The explosion of fintech has been nothing short of incredible. By 2022, the sector will be worth $26.5 trillion worldwide.

Many factors are at play here, including market timing, new services, and even social distancing during the pandemic. But arguably, the most important one is interconnection.

Financial services are now much more intertwined than ever before. Mobile apps, banks, payment processors, credit card companies, and lenders now work together to provide better services to users.

And the technology behind it all? The humble API.

What are fintech APIs?

Ever wondered how your wallet app can retrieve funds from your bank account? Or how your credit card gets approved when you shop at Amazon? You can have APIs to thank for that.

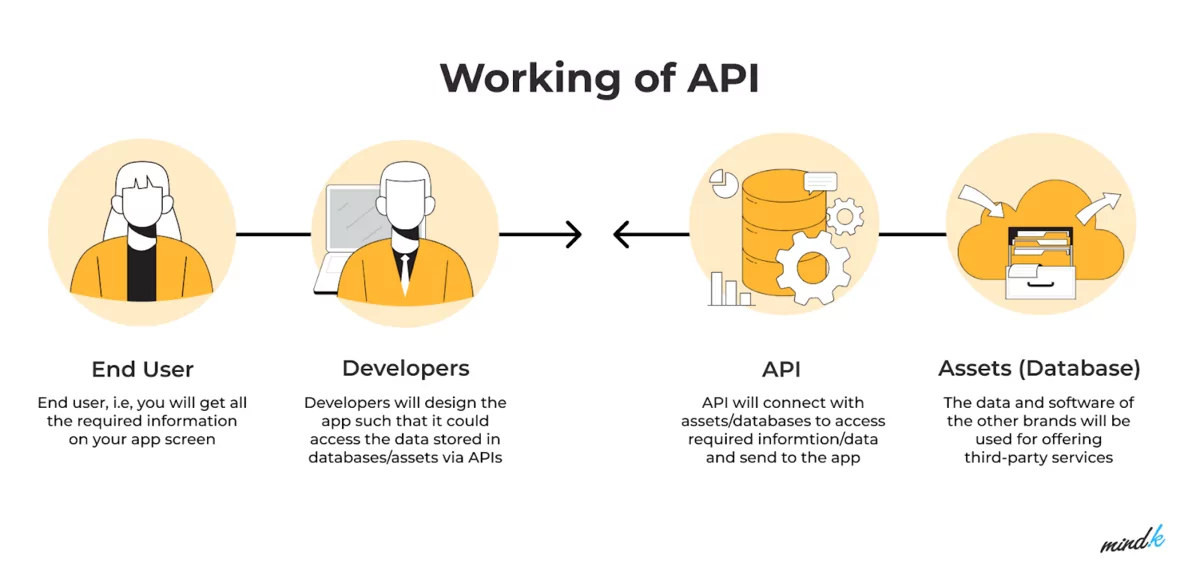

Application programming interfaces (API) are the bridges that allow different software to interact and exchange data with each other. For example, a personal finance app can use an Open Banking API to connect to a user’s bank and retrieve their balance.

Source: MindK

APIs are necessary because two platforms are incompatible by default. They might use different programming languages, function calls, and other technical specifications—it’s like they’re speaking different languages. So you need an API to act as an interpreter.

APIs also allow a proper separation between entities, facilitating a safe data exchange without revealing the underlying logic. This is important for financial security. It’s OK to share financial data, but not how the financial system works.

