Gamification is undoubtedly one of the most effective and well-loved app strategies right now. The market was valued at $10.19 million in 2020 and is expected to nearly quadruple to $38.42 million by 2026.

And the reason for this popularity is simple: people of all ages are hardwired to play games.

It’s no surprise that nearly every fintech app, from digital banking to regtech, uses gamification to improve user retention and acquisition.

But while most try, only a handful are truly successful at it.

Here are some of the apps that represent great examples of fintech app gamification.

Fortune City: Building good financial habits

Sometimes, the best gamification approach is the most direct one.

Instead of adding game elements to a financial app, why not just turn the entire app into a game?

This is exactly what the budget tracking app/game Fortune City did.

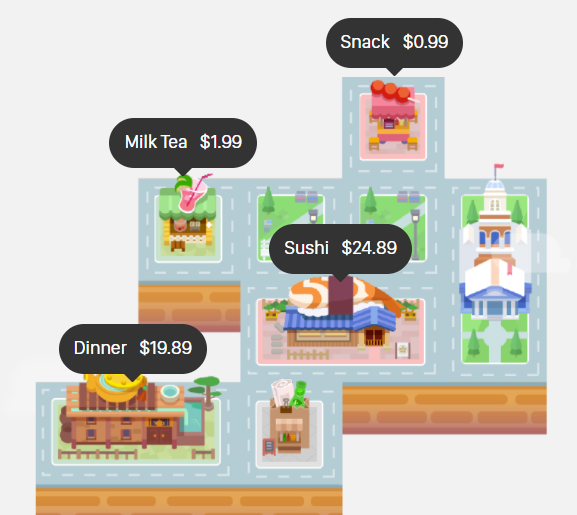

Fortune City is like any simulation game where you can build and manage a virtual town.

But what makes it unique is how you construct buildings—by recording your expenses or income like a budget app.

Source: Fortune City

Different expense categories will generate different types of buildings.

Logging food expenses, for example, will create a Food Stall. On the other hand, recording your income lets you build a Cash Register structure.

This approach encourages users to record every expense and earning in their lives if they want to create a thriving and well-balanced town.

Next, players can then hire citizens to work on your buildings to generate coins.

This in-game currency can be used to merge identical buildings to form bigger ones, upgrade existing structures, or buy improvements at the town’s City Hall.

Source: Fortune City

On the surface, Fortune City might look like a fun game.

But beneath that, it has powerful features that can compete with any expense tracking or budgeting app.

For example, it provides ten spending categories and the ability to differentiate between cash and credit card expenses, which can help you become very granular in your budgeting.

Fortune City also has a robust analytics dashboard that allows users to see expenses in colorful charts and graphs.

They can monitor their costs weekly, monthly, or at set periods. This makes spotting trends and patterns quite easy.

Source: Fortune City

The brilliant integration of budget tracking in a simulation game makes Fortune City a hit with users.

It currently has a 4.7-star rating in the Apple App Store with over 5 million downloads.

Although, it isn’t hard to see why Fortune City is so popular.

The city-building aspect of the app encourages users to be diligent with recording their expenses to expand their town.

This creates an addictive feedback loop that helps users become more financially responsible.

If that’s not enough motivation, the game also has achievements and a ranking system that lets you compete against your friends.

Source: Fortune City

Fortune City is, in our opinion, one of the purest examples of fintech gamification.

It shows how a well-executed game can help reinforce healthy financial habits with users.

eToro: Learning to invest like the pros

The Robinhood app popularized investing for the masses when it launched in 2015.

But there were actually already dozens of great examples of trading apps before them. One of these is eToro.

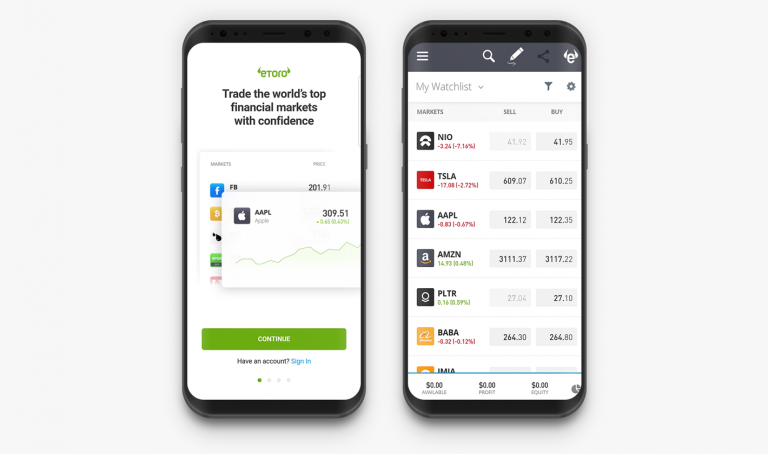

eToro is a trading and investment platform that allows users to trade everything from stocks to cryptocurrencies.

