their creditworthiness. This not only speeds up the approval process but can also grant lower interest rates.

We’re fintech app developers →

Major businesses trust us to handle their mobile banking solutions, and we help agile startups disrupt mobile payments, stock trading and the rest of the rapidly evolving sector.

Loan apps can make the loan process more secure for lenders as well. Plus, P2P lending opens up an investment opportunity for individuals in a less risky way.

Various loan apps are available in the market, from general lending platforms to those that offer more niche services.

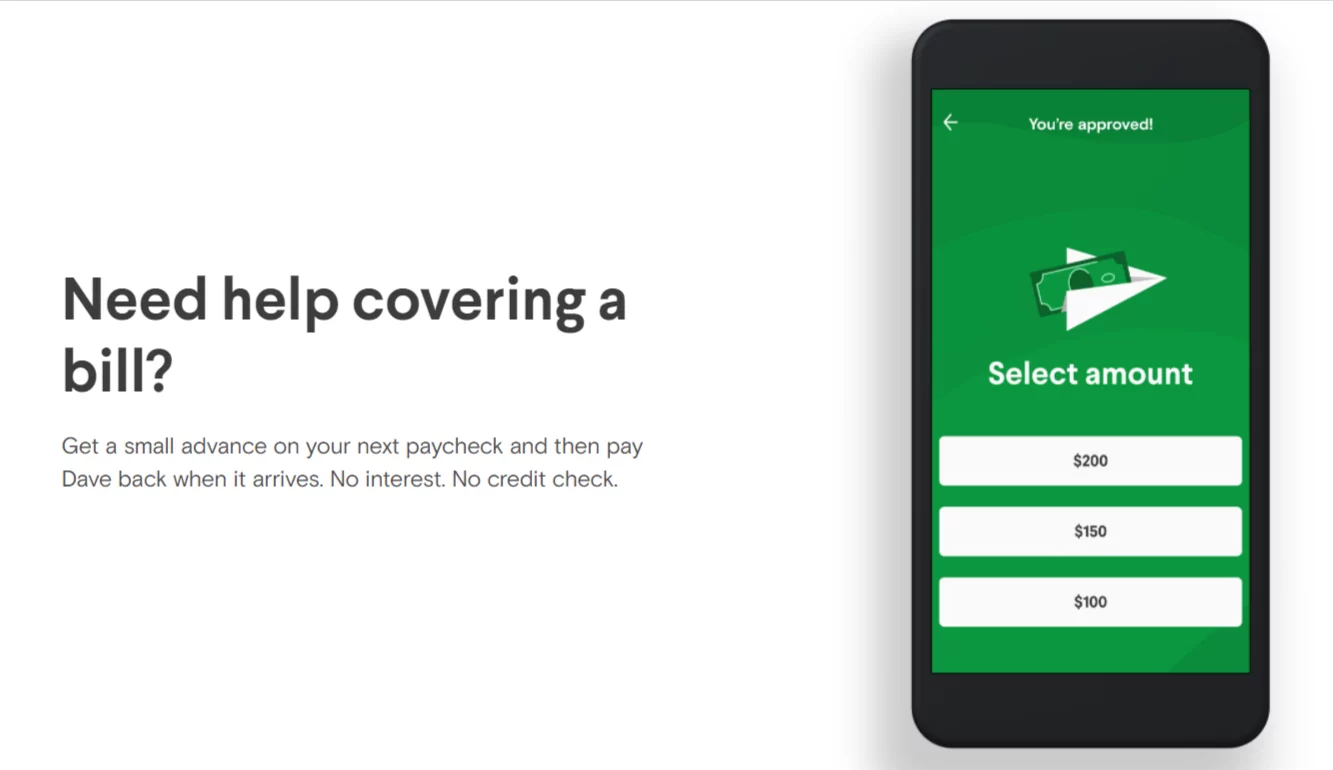

For example, Dave is an app that specializes in small-scale lending, offering only a maximum $200 loan amount.

Source: Dave

Their intended market consists of people who need to pay bills or pay for groceries while waiting for their paycheck.

On the other hand, MoneyLion is a more comprehensive platform that offers various loans, investments, and other financial products.

In short, the Fintech market caters to a wide range of financial needs, and developers can choose which area to focus on.

Some Tips for Developing Loan Apps

Loan apps typically need two app interfaces: one for the borrower and another for the lender, with different sets of features for each.

Lenders

| Need a place to manage all of their loan investments. |

Borrowers |

| Need payment reminders and multiple payment options. |

Know Your Customer (KYC) is particularly important with lending apps, so make sure you focus on that during development.

Source: DECODE

Also, make sure it’s complying with data and AML regulations in your country.

APIs are critical to speed up loan app development, especially with identity verification and KYC. For example, you can use the Plaid API to integrate with banks securely without writing the code yourself.