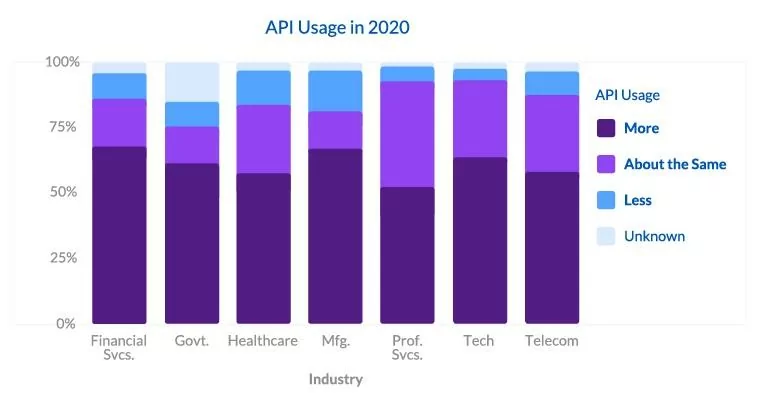

The 2020s saw a sharp increase in API usage, with the highest adoption rate being in finance, according to research.

Source: DevopsDigest

There’s also an increased initiative from world governments to implement Open Banking, possibly one of the more important APIs to date.

The UK, long considered the center of the initiative, currently has 297 companies and 3 million consumers using Open Banking.

Additionally, a McKinsey article predicted that by 2030, cloud technology would be a prominent feature in the world’s top 500 companies. And with it comes the need to adopt a cloud-based microservice architecture, where APIs are essential.

Therefore, it seems like APIs are the bedrock that will drive the interconnected future of fintech. But how do APIs work in the first place?

How do fintech APIs work?

From a programming perspective, APIs are like building blocks. You insert them in your code like you do classes and functions, and they perform specific actions or give a certain result.

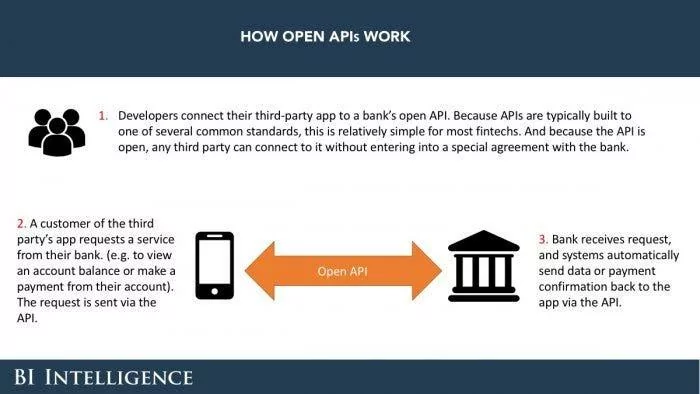

Source: Business Intelligence

When the app user tries to make a request (such as withdrawing funds from their bank account), that request is sent to the third party via the API.

On the other end, the receiving system processes or authenticates the request then sends data back to the app.

Here’s a simplified example: say you’re buying something in an e-commerce app. Upon checkout, you provide your credit card information and hit “Pay.”

In the background, your card data is sent via an API to the payment processor to verify the transaction. The data is then sent back to the app, and (if successful) approves the order.

As you can see, the API maintains a clear delineation between the app and the third party. It also enforces security protocols that stop any parties from making unauthorized requests.

However, this doesn’t mean APIs are completely risk-free. In fact, hackers commonly exploit vulnerabilities in APIs. Indeed, an ethical hacking experiment successfully changed customer PIN codes in over 55 banks—all through their APIs.

Hence, API security is crucial for your app’s cybersecurity protocols. Consequently, you should also only connect through APIs that you trust or that come from reputable institutions.

Types of APIs you can use for your fintech app

If you’re planning to incorporate a feature into your app, there’s a big chance that there’s already an API for it. Here are the different types of APIs and how they can benefit a fintech app.

Financial data aggregators and providers

These APIs allow third-party apps to access financial information such as bank accounts and balances. Some also enable other apps to offer financial services to their users.