Its long tenure (eToro was launched in 2007) and regulatory approvals in various countries make it relatively dependable and safe.

Source: Stockspot

However, what differentiates eToro from other competitors are its social investing features.

This highly effective gamification strategy leverages social behavior and competitiveness among peers.

You can see this clearly in the app’s News Feed, which looks similar to the Facebook feed.

Here, users can post opinions, trading strategies, or even brag about their stock plays.

This is both educational and motivational, as seeing other people win can encourage other users to try and beat them.

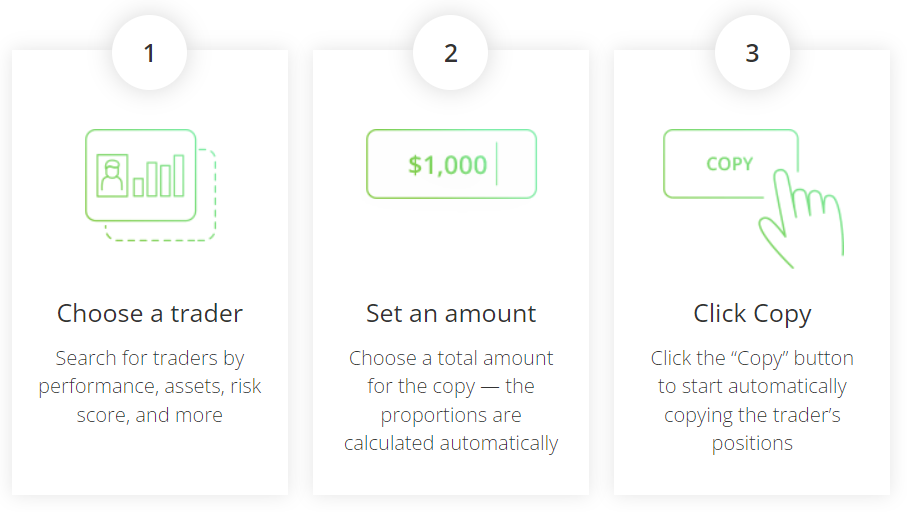

But what truly drives the competitive spirit of eToro’s social investing is their CopyTrader feature.

This is great for beginners who want a chance at profit by leveraging the experience of others.

Here’s how it works.

Source: eToro

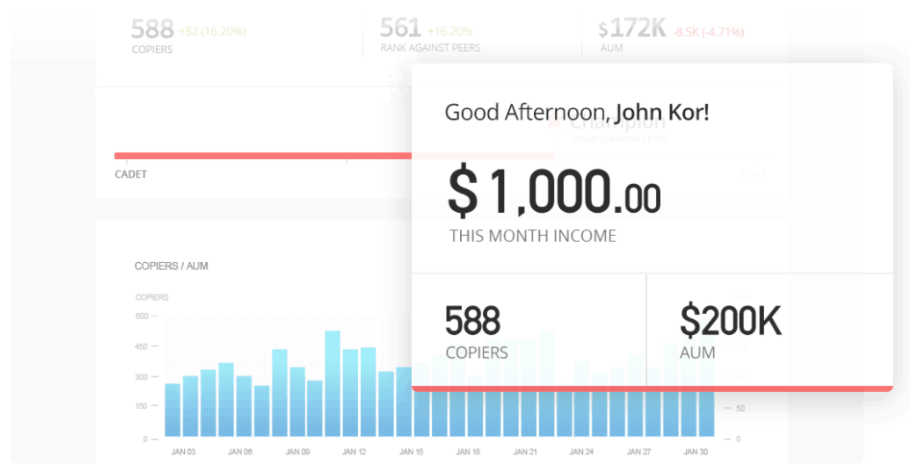

On the flip side, the platform also rewards the traders whom others copy from through their Popular Investor Program.