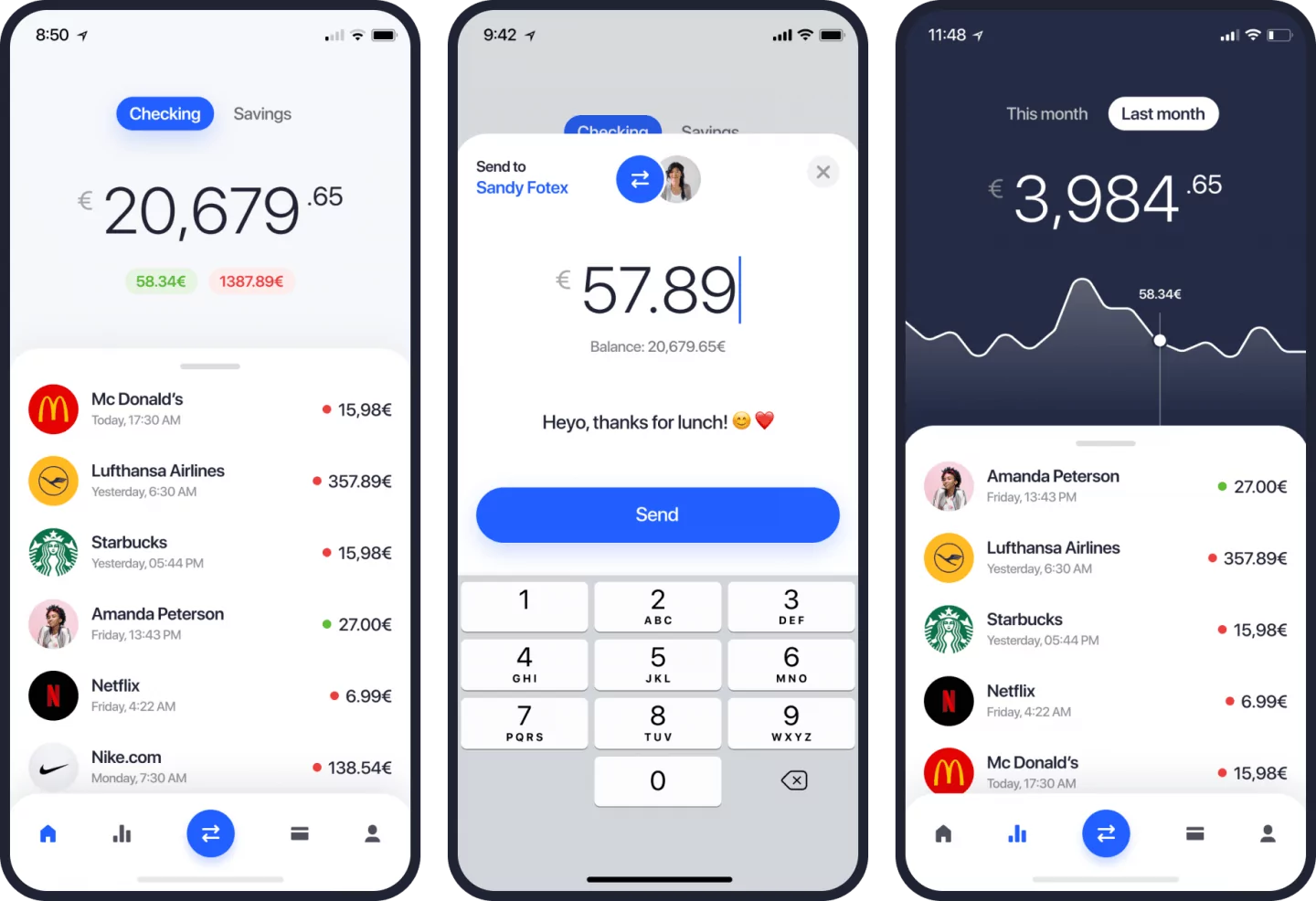

Digital Banking Apps

Digital banking apps allow clients to manage their accounts and access financial services without going to a brick-and-mortar branch. It encompasses both mobile and online banking to provide banking services anytime and anywhere.

A digital banking app offers services that typically cover everything a person can get in a physical bank, which includes:

- opening an account

- checking the balance

- transferring funds

- making payments

- taking out a loan

Their main benefit is that they allow the transparency and convenience of 24/7 access to your money.

These apps also help you stay on top of your money. For example, app notifications can let you know when your paycheck is in so that you can pay your bills. Indeed, you don’t even need to do this manually, as most banking apps enable you to set up automatic payments.

On a broader note, digital banking apps also contribute to greater financial inclusion. That makes them a valuable tool to serve the estimated 1.7 billion unbanked individuals worldwide, since opening an online banking account is easier with fewer requirements.

Today, most digital banking apps are separated into two camps: standalone digital-only banks and the ones developed for the incumbent institutions, i.e., the big banks.

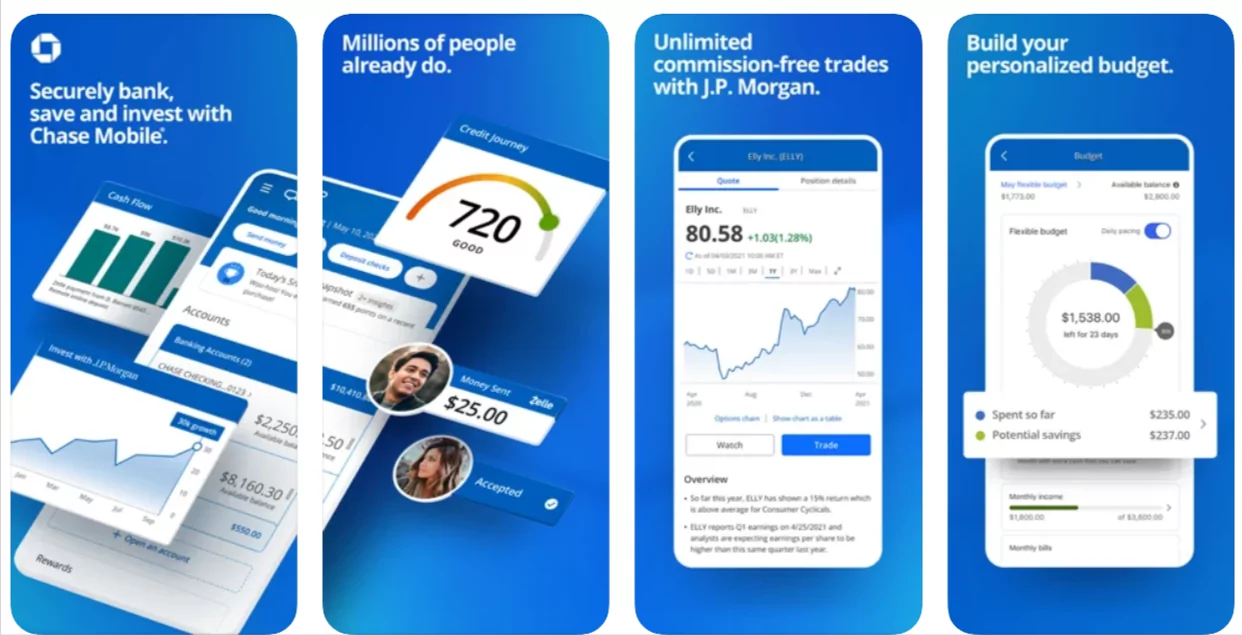

An excellent example of a platform that belongs to the latter is the Chase app.