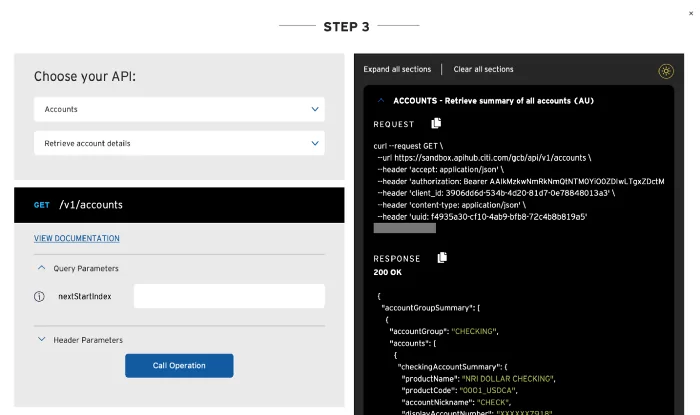

Most major banks offer APIs. For instance, Citibank provides an extensive selection that enables apps to access their accounts, payments, and security functions.

In addition, the developer page is rich and well supported, with lots of examples and use cases for developers.

Source: Apimatic

While robust and secure, bank-specific APIs are limited only to transactions involving that institution. If you want more flexibility, a better option would be to go with data aggregators like Plaid.

They can access information from many different banks, plus they also handle the legwork like authentication and validation.

With the fast-tracking of Open Banking initiatives worldwide, financial data aggregators will undoubtedly become one of the most important APIs shaping fintech’s future.

Payment processors

Payment processors are easily the foundational APIs that impact both fintech and the entire Internet economy.

These intermediaries do the hard work of accepting, validating, and processing payments for various online transactions. Some leading APIs are Stripe, Paypal, and MangoPay.

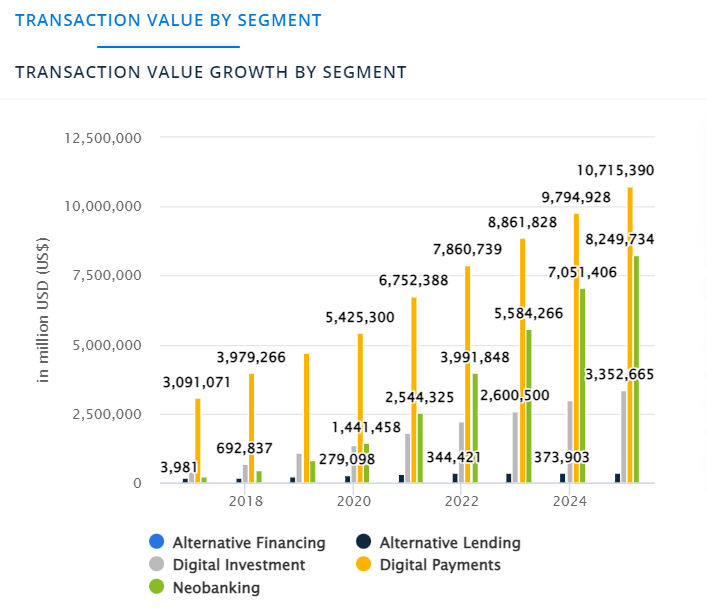

The payment space is currently the strongest performing fintech niche, according to a Statista study. This isn’t at all surprising because virtually every fintech app that needs payments will need them.

Source: Statista

Payment processors are vital because they handle all the nitty-gritty aspects of payments that you’d rather not have to deal with. These include currency exchange, security, and anti-fraud detection.

Thus, this will probably be a basic API you’ll need to use for the foreseeable future.

KYC and RegTech tools

Know Your Customer (KYC) is a fundamental process for compliance in many countries, despite the many challenges.

Increased onboarding time, costs, and security concerns are some of the things that can get in the way of smooth KYC in your app.

KYC tools offer an easy solution by handling the verification process and its many complications. ShuftiPro, for example, provides facial biometrics and video interview KYC to thwart fake videos and fraudsters.