Here, you get a payout whenever someone copies your trades. The more of these copiers you have, the more money you can earn.

However, you need a certain performance level to get into the program.

When these two features are combined, they become a game loop.

Savvy traders will try to up their performance and even promote themselves through eToro’s social features, to get more exposure from copiers.

This, in turn, helps newbies become top traders in the future.

Source: eToro

eToro also utilizes gamification in other ways.

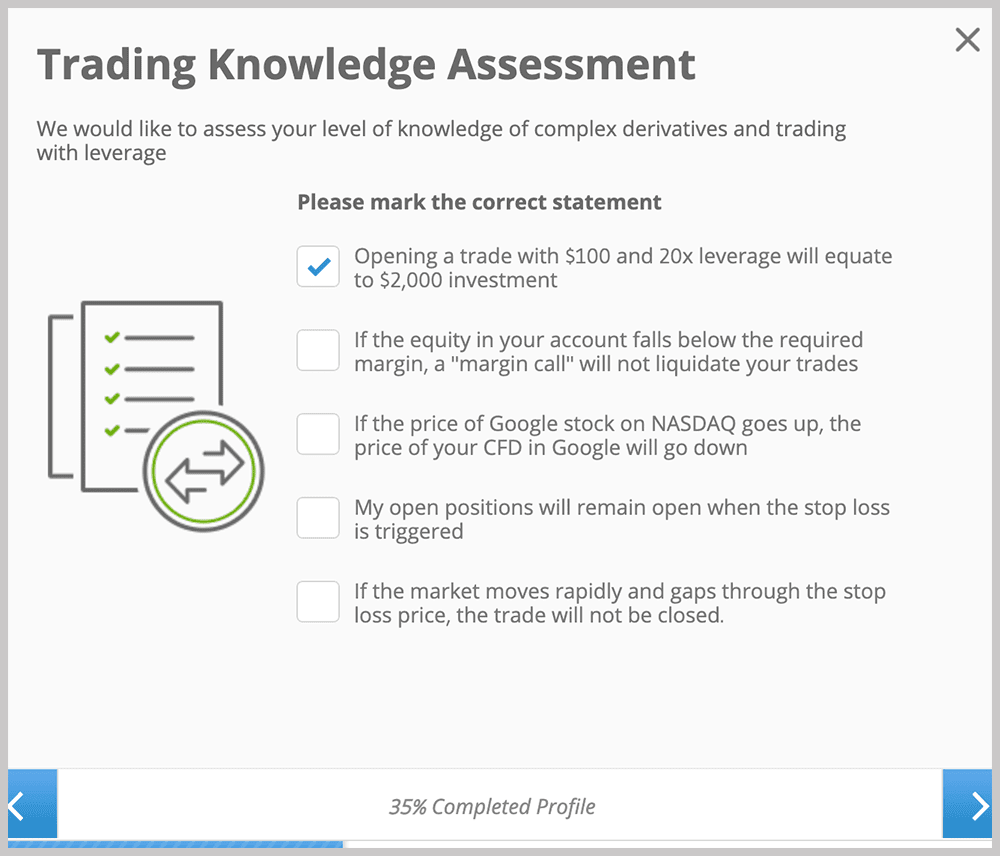

During onboarding, for example, users undergo a Trading Knowledge Assessment quiz to evaluate their trading experience.

It’s a quick and fun way to make the app safer by ensuring beginners can’t access risky features they’re unprepared for.

Source: Trade the Day

Lastly, eToro also includes virtual trading.

This gamified feature perfectly simulates real market conditions where novices can hone their skills with zero risk of losing money.

eToro is one of the leading trading apps today, even with big players like Robinhood.

And we believe it’s because of their masterful execution of these social gamification strategies.

Monobank: Making routine transactions fun

Banking tasks like depositing money or opening an account are often seen as routine and boring by most people.

That’s why gamification can be so effective in digital banking apps—it can make the process much more fun.

A case in point is the Ukrainian virtual bank Monobank.

You can clearly see their fun approach with their mascot—a cute cat—which appears throughout the app.

Source: PaySpace Magazine

This character immediately dispels the stereotype that finance is boring and sets a different expectation before users even open the app.