Source: App store

Aside from the usual functions like sending money or managing your account, it also allows you to track your credit score and automatically deposit money into separate funds.

As for the neobanks, there are plenty of great examples, such as Revolut and Chime.

DECODE also recently contributed to the digital banking space with a joint app project with Asseco SEE. You can check out our case study of it here.

Some Tips for Developing Digital Banking Apps

One of the most sought-after features of any digital banking app is the check deposit feature.

Users can cash in their checks by taking a photo with the app, eliminating the need to visit a physical branch. You can easily incorporate this feature with APIs such as Mitek Mobile Deposit and Ingo Money APIs.

As with any Fintech app, security is critical, but more so with digital banking apps. Make sure to have robust security like biometrics and two-factor authentication (2FA).

Source: DECODE

Likewise, customer data protection and handling are paramount, especially if you operate in the E.U., where you need to comply with GDPR.

Moreover, despite the convenience of mobile banking apps, some customers still want the experience of talking to a human teller. You can achieve this by incorporating chatbots to make interacting with your app feel more natural.

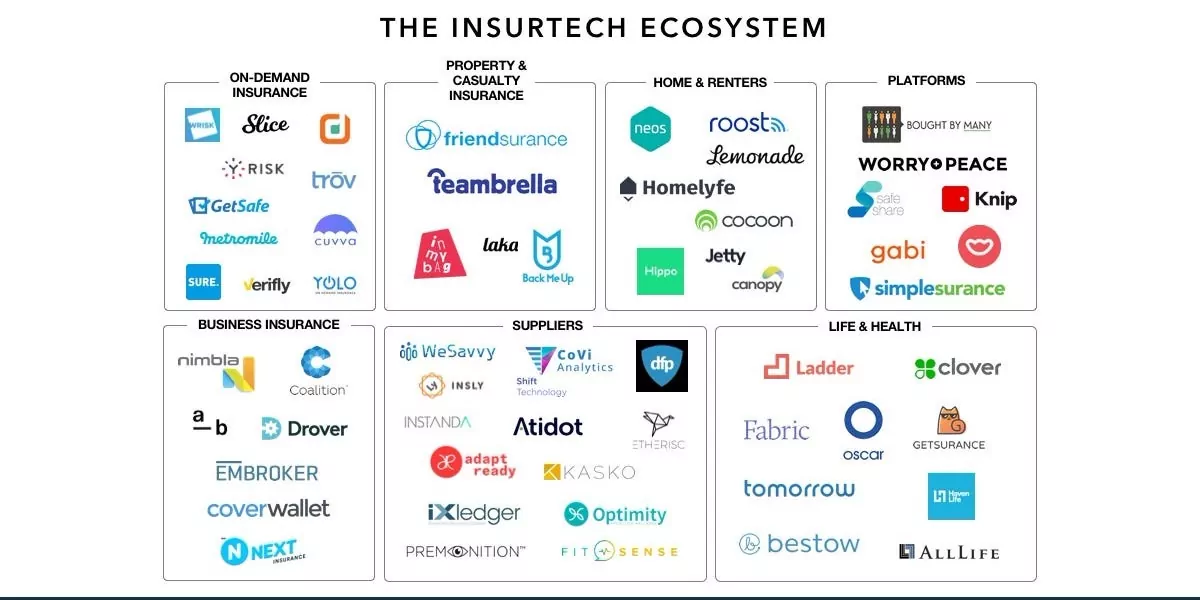

Insurance (Insurtech) Apps

Insurance technology (Insurtech) apps help enhance the insurance industry by providing more accurate ways to assess risk. It also benefits policyholders by giving them a faster way to apply for coverage or process claims.

There are many implementations of insurtech apps for covering every type, from property to car insurance. While most are for people who want to manage and make claims, some apps also help insurance agents to make on-site risk assessments and close deals better.

However, the scope of Insurtech goes beyond just apps. It also uses IoT devices, smart wearables, vehicle telematics, drones, and A.I. to better gauge a person’s lifestyle and risk profile.

Despite insurtech being a relatively new niche, it’s a rapidly growing one. Its market size was estimated at $2.72 billion in 2020, where four of its IPOs were the biggest during that year.

Source: businessinsider.com

The most significant impact of insurtech is that it makes getting coverage more accessible for many people. Anyone knows that applying for insurance used to be a tedious, even annoying, experience. You typically had to deal with persistent sales agents who might not have your best interest at heart.