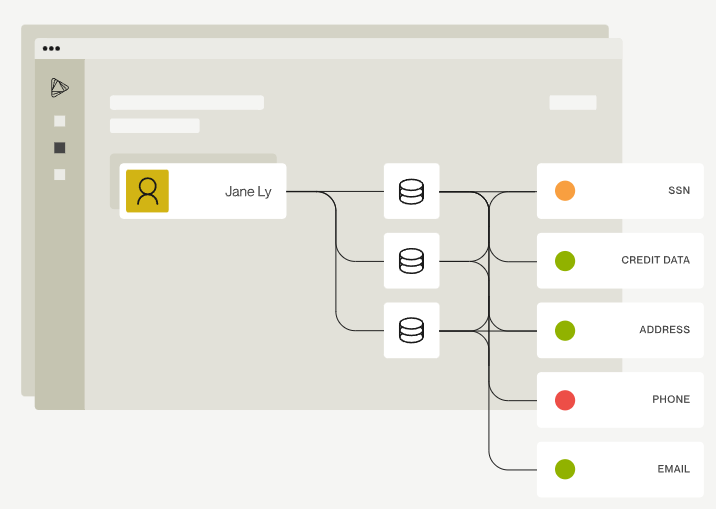

Some, like Alloy, even automate KYC through AI and rich customer data.

Source: Alloy

In the same way, RegTech is also helping shape the compliance landscape by automating repetitive tasks. Ascent Tech, for instance, uses AI to spot regulatory risks to help firms conform to regulations.

Undoubtedly, compliance will continue to be an expensive and time-consuming aspect of fintech moving forward. But KYC and RegTech APIs can help make it more manageable.

Authentication and authorization tools

Security is a vital part of fintech, due to the many cybersecurity attacks the industry faces regularly. And it’s increasing in sophistication, meaning protective measures need to evolve constantly.

Luckily, there are security APIs that you can easily integrate into your apps. These free you from the worry of having to implement them yourself.

For biometrics, you can use native solutions such as Apple’s Face ID or the Android Biometric Library. In addition, multi-factor authentication (MFA) adds another layer of security, which you can integrate using solutions like the Duo Auth API.

Source: SecureID

However, APIs can only do so much, as security involves every aspect of your app’s ecosystem. To read up on this topic, check out our helpful article here.

Investment brokers

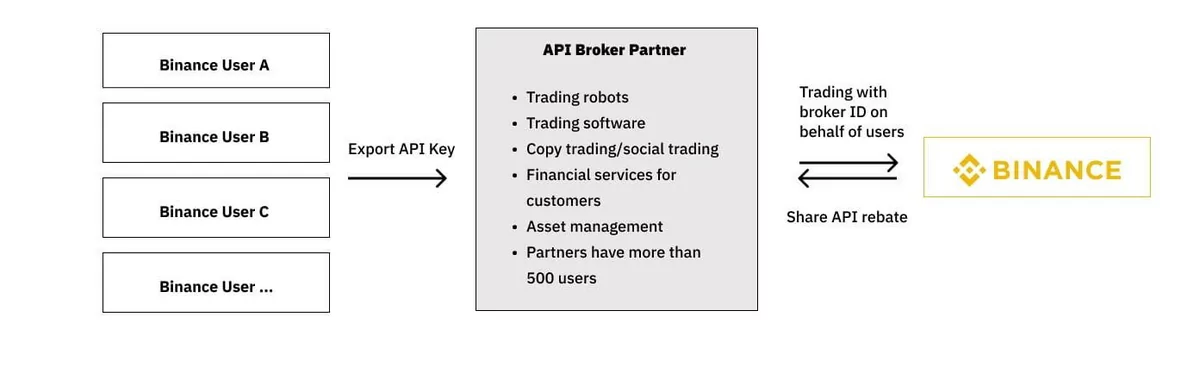

Building investment apps is challenging and risky, but the hardest part is designing algorithms for trading in the markets. Fortunately, you don’t have to do it from scratch, as there are several excellent broker APIs to do it for you.