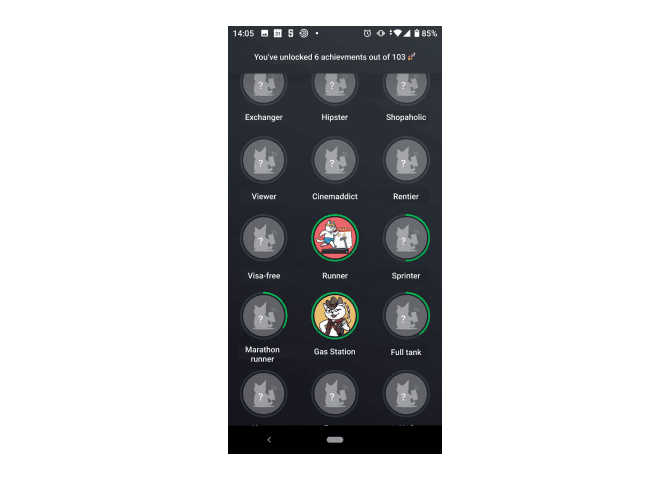

It also paves the way for the Monobank app’s best gamification feature—achievement badges.

Source: Monobank

To earn achievements, users need to perform various banking tasks. These include spending on certain categories, doing transactions in other countries, or splitting bills with a friend.

This move is a masterstroke on Monobank’s part.

Like Fortune City earlier, users are motivated to do routine banking in return for benefits—even something as trivial as earning a virtual badge.

Unsurprisingly, this can boost an app’s retention rate dramatically.

Indeed, this is what happened.

As of April 2021, the app saw 1.3 million daily active users from a base of 3.5 million people.

The company also stated that they see roughly 100,000 new users monthly.

But it’s not just through gamification alone that Monobank achieved these impressive metrics.

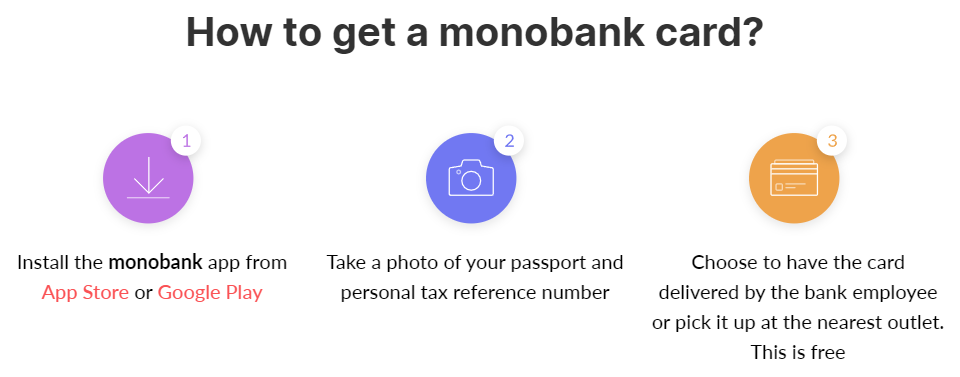

Because beneath it all, the app delivers incredible benefits to banking users.

Notable of these are their generous cashback, affordable installment schemes, and the usual conveniences of a virtual bank.

You can even apply for a free physical card in-app, and it will be delivered straight to your doorstep.

Source: Monobank

Monobank is a great example of gamification done right.

Moreover, it reinforces an important concept: gamification only works if the app’s core features deliver true value to users. It’s never a substitute for a poor app idea.

BBVA game: Rewarding the experience

Effective gamification relies on offering benefits for users to strive towards.

And when it comes to rewards, few can beat the thrill of winning tangible prizes like football tickets or smartphones.

This is the strategy that Spanish bank BBVA chose when they launched their award-winning BBVA Game platform.

The goal was to promote the bank’s services through gamification.

The BBVA Game works on a point system. Users earn them by doing everyday banking tasks, like purchasing items, paying bills, or transferring money to your account.

These can then be exchanged for prizes, such as music downloads or game tickets.

Source: UX Planet

The beauty of BBVA’s approach is the variety of rewards on offer. Whatever your interests are, there’s bound to be a prize that aligns with that.

Moreover, it’s a smart move from BBVA since it ensures the widest user coverage.

A nice touch is that they also included financial education as one of the tasks that garner points, such as watching a simple how-to video on using BBVA services.