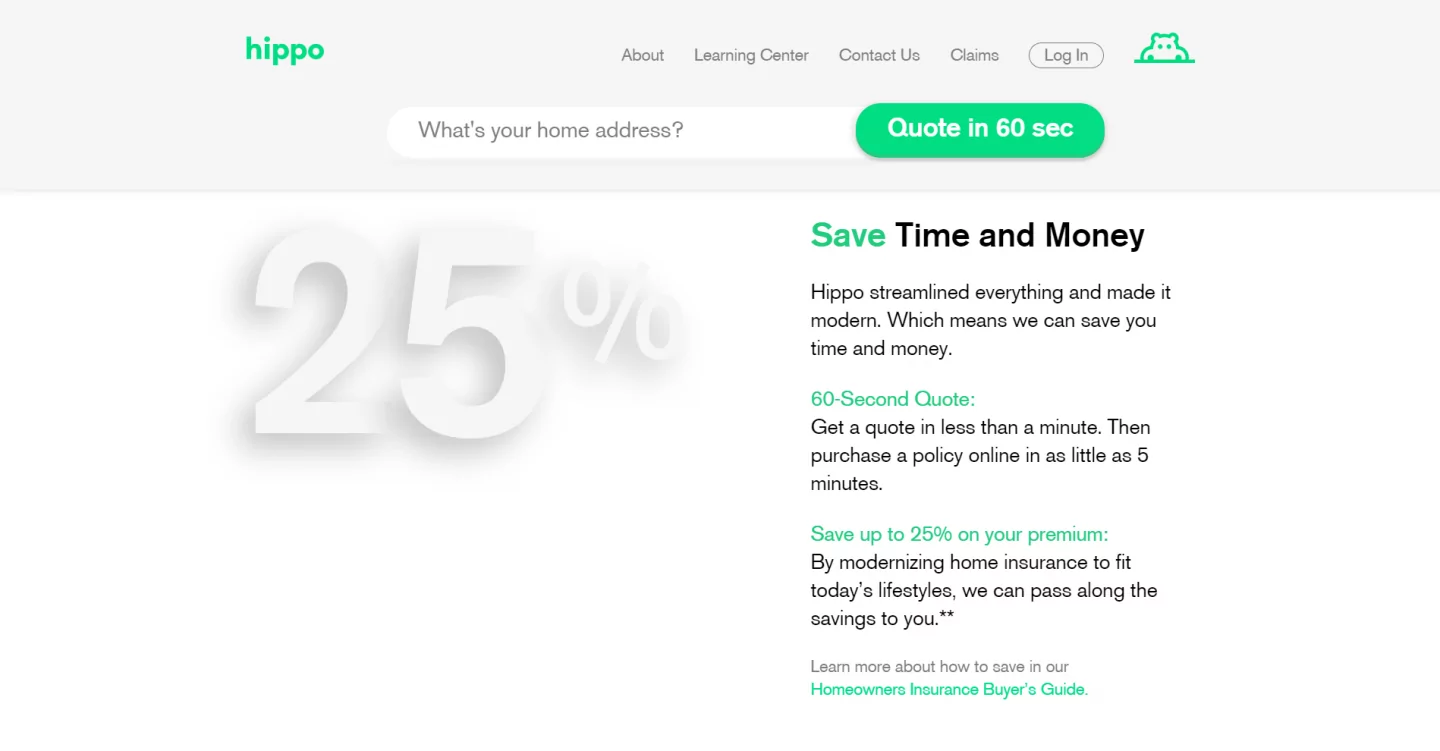

But with insurtech, you get to skip all of that. Instead, you can do your research, shop for the best options online, and get quotes instantly. One good example is Hippo, a home insurance app that provides quotes online that are 25% cheaper than average in under 60 seconds.

Source: Hippo

Insurtech apps also use big data and A.I. to assess a person’s risk profile based on their financial and personal information more accurately.

For example, automobile insurance firms can implement usage-based insurance (UBI).

This approach gathers real-time vehicle data through telematics to better gauge driving habits. As a result, it rewards safer, less risky drivers with lower car insurance premiums while helping reduce compensation payouts for insurance companies.

Insurtech even makes claims processing easier. For instance, a driver who gets into a car accident only needs to take a photo of the scene to process claims via a smartphone. Lemonade, one of the top insurtech apps, does this using a combination of A.I. and chatbots.

Some Tips for Developing Insurtech Apps

It’s essential to focus on a specific insurance type for your insurtech app since the features for each will be radically different. Car insurance, for example, needs vehicle telematics data, while life insurance apps would need access to a person’s medical data.

Because of the potentially numerous features of an insurtech app, it’s best to use APIs and SDKs to ease development. For instance, you can use DocuSign for digital signatures, Google Maps for geolocation, and Apple Health for accessing health data.