Broker APIs are similar to their human counterparts—they buy and sell assets on the market on the user’s behalf. Here’s an example of how the Binance broker API works:

Source: Binance

The range of what broker APIs offer varies. Some, like Interactive Brokers, entail a full suite that offers trading in every market you can think of.

Others, like Polygon.io, focus solely on providing rich stock data. And if you plan to dabble into cryptocurrencies, CoinAPI gives you access to crypto exchanges.

With broker APIs, adding investing features into your app becomes trivial. Thus, you can easily integrate it into other fintech app types like personal finance or digital banking.

How can fintech companies benefit from using APIs?

APIs are a win-win scenario for both the app developers and users alike. Here are some of the benefits they bring.

Lowers development costs

APIs eliminate the need for developers to create app features from scratch, thus cutting working hours significantly. And at an estimated $40 per hour for the average fintech app, the cost savings can be significant.

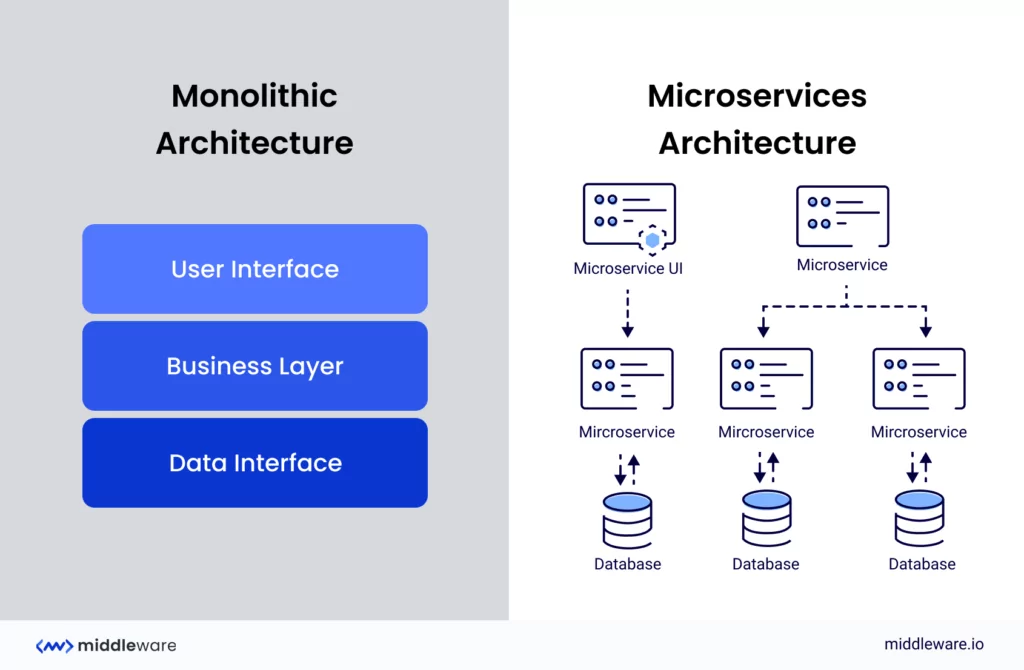

The savings will also go beyond development and into maintenance. That’s because APIs are the key to building a microservices app.

Source: Middleware

So, why does this matter?

With such an architecture, features are built as independent components that can be developed and debugged without affecting the rest of the system. That makes fixing bugs fast, easy, and—most importantly—non-disruptive to your operations.

Speeds up development of new features

APIs are crucial for rapidly expanding a fintech app’s feature set with trivial development times. For example, instead of building a payment module on your own, why not just get an API like Paypal or Visa? That can save developers some valuable time.

But APIs also allow you to offer features or services that are normally impossible.

For example, big banks have a huge advantage over their digital counterparts because they’re licensed, allowing them to offer services like deposit insurance and lending.