This is a genius strategy to get more non-banking users on the platform by educating them to become savvy banking customers.

Not surprisingly, the BBVA game was a smashing success.

In its first six months, the platform attracted over 100,000 users. It also received the prestigious Bank Innovation Award.

BBVA Game is a fantastic example of how using tangible rewards can boost the success of your gamification efforts.

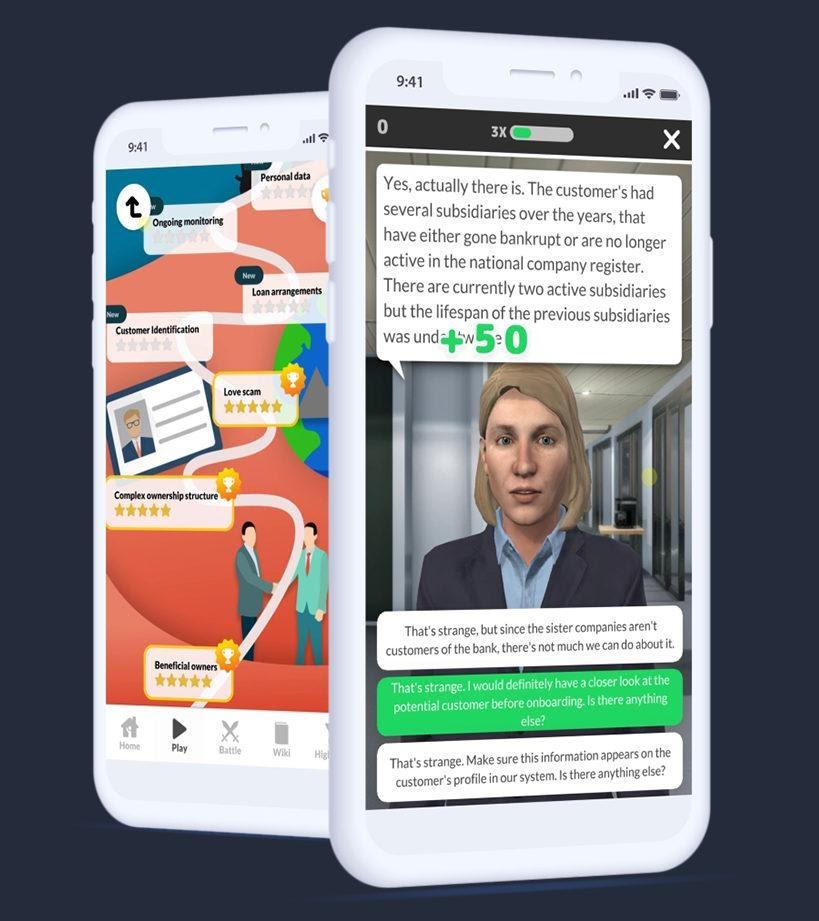

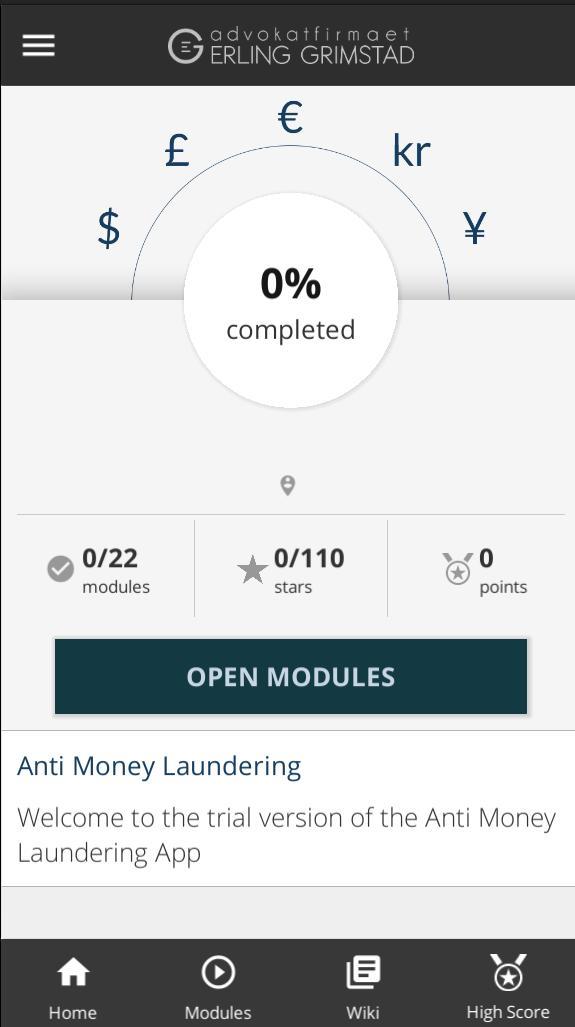

AML App: Fighting money laundering

AML App is an anti-money laundering certification app presented as a detective/mystery game.