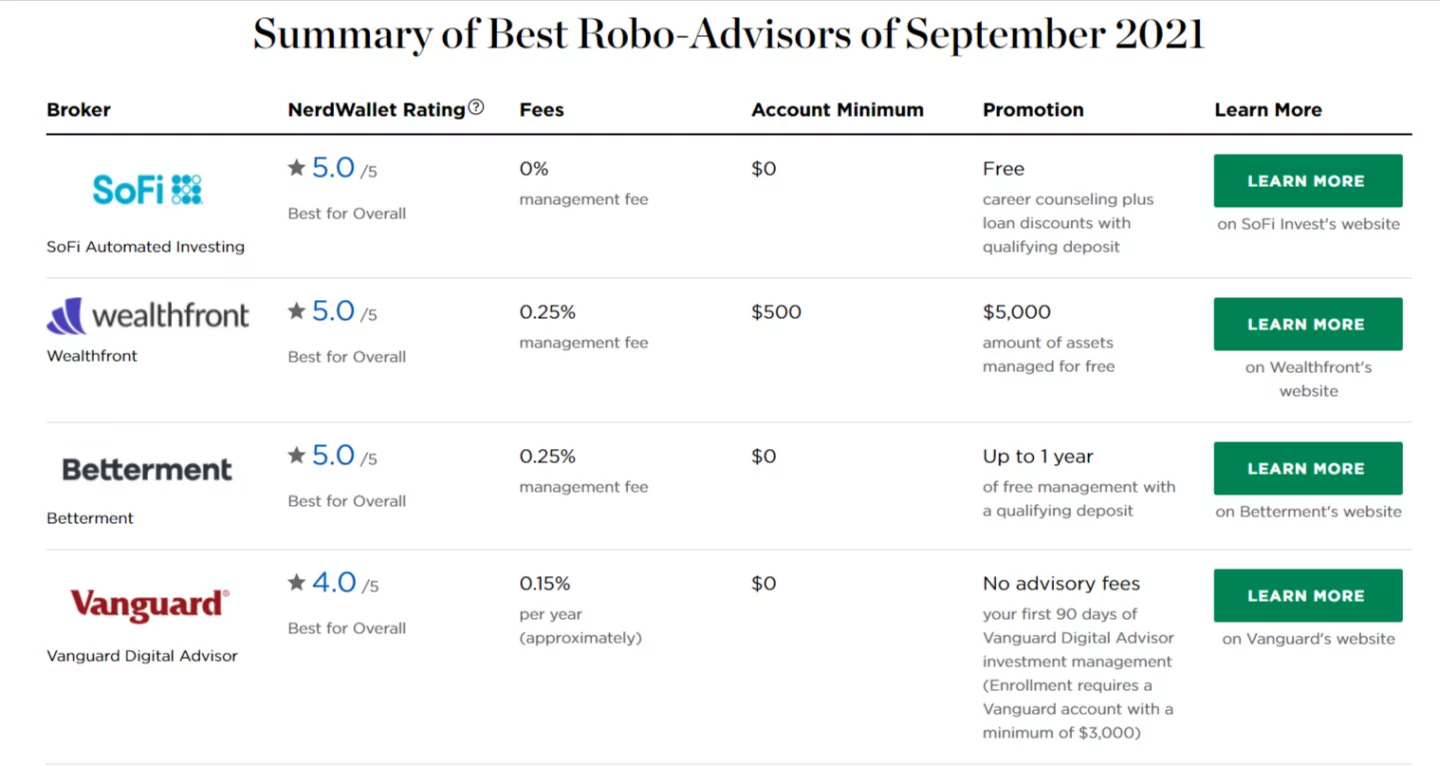

Investment Apps and Robo-Advisors

Investment apps are digital platforms that “democratize” investing by making it accessible to everyone, and not just the wealthy. It eliminates intermediaries, lowers commissions, and makes it easy to place trades with a few taps.

Robo-advisors take this idea one step further by providing an automated broker to manage your portfolio and make trades on your behalf. They use A.I. and machine learning to assess your financial standing and risk profile.

With this knowledge, the app can suggest possible investment options or automatically invest some of the user’s funds.

Nowadays, there are many investment app options for people who want to get into the investing game.

This ranges from beginner-friendly platforms like SoFI to apps geared towards active, experienced traders like T.D. Ameritrade.

Source: Nerdwallet

Lower costs and minimum balance requirements are the main benefits of investment apps. One of the most popular apps to date, Robinhood, even touts commission-free investing.

Source: Facebook

This setup is possible because everything is automated and digital, which means that it requires fewer resources.

Digital investment apps also allow the possibility of dealing with alternative assets such as cryptocurrencies and commodities. Moreover, because they operate in the digital sphere, they give you the possibility to access any market in the world 24/7.

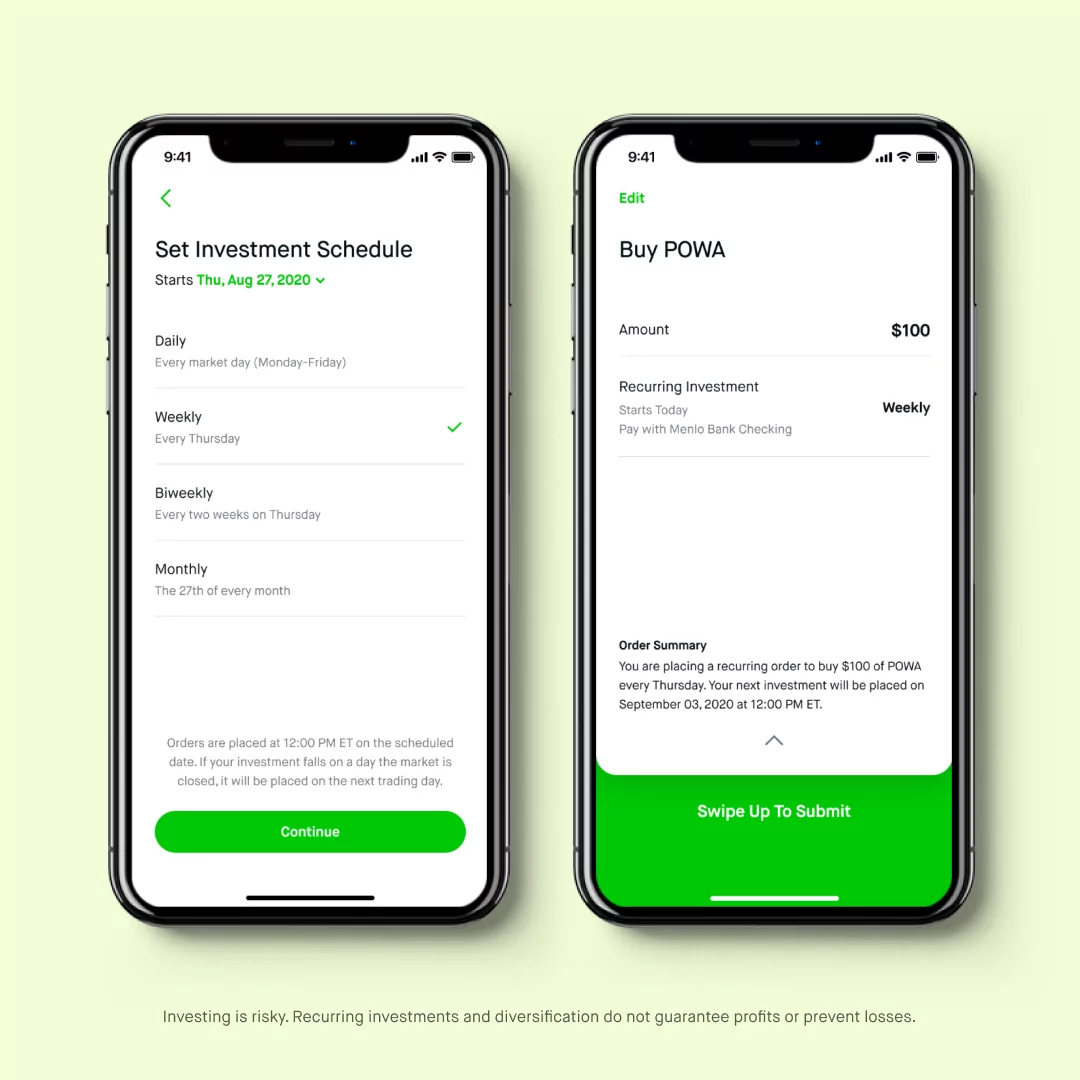

The automated trades of robo-advisors can help newbie traders get into the stock market, and even profit from it. And for aspiring investors, it can be a fantastic learning opportunity without having to risk a whole lot of money.