Unfortunately, if you want to provide these in your app, you’ll need to go through expensive compliance.

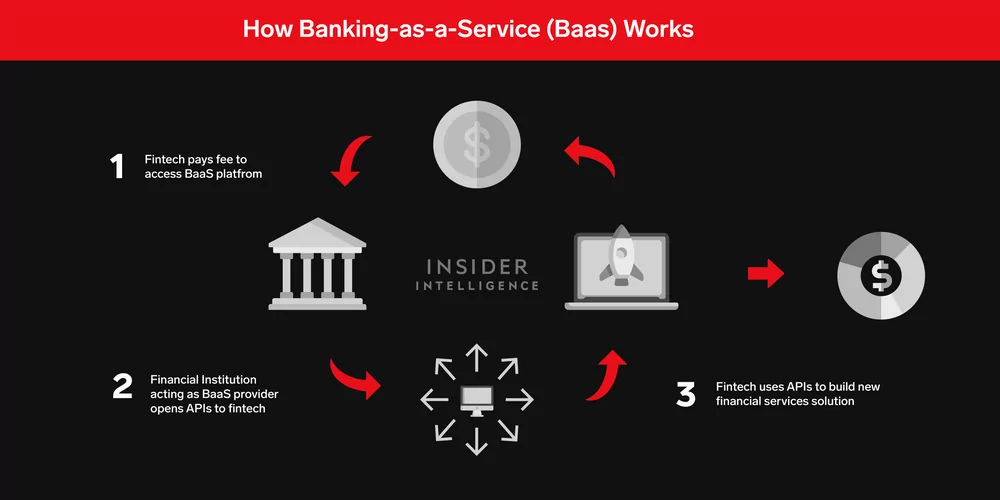

The solution is Banking-as-a-Service (BaaS). This scheme allows a third party to access a bank’s services through API calls. Through it, anyone can offer banking services without having a license themselves.

Source: Insider Intelligence

In a saturated market, rapidly improving your app is key to staying competitive and innovative. And APIs are a vital tool for doing that.

Helps with compliance

APIs also help with strict regulations like GDPR and PSD2 by opening up their data to government agencies and regulators. They solve the problem of privacy and security when sharing such sensitive information with external parties.

What’s more, APIs are also a key ingredient for many complex compliance processes such as KYC. Finally, RegTech APIs can streamline the process by automating processes like compliance checks and data governance.

Impacts customer experience

Ultimately, APIs are all about enhancing the customer experience.

APIs help keep users’ data secure by making the app more compliant. In addition, speeding up development times means that APIs allow users to receive better features. Also, users can enjoy affordable fintech services thanks to reduced development costs.

APIs also allow you to focus on your core competency. For example, building a fintech app doesn’t involve only finance but also cybersecurity, social media, and even legal knowledge. But you can offload these responsibilities to an API instead.

Indeed, the rich feature sets in today’s apps are mind-boggling. And what’s even more amazing is that they’re released in record time. Developers have APIs to thank for that.

Interesting API strategies in fintech

APIs have been around since fintech first emerged as an industry, so there’s no shortage of interesting strategies involving them.