Here, users are presented with various real-world scenarios and a series of possible actions.

Picking the right option allows them to progress through the game.

Source: Attensi

The fun nature of the AML App encourages employees to learn anti-money laundering concepts without forcing them through boring lectures.

The app is now the go-to training tool for the biggest banks and financial institutions across Scandinavia.

So what makes the app so effective?

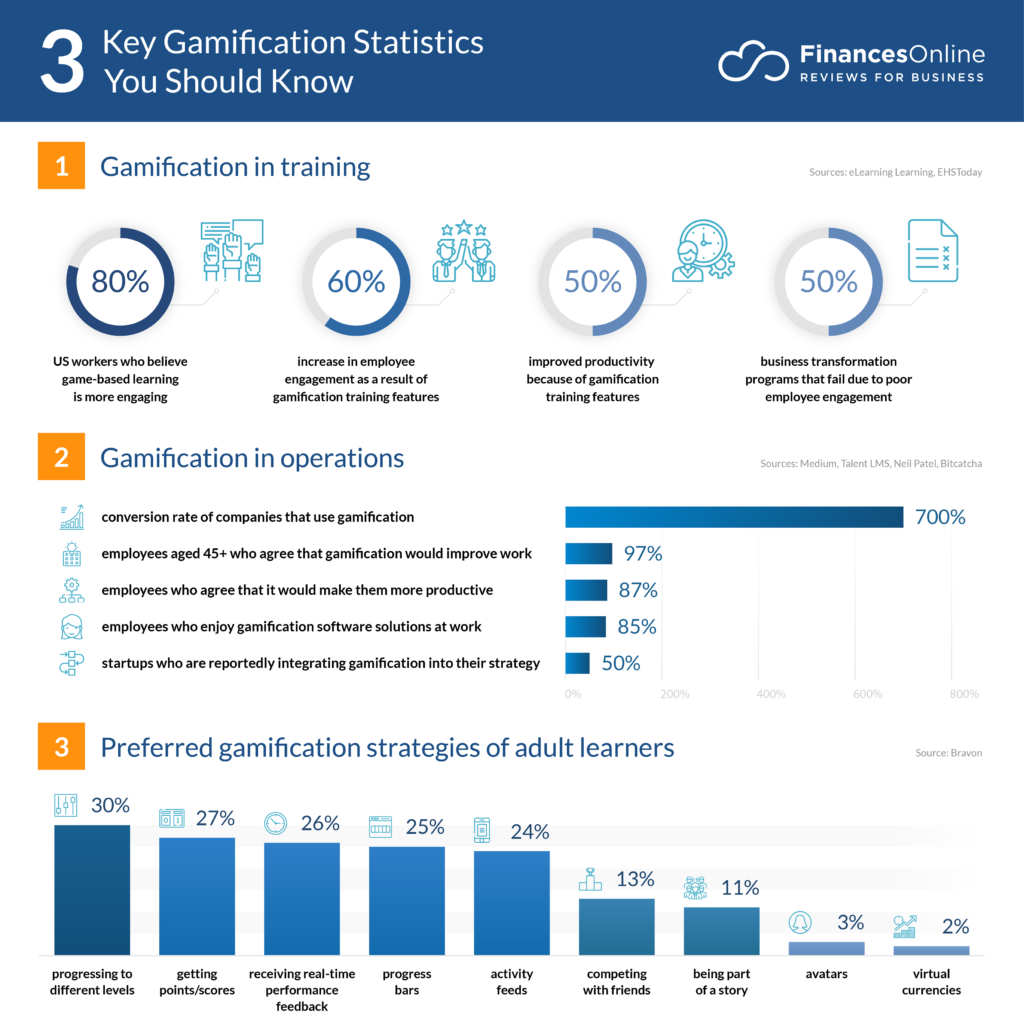

Studies reveal that as much as 80% of workers believe gamified learning is much more effective.