Some Tips for Developing Investment and Robo-Advisor Apps

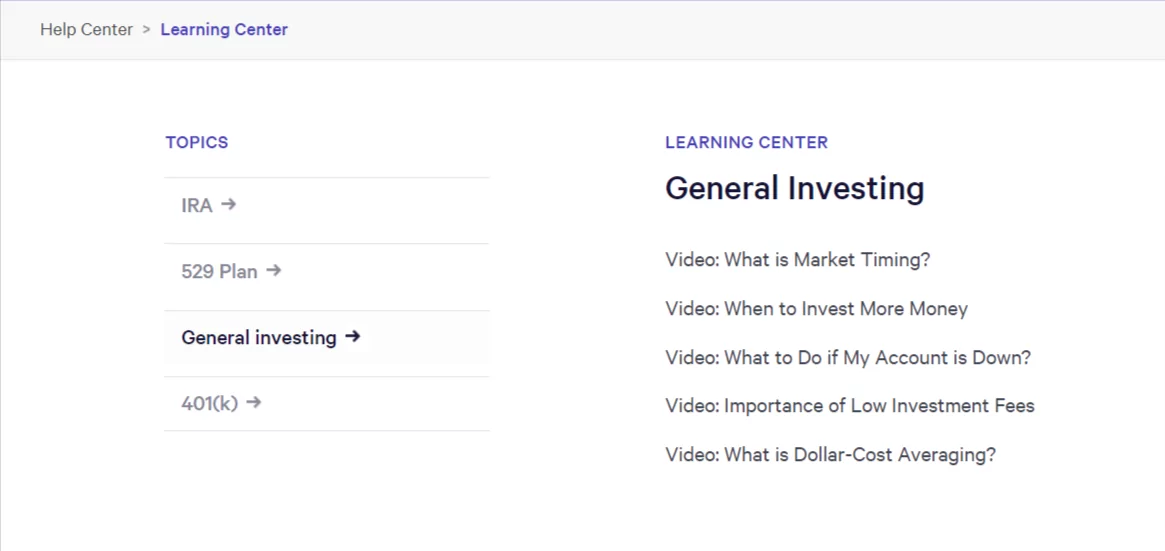

Educating the users is arguably one of the most critical aspects of creating an investment app. Investing is inherently risky, especially for beginners. Thus, it’s crucial to arm users with the knowledge to make sound investment decisions.

You can educate users with video tutorials and helpful articles like Wealthfront does with their learning center.

Source: Wealthfront

But one particularly effective feature is paper trading, where users can trade with real-market data using pretend money. This allows novice traders to practice concepts and investment techniques before risking their real resources.

A well-thought-out user interface is vital with investment apps. That’s because they tend to be data-heavy, with stock graphs and quotes potentially cluttering the screen. However, the key is to make information easily accessible without overwhelming people.

Source: Pexels.com

Lastly, always have safeguards in place to help users limit risk. Start by implementing screening questions to assess a person’s risk appetite so that the app can assign appropriate features.

Then, make liberal use of notifications and warnings to alert people of the risks before making every trade.

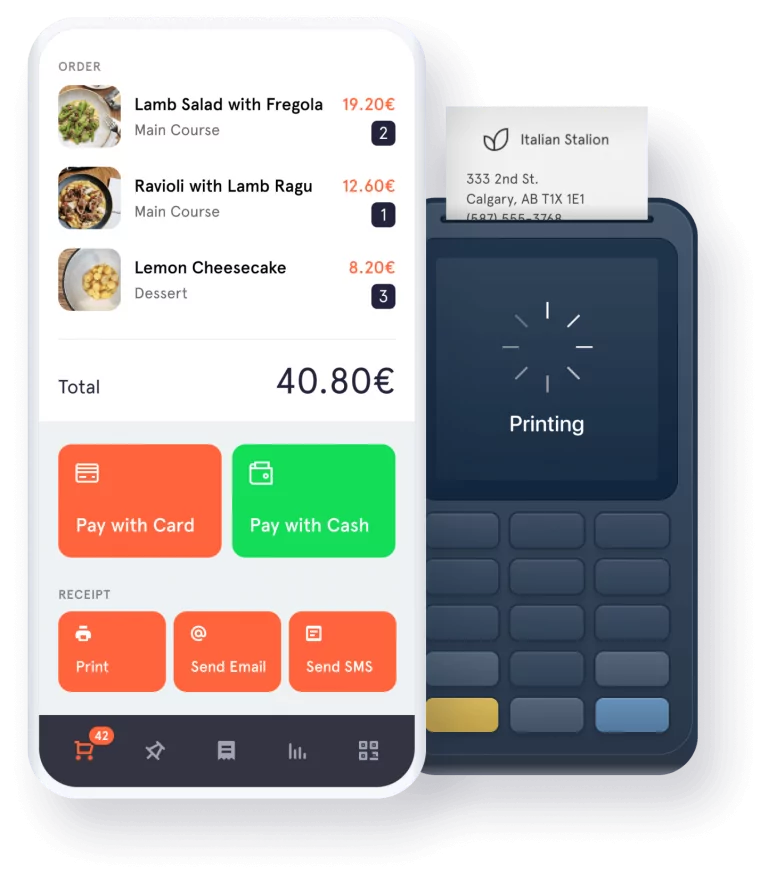

Payment Processing Apps

Payment processing apps handle all payment transactions on a company’s behalf. They take on the role of the middleman that connects credit card companies with a customer’s card information.

The handy graphic below explains where payment processing fits in a typical eCommerce ecosystem.

Source: NCR.com

Payment processing apps make financial services more accessible to everyone. In this case, they open up the opportunity to offer credit card and online payment transactions to small businesses. In fact, anyone, even individual users, can utilize payment processors to accept money from anyone else.

A reputable payment processor is crucial for any online business. Aside from enabling the instant transfer of funds from buyer to seller, it also provides multiple payment options for the customer’s convenience.

Source: DECODE

The value of payment processing apps becomes even more apparent when accepting foreign transactions. It facilitates seamless cross-country money transfers without having to deal with currency exchanges and other headaches.