Data aggregator APIs deliver rapid innovation

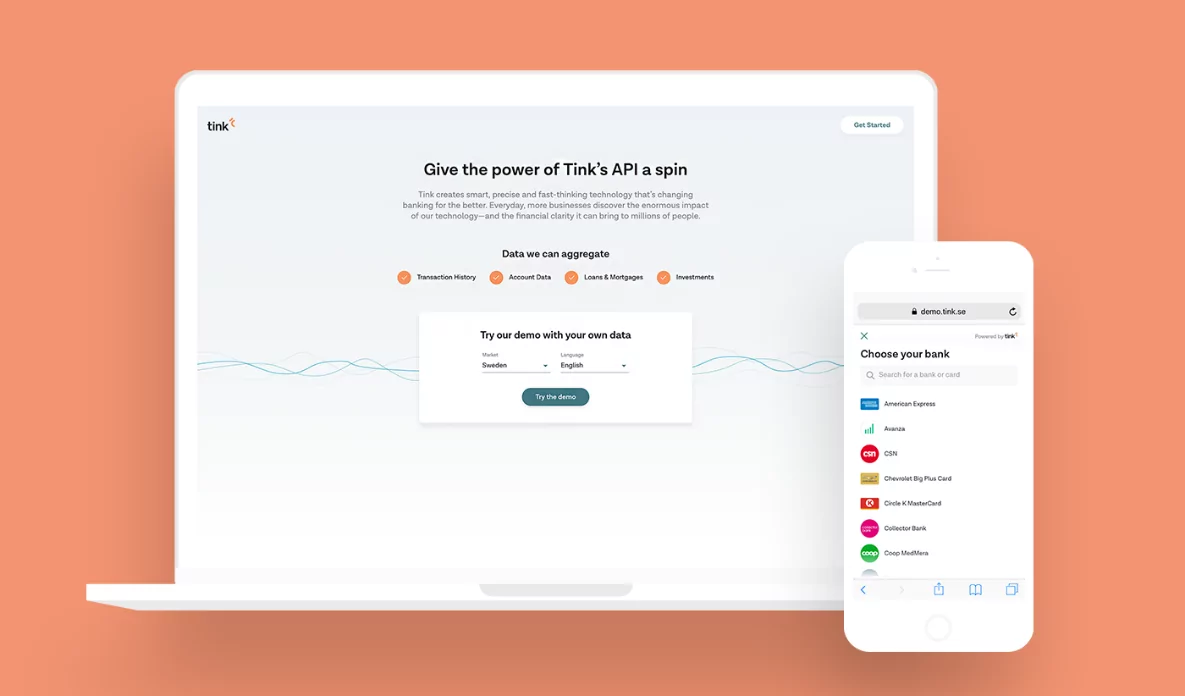

One good example is Tink, an API platform that allows third-parties access to over 300+ European banks and fintech firms. With it, developers can access bank balances, use data for analytics, and even access credit data for lending decisions.

Source: Medium

When the Dutch bank ABN AMRO planned to build their personal finance app Grip, they tapped into the rich data network of Tink API. Thanks to this move, they were able to launch the app in a record-breaking 90 days since the contract was signed.

ABN AMRO’s Digital Innovation Director Roland Booijen relates the experience:

“With an unbeatable time-to-market, the Grip app is one of our most successful partnerships to date.”

Tink was also the driver behind Bofink, the world’s first robo-advisor focused on mortgages. The API’s success clearly shows the importance of data aggregators in the fintech ecosystem.

Big banks embrace BaaS to stay competitive

Banks have also been using APIs to their benefit. Instead of competing against emerging neobanks, financial institutions are working with them through APIs like Banking-as-a-Service (BaaS).

BBVA and Goldman Sachs are entering the estimated $32 billion market, with other big banks following suit.

Indeed, the essence of BaaS—and why it’s a lucrative strategy for banks—can be summed up with a quote from Hari Moorthy, Global Head of Transaction Banking at Goldman Sachs:

“We are trying to create a new industry by integrating our services into their businesses so they can cater to their clients as if we had them.”

As a result, banks can tap into the huge user base of fintech firms while also charging a small fee for API access. They also gain insights into what digital users want. In return, app developers can access banking services without a license.

The API that handles the world’s assets

Aladdin is a portfolio and risk management software by Blackrock, the world’s biggest asset manager. What started as an in-house investment program has evolved into a platform that handles over $21.6 trillion in assets.

Source: Adam Tooze

Part of its success can be attributed to its use of APIs that allow anyone in the world to tap into the platform’s capabilities. To date, the world’s top investment firms, financial institutions, and asset managers use Aladdin, including Macquarie and Fannie Mae.