This is on top of various other metrics that support gamification in employee training.

Take a look:

Source: Finances Online

The AML App is also effective because it covers the top gamification strategies preferred by adult learners, as per the chart above.

The AML App has a tiered system that allows you to progress through different levels if you get the answer right.

If you get an answer wrong, you receive real-time feedback on where you got it wrong. And the different scenarios make users feel like they’re part of the story.

But what makes the AML App truly shine is the scoring system.

Because most users want to beat their old score, they often retry multiple times.

And each time they do so, it reinforces the concepts the app is trying to teach, making learning far more effective.

Source: APK Pure

This was also the observation of developer Solve Johannessen:

“What’s interesting is that after people have continued to use it, they get better and achieve a higher score—almost like a competition—so they repeat the training for enjoyment and interest rather than a classroom where you attend just to get your qualification.”

The AML App proves that gamification isn’t just limited to consumer apps.

It can also be an excellent in-house training strategy.

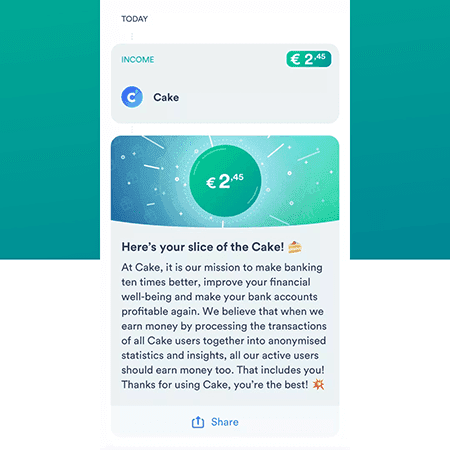

Cake: Sharing is caring

The Belgian fintech Cake app uses what is perhaps one of the more unique gamification strategies on this list: sharing profits with users.

The Cake app is, at its heart, a data analytics platform. It processes banking transactions and transforms them into anonymized data that other companies can use.

But unlike most data companies, they actually reward their users for sharing their data by giving a portion of the profits back to them.

Source: Strive Cloud

This is both an ethical and profitable move. It assures transparency in a world where most people are concerned about their data privacy.

It also creates a gamified loop: because people want to earn profits and rewards, they’ll transact with Cake as much as they can.

Indeed, the numbers reflect this.

At the time of writing this post, the Cake app has paid out a total of €884,417 to date, with users getting an average of €2.11 per month. It has 112,200 users and transactions worth €44.81 billion.

There’s also another side to Cake’s strategy: the insights they share are also helping power other companies’ gamification approaches through targeted cashback campaigns.

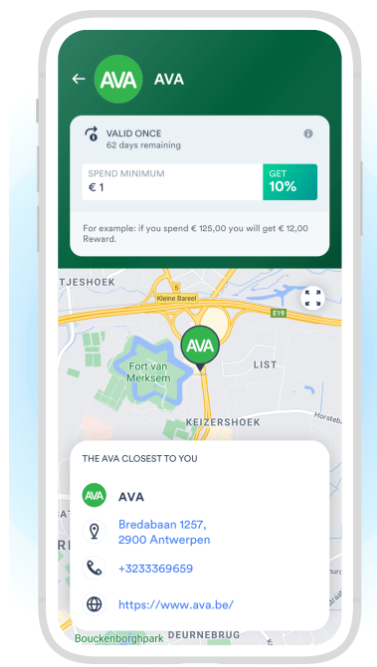

For example, AVA tied up with Cake to run a campaign where users get 10% cashback if they haven’t shopped at the store for the last three months.

Source: Cake

The Cake app is unique because it gamifies an entire ecosystem. And it’s a win-win for both the users and businesses they serve.

Time to give gamification a try

These six app examples have only scratched the surface of effective gamification in fintech.

With innovations like VR and AR technology on the horizon, we’ll undoubtedly continue to see more fascinating examples in the future.

Nevertheless, we hope this article has inspired you to gamify your own app projects.

And if you need a fintech app developer to help you with this, we think DECODE is a great fit.

So contact us today, and let’s talk!