Paypal is perhaps the most well-known payment processor on the planet, allowing anyone to send money anywhere as long as the recipient has a Paypal account.

Additionally, some providers, like Square, also provide a physical reader that’s helpful for brick-and-mortar stores.

There are also payment processors that specialize in cost-efficient cross-border transactions, such as Wise.

Some Tips for Developing Payment Processing Apps

Transaction speed is the name of the game with payment processing apps, so you need to make it a top priority during app development. Thus, app load time and app latency are essential metrics to optimize.

Source: DECODE

In payment processing apps, you should go beyond the usual security standards. In particular, users should authorize every transaction before it goes through to prevent credit card fraud. Having other fraud prevention techniques is also beneficial to merchants.

One of the best ways to do this is with a One Time Pin (OTP). Every time a user needs to make a transaction, a temporary PIN is sent to their registered mobile number, which they need to enter to complete the transaction.

Lastly, since you’re processing credit card data, the payment processing app must follow the Payment Card Industry Data Security Standard (PCI DSS). Government agencies require it, and it reduces credit card fraud.

Personal Finance Management Apps

Helping people manage their money better is one of the critical benefits of Fintech. Nowhere is this more apparent than with personal finance management apps.

Think of these apps as automated financial advisors. To start, a person simply needs to set a financial goal and connect their various bank accounts to the app.

The genius of personal finance management apps is that they centralize all your financial information in one location.

That simple act makes it easier to manage your finances and track your spending habits.

Source: DECODE

It can also reveal trends and opportunities that would be hard to see otherwise.

For instance, a personal finance management app can detect where you spend the most money based on your daily transactions, then suggest ways to save up. It can also tell you how much spending you need to cut back on if you want to pay off your debt by a specific date.

However, the app’s greatest benefit is that it forces the habit of saving and making sound financial decisions, which is exceptionally challenging without assistance.

It’s no wonder that personal finance management apps are extremely popular, with around 63% of smartphone users having one on their devices.

Interested in this Fintech niche? Here are some examples of personal finance management apps already out in the market for inspiration.

Mint is arguably the most well-known and comprehensive app for general management tasks.

Source: mint.inuit.com

Some apps also specialize in budgeting for debt payoff, such as the You Need a Budget app with its “Four Rules” method.

There’s even an app for the management of shared expenses called Spendee with its shared wallet feature.

With such a wide variety of options, all it takes is a little research to decide what kind of product to develop.

Some Tips for Developing Personal Finance Management Apps

Personalization is key to making personal finance management apps work, and it all starts with proper onboarding. This process enables you to gather personal information and bank details to customize the app to the user.

But more importantly, effective onboarding trains the user to check on the app often because consistency is vital with personal finance. This practice can be further encouraged with timely notifications and reminders.

Source: DECODE

You should also include features that make it easy to input transactions and expenses. Apart from manual entry, your app should also allow receipt scanning to make recording bulk expenses easy.

Finally, as personal finance apps act as the hub of a person’s financial life, integrating with banks, financial institutions, and other Fintech apps is required. Again, using APIs like Plaid is useful here to speed up development.

Tax Filing and Management Apps

Taxes are often one of the most complicated aspects of finances that the average citizen needs to handle. There are nuances, rules, and fine print that are hard to understand for a layperson, increasing the chances of error.

Indeed, the U.S. Internal Revenue Service paid more than $736.2 billion worth of tax refunds in 2020, settled to taxpayers that overpaid their taxes.