More than anything, the success of Aladdin shows how a technology platform can take over an industry through the simple use of APIs.

Use cases for APIs in fintech

By now, you should already have a good idea of how APIs can shape and benefit your fintech app. But if you need more inspiration, here are a few more use cases.

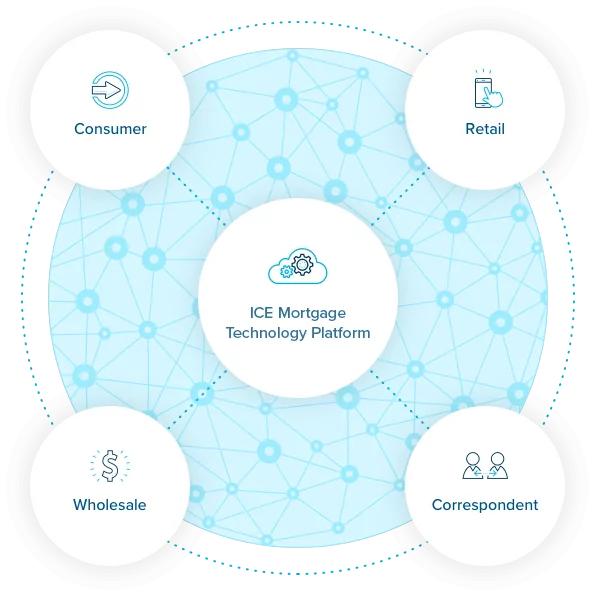

APIs have been positively impacting the loan and mortgage space by speeding up the otherwise slow process of approval.

Platforms like ICE Mortgage accelerate the application considerably.

Also, access to financial data through Open Banking platforms can make gauging creditworthiness easier, allowing for fairer loan terms for both parties.

Source: ICE Mortgage Technology

Blockchain technology might be innovative, but it’s also challenging to build from scratch.

Fortunately, blockchain APIs exist that allow you to tap into its power with minimal lines of code. Examples include Nownodes, Bitcore, and the Ethereum service provider Infura.

Another good example would be GetBlock which offers instant API access to more than 50 multiple blockhains.

The increase in cashless payments is accompanied by the rise in the popularity of mobile wallets. Nowadays, you can easily integrate these into your app using wallet APIs. A good example is Sila Money.

Next, AI and big data are two of the biggest trends predicted to shape fintech’s future. However, like blockchain, they require talent and expertise to pull off.

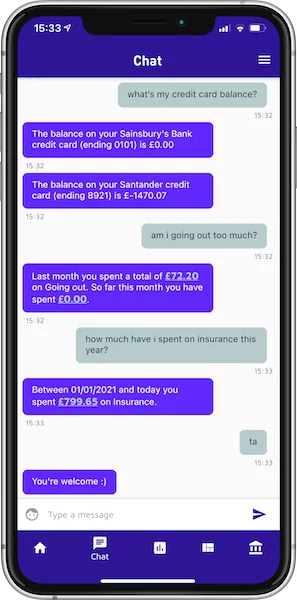

Nevertheless, soon we might see the appearance of more and more APIs that would allow developers to tap into intelligent systems.

A good early example is Ducit.ai, an Open Banking platform that uses machine learning to analyze risk, detect fraud, and even converse naturally with users.

Source: Ducit.ai

Indeed, there are many more amazing examples of fintech APIs out there. And even if we’ve described quite a few of them in this article, it’s just scratching the surface. This tells you how wide the variety of fintech APIs really is.

APIs are just the foundation

APIs are important building blocks of successful fintech apps. Nevertheless, they’re just that—ingredients. You still need skilled hands to combine them into something special.

Here at DECODE, we’ve had extensive experience building successful fintech apps. As an award-winning mobile app agency, we believe we’re the right partners to help guide your app development.

Need help? Schedule a call with us today, and let’s talk!