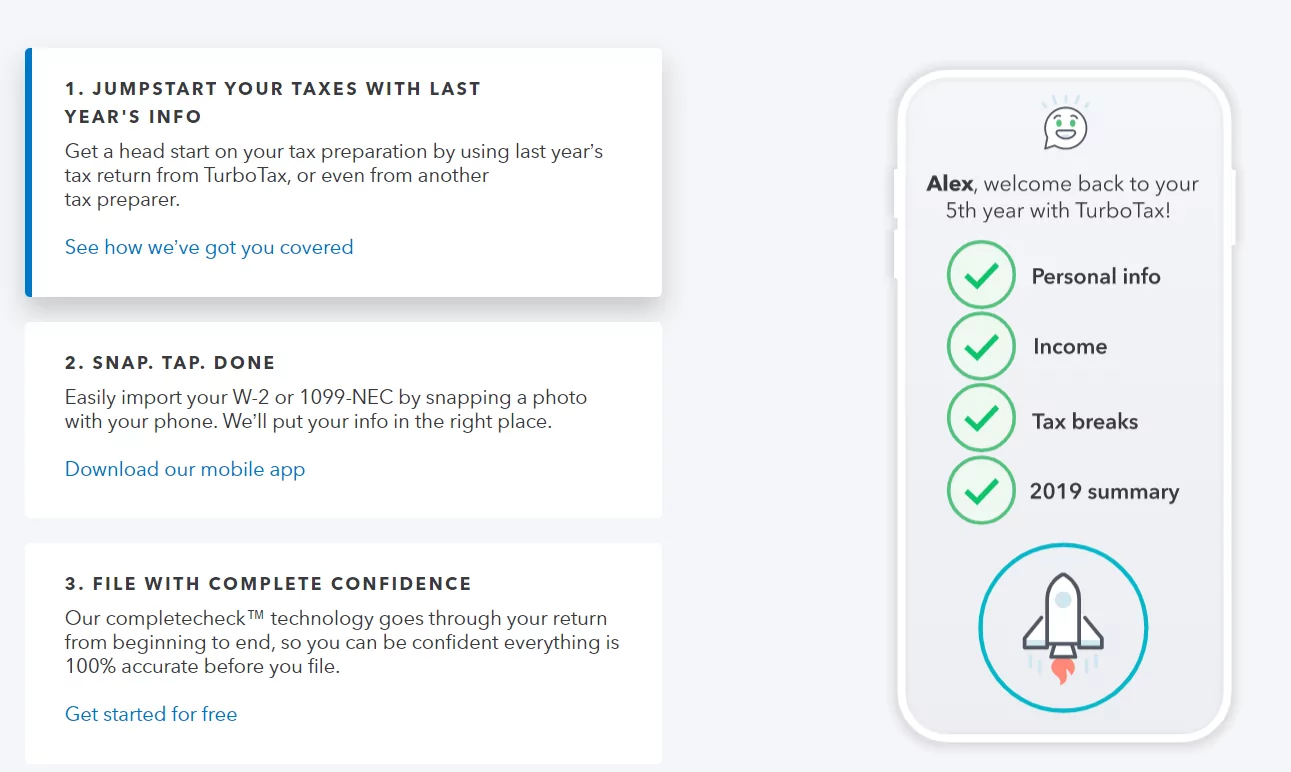

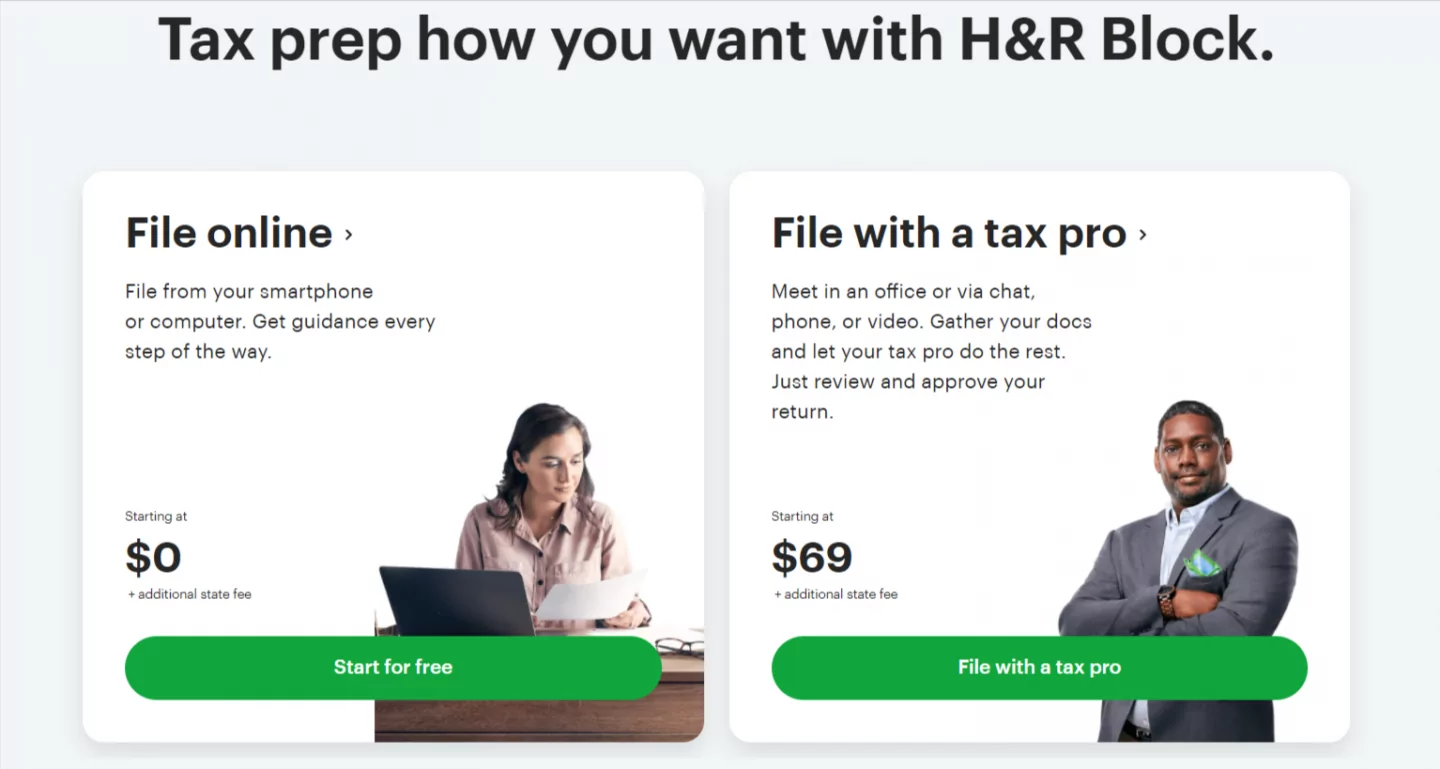

Tax management software isn’t new; in fact, it’s been around for years with pioneers like Intuit Turbotax and H&R Block. Some platforms like Credit Karma Tax even offer the service for free, albeit with reduced live support.

The complexity of the tax system is the reason why tax filing and management apps are so valuable. They greatly simplify the preparation, filing, and management process for individuals and businesses. In addition, you don’t even need to hire an accountant or have the experience to use it.

Instead of filling up forms, most tax apps use a question-based approach to gather relevant information. They then use this data to fill up your tax form automatically.

Example of how Turbotax software works

The app can also advise you of tax mistakes, suggest deductions that you can qualify for, and electronically file the tax return for you.

Users will always need help managing their taxes, making apps that do so one of the potentially most worthwhile niches to get into.

Some Tips for Developing Tax Filing Apps

While tax filing apps are designed to be used independently even by people with no prior experience, not everyone’s tax situation is straightforward.

That’s why enlisting support from a tax expert, in case the user has any questions, using the app is crucial. Look how H&R Block does it.

Source: H&R Block

It’s paramount that you have a CPA or tax expert to consult with during and after app development. That’s because tax laws frequently change; for instance, 2021 alone will introduce up to seven changes to U.S. tax law.

Having a tax consultant ensures you can make timely updates to your app to anticipate these changes.

Fintech Is an Ever-Growing Field

As we mentioned in our intro, countless Fintech niches are popping up every day. The seven Fintech app types that we’ve described here are just the tip of the iceberg.

So, how do you pick which one to go with?

Like any profitable business idea, it all comes down to matching the problem with your solution. Ask yourself, which financial sector is currently underserved and will benefit the most from your app project? That’s an excellent place to start.

And if you need help developing your next big Fintech app idea, get in touch with us. We’ll be happy to lend our Fintech and mobile app expertise to your